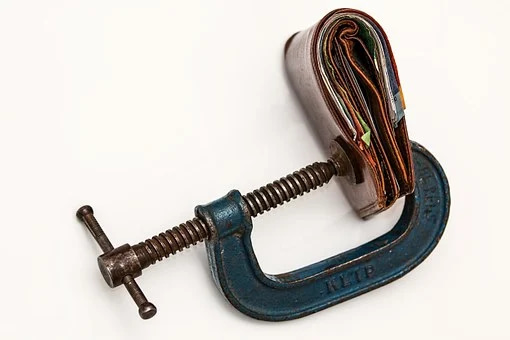

At the mention of the word bankruptcy, most people think about a scary monster that comes to spell financial doom and misery. It is often confused for going bankrupt or being declared so. On the contrary, filing bankruptcy is simply the legal process when debtors seek relief through the courts when unable to pay their creditors for one reason or the other. In this piece, we shall talk a bit about the legal regulations available in the US regarding bankruptcy. Before that, however, it is important to understand some basic things about the bankruptcy process.

The Bankruptcy Process

For starters, bankruptcy is a legal process that takes time and resources in some instances. This largely depends on which type of bankruptcy you file, or which chapter the debtor falls in. The debtor could be an individual, business, corporate, state agency, or any other legal entity that runs into financial difficulties and is unable to pay their creditors.

Since it involves petitions and hearings in a court of law, filing bankruptcy in the U.S requires legal counsel, interpretation, and representation. This is especially because there are different laws and regulations for different bankruptcy chapters. As the experienced attorney Tristan Brown and his team at https://tlbrownlaw.com/ point out, a debtor that qualifies for chapter 13 bankruptcy may not be eligible to file bankruptcy under chapter 7. These are some of the many reasons one needs an experienced bankruptcy attorney when seeking relief from debt through bankruptcy.

Also, depending on the type and outcome of the bankruptcy case, the debtor may end up losing or keeping their individual property and even company assets. Some end up getting a full acquittal or forgiveness, so they won’t have to pay their creditors back. Some cases take longer than others, whereas others are finalized within a short time. In a nutshell, filing for bankruptcy can be an easy or complicated process depending on how informed you are, legally speaking. Let’s now look at a few legal regulations applicable in the U.S. regarding Bankruptcy law based on the various chapters available.

Chapter 7: Liquidation

This is the most common form of bankruptcy where a trustee is entitled to collect the debtor’s non-exempt property, sell it, and distribute the takings to the creditors. In this case, the debtor has no liability for any discharged debts whatsoever. Legally, however, many state laws allow the debtor to keep the essential property.

In 2005 the U.S. bankruptcy law significantly changed, making it tricky for consumer debtors to file for bankruptcy. That is why the state allows debtors to keep the essential property even though some of the property can be seized.

Therefore, debtors who are in business can go about their business to avoid liquidation even after filing bankruptcy chapter 7. After all, the main purpose of bankruptcy is to discharge certain debts to give a debtor a “fresh start”.

Chapter 9: Reorganization of Municipalities

This chapter of the Bankruptcy Code provides for municipalities’ reorganization, like cities, towns, villages, counties, taxing districts, municipal utilities, and schools. The purpose of this chapter is to provide financially-troubled municipalities protection from its creditors while it develops and negotiates a strategy for adjusting its arrears. The reorganization of debt can be accomplished by extending debt maturities, slashing the interest, or endorsing the debt and obtaining a new loan. In this case, there is no provision for liquidation of the municipality’s assets.

In this bankruptcy chapter, the court functions are generally limited to several things. These include approving or declining the petition, creating a debt adjustment plan, and ensuring the plan is implemented. However, the debtor should fulfill certain requirements for them to be considered eligible. Some of these include the following:

- The municipality must desire to conclude a plan to adjust its debts.

- The municipality must be insolvent

- The municipality must be authorized to be a debtor by state law, the appropriate governmental officer, or an organization mandated by State law.

Chapter 11, 12, and 13: Complex Reorganization

This is a very lenient regulation where a debtor gets to keep all assets regardless of the amount of debt they owe. However, the debtor is still required to pay off and clear the said debts from their future earnings. Below is a brief outline of what these chapters are all about.

Chapter 11:

Bankruptcy Chapter 11 permits the reorganization of debt and is available for all sorts of business organizations. This is why it is commonly called the reorganization bankruptcy, aimed at giving the debtor a fresh start. To be eligible for this chapter, the law requires that one should:

- Have filed a chapter 11 petition in his/her domicile jurisdiction

- Have received credit counseling at least 180 days before the preceding

- Not have a previously dismissed bankruptcy petition for the failure of appearance

- Have filed schedules of assets and liabilities; income and expenditure; contracts and actual leases; and financial statements.

Chapter 12:

This one has a similarity with chapter 13 structurally, but there are additional benefits for farmers and fishermen. The below criteria makes one qualify for relief under this chapter:

- Must be a farmer or fisherman

- Debts must not exceed the cut mark of each occupation

- More than 50% of the gross income for the preceding tax year must be from the mentioned occupations.

50% and 80% of income for farmers and fishermen, respectively, will be used to fix the owed debt.

Chapter 13:

This one is commonly called the wage earners’ plan. In this chapter, the U.S. Bankruptcy Code offers an individual the platform to reorganize their financial affairs so they can be allowed to pay their debts more comfortably. In other words, it involves creating a new, more convenient payment plan for the debtor, which may cover as long as five years. To qualify for chapter 13 bankruptcy, the debtor is supposed to provide the following:

- Schedule of assets and liabilities

- Schedule of current income and expenditure

- Schedule of contracts and leases

- Statement of financial affairs

The official bankruptcy forms are incomplete without the statement of financial affairs, schedules, and debtors. The following musty also be provided:

- All creditors and their claims

- A detailed list of the debtors’ monthly expenses

- The debtors’ property

- Source, amount, and frequency of debtor’s income

As you might have guessed, filing bankruptcy is not your everyday cup of tea. All these terms can be confusing and, especially without proper legal guidance, it can be a frustrating and intimidating process. With the help of a good bankruptcy attorney, however, the process can be smooth, and the odds will highly likely be in your favor.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]