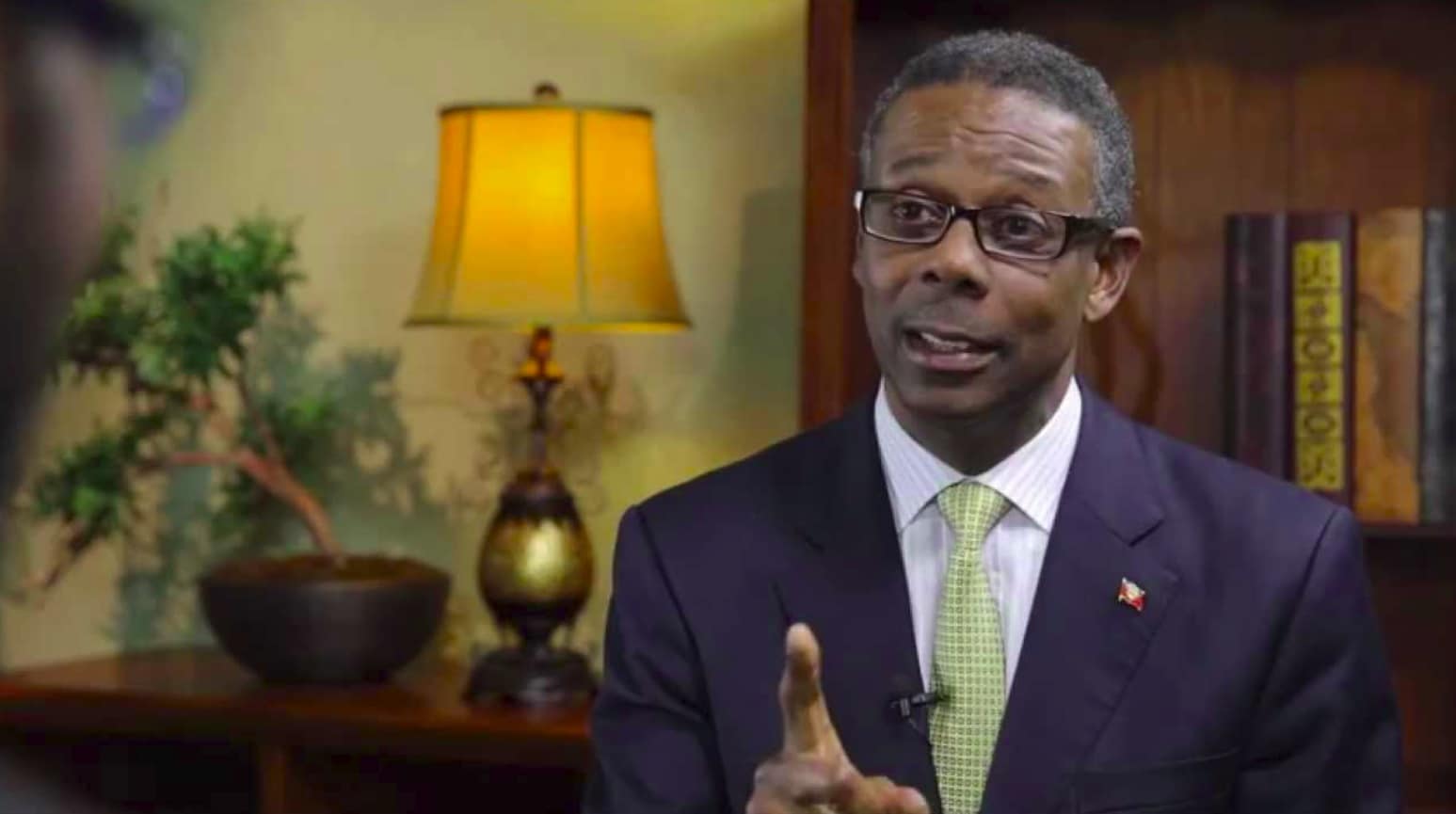

OBSERVER: Leader of the United Progressive Party (UPP) Harold Lovell has given Prime Minister Gaston Browne a failing grade for the “unacceptable” manner he has been dealing with the ECAB shares conversion saga.

Last week, PM Browne blasted the directors at the regional bank, claiming they were dragging their feet on allowing the government to attain ordinary shares in the financial institution.

Government has 25 percent preferential ownership in ECAB and gets the first claim on the distribution of profits, but it is restricted to voting only on resolutions that directly affect its rights.

More than three years ago, the government wrote to ECAB’s board of directors asking to convert its shares to ordinary shares, which would allow the government to claim full voting rights in key decision-making processes.

But that has still not happened, delaying the government’s intentions to sell citizens some of its ownership in the local bank.

Together with ACB, which owns 15 percent of ECAB, local shareholders will account for 40 percent of shares, and voting power in the institution, if the government is successful in acquiring the ordinary shares.

However, Lovell said Browne’s handling of the matter is inappropriate.

“The way in which he has accosted the board is unacceptable. You don’t do that as a prime minister,” the UPP leader said.

He also expressed concern that PM Browne is pushing to gain more control of the bank.

Lovell, a former finance minister, said the banking sector should be protected at all costs so as to prevent any possible corruption or collapse.

“A bank is the only business where the stock does not belong to the owner. It’s somebody else’s stock and you need responsible management of that stock,” he said.

“We have seen banks go down because you have governments which are broke and will be tempted to simply call up and say ‘I need 10 million dollars and you must send it to me’. And that type of pressure that we have seen the prime minister exert now, you can imagine what will happen down the road when the government needs money.

“We have to be very careful because we have to look about the interest of depositors. Your money is in there and you need responsible management of that money and what will eventually happen is that the government, yes, will be in a position of control but can we trust the Gaston Browne government to simply allow the bank to be run in a professional way or will there be the temptation to say ‘we need money, give us money and if you don’t, we will pressure you until you do’?

“That’s a very dangerous situation,” Lovell added.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

If Gaston Browne don’t get the shares yet and he bullying the directors to give him the shares, can you imagine what would happen if he had those shares?

People who have money in ECAB had better watch out.

it seems that anything Gaston Brown is involved in always have trouble.

Gaston Browne used to work at Swiss American.

Swiss American went bankrupt

Gaston Browne is affiliated with CUB

I see on line that somebody is suing CUB for their money

Gaston Browne used to run a supermarket in Jennings

The supermarket went out of business

This man Gaston Browne is just bad news

G-Greedy

A-Arrogant

S-Self enrichment

T-Tyrant

O-Obsessive

N-Nefarious

With leaders like these who abuse their power will one day suffer the consequences.

Just curious if there is a possibility of liquidating privately held assets and founding a fully privately held bank.

The situation as presented sounds more than a little shady.

Mr. Lovell you are absolutely in the right on this one. Whilst I supported the PM’s initial premise to consolidate the banking sector with a view of building capacity a d all the associated benefits that go with that, I am always wary of Government’s or adminstrations getting their hands on depositor’s money. This should be fought tooth and nail by the board and the ECCB…particularly with a PM that threatens managers and CEO and any one who stands in his way….. we cannot turn ECAb into a Government Bank… we can’t do it!!!!! Turn ABDB into you playpen. .

“We have seen banks go down because you have governments which are broke and will be tempted to simply call up and say ‘I need 10 million dollars and you must send it to me’.”

The above statement by Harold Lovell is VERY telling. It exposes exactly what he, as Finance Minister, did to ABIB. He had his cronies in key positions and pillaged ABIB to the point collapse. It was the Gaston Browne government that in fact saved the bank by pumping over $300 Million into the institution. So tell me, why shouldn’t the government, after saving the bank, not have a say that is in line with the amount of money it put in?

You folks who are supporting Lovell on this have no idea what you are opposing. Do you think it’s Gaston Browne who stands to benefit from this? What the PM is indicating is that the GOVERNMENT spent money on ECAB and the PEOPLE of Antigua and Barbuda DESERVE VALUE FOR THEIR MONEY. Gaston Browne will not be around forever, but ECAB will continue to hold on to what RIGHTFULLY belongs to the PEOPLE!!! That is what is at stake.

Lovell needs to stop his nonsense and fight for the patrimony of Antiguans and Barbudans. But school children say he can’t because the chairman of the board and the GM of the bank are KNOWN UPP supporters!

Wash an’ Basin = GASTON BROWN. Which ABIB you pump $300 million into?

You all like to take credit for nothing done by yourselves. When it’s bad its UPP, but when it’s good it’s ABLP.

I think you made a mistake however, the figure is $300,000,000,000,000,000,000,000,000,000.

YOU MUST BE REFERRING TO THE FAILED SWISS AMERICAN BANK AND THE JENNINGS SUPERMARKET. YOU ARE A FAILED BUSINESS MAN AND BANKER.

Comments are closed.