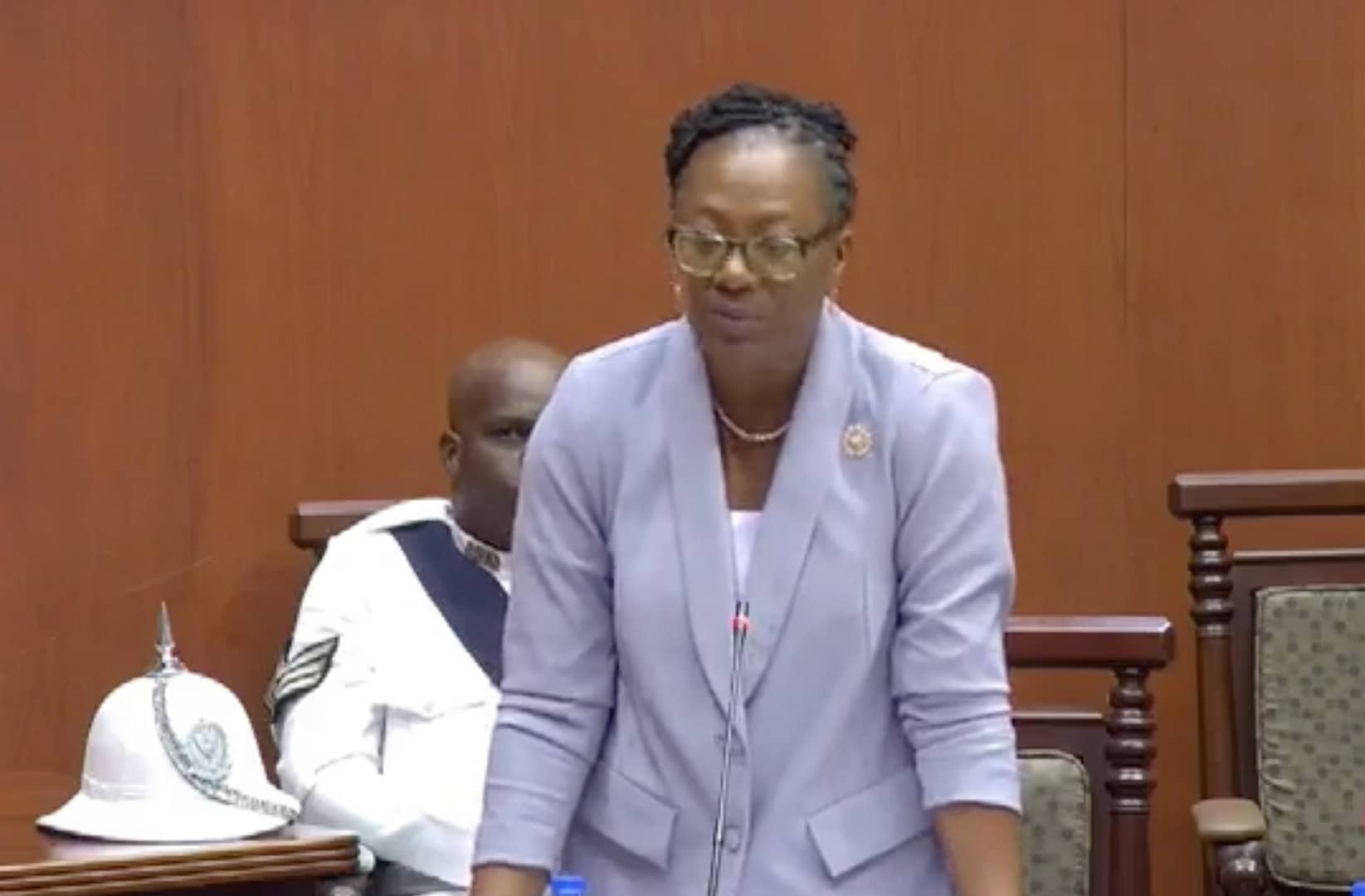

Senator Nicholas Urges Government to Rethink ABS Tax Amendments, Calls for Incentives Over Penalties

Senator Shawn Nicholas is urging the government to reconsider its approach to amending the Antigua and Barbuda Sales Tax (ABST) Act of 2006.

Senator Nicholas began her presentation in the Senate today by emphasizing the core function of Parliament to refine legislation for the betterment of society.

“We look at the legislation and we try to see how we can refine it, how we can make it better, where it’s not working, how we can make it work better,” Senator Nicholas stated.

While acknowledging the importance of the ABST, Senator Nicholas expressed concern over the current state of compliance, suggesting that non-compliance, rather than inherent flaws in the tax itself, might be the root issue.

“The issue with the ABST as it is right now is an issue of compliance. Persons are not being compliant in paying the ABST,” Senator Nicholas noted.

She further highlighted the need to widen the tax net to capture businesses that are conducting operations in Antigua and Barbuda but are not registered to pay the ABST.

“There are a number of businesses out there that are conducting business in Antigua and Barbuda who are not registered, and it is unfair for those who pay continuously every year, every month,” she remarked.

Senator Nicholas called for a shift in approach, advocating for incentives to encourage compliance rather than penalties for non-compliance.

She emphasized the need for a cultural shift towards tax compliance, stating, “We need to cultivate that culture of tax paying because all of us have a responsibility to make sure that taxes are paid.”

Additionally, Senator Nicholas raised concerns about the impact of shortened payment deadlines on businesses, particularly small enterprises and wholesalers who often rely on credit to operate.

Senator Nicholas urged the government to engage in dialogue with the business sector to explore ways to reduce tariffs at the port, making it easier for businesses to meet their tax obligations.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Correct Senator Nicholas. However in 2003 your UPP said there was no need for new taxes since there was enough on the books that just needed to be collected. But when your UPP got into power it took the easy way out and instead of enforcing and collecting these taxes, the UPP reintroduced Income Tax AND added ABST. This government is simply following the UPP playbook. The Inland Revenue Department has no interest in going after the taxes that are owed by those who are non compliant. Instead they pressure the well established businesses, at least those who are not connected to ruling politicians. They are lazy. Millons are not being collected just in the Air B& B industry alone. But who cares.

The shortening of the period to submit the returns from end of next month to 15th, must have been designed to cause unnecessary stress to small businesses. Some rely on credit and may find it difficult to pay at that time. Some vendors (example some security companies) are notorious for sending in their bills late so the business may not have even recorded all their ABST inputs. What is the real benefit of this amendment? It’s only the first month that the money will get to the treasury 2 weeks earlier than usual, after that, it’s still a month between payments. It’s a stupid and unnecessary amendment. Who proposed this? I wish parliamentarians and senators would think through these bills while they are being debated or presented and don’t just support or reject based on which party proposed.

Comments are closed.