Antigua and Barbuda Moves to Exit EU Grey List Amid Updated EU Tax Blacklist

Antigua and Barbuda’s Parliament approved several legislative amendments aimed at aligning with international tax standards and extricating the country from the European Union’s grey list.

This session comes at a crucial time as the EU has recently updated its blacklist and grey list of non-cooperative tax jurisdictions, affecting various countries including Antigua and Barbuda.

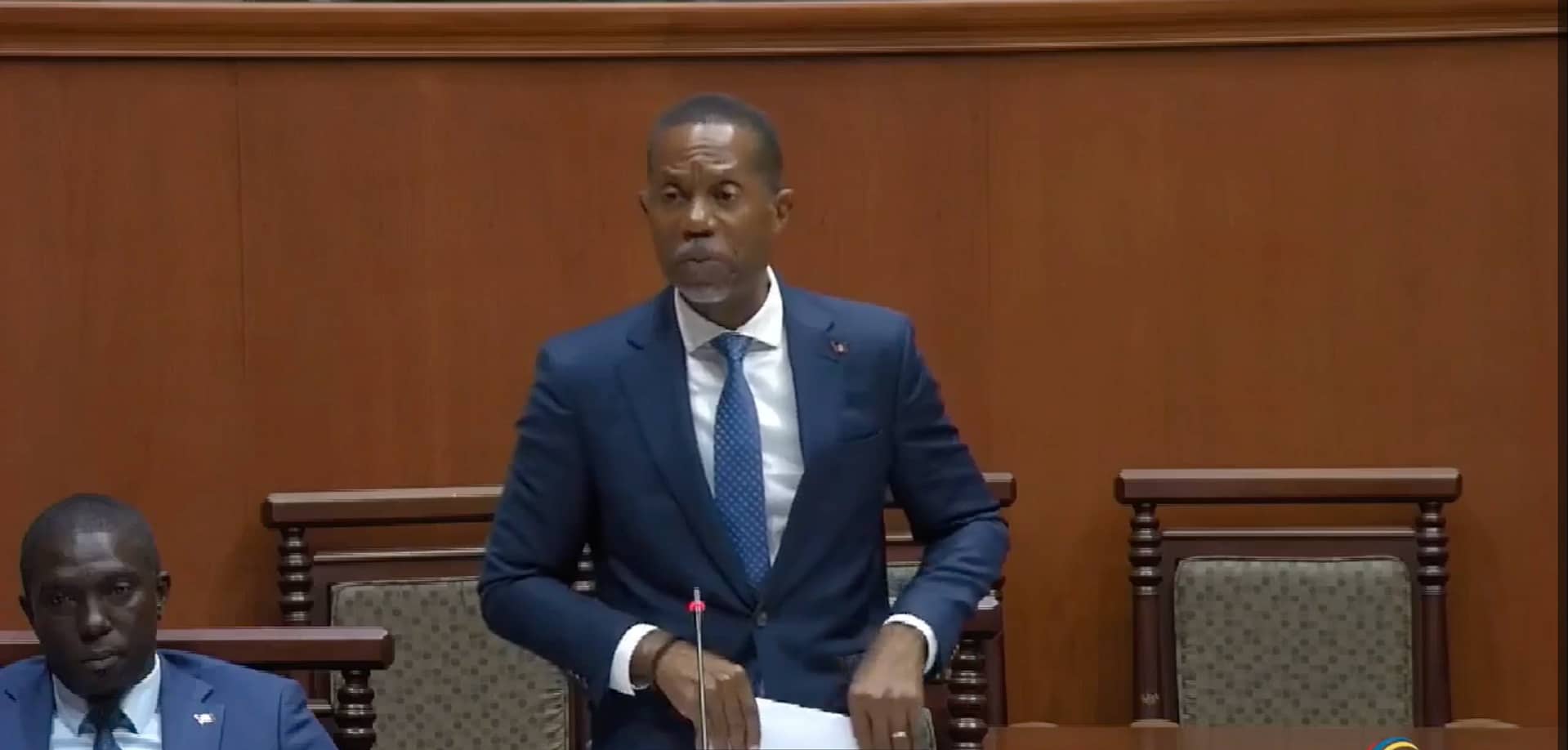

During the session, Opposition MP Trevor Walker expressed support for the legislative changes but voiced concerns about the timing and urgency of these amendments.

Walker began by acknowledging the critical need for the changes due to the EU’s stringent criteria, which include tax transparency, fair taxation, and the prevention of tax base erosion and profit shifting.

“As was mentioned, in these small developing states in the Caribbean, we really don’t have a choice. However, I’m disturbed by the late receipt of these amendments which could have been avoided,” stated Walker, emphasizing the necessity of proactive legislative action.

Antigua and Barbuda, along with Belize and the Seychelles, has been included in the EU’s updated blacklist, which imposes stricter reporting rules and restrictions on EU funding among other penalties.

Antigua was later removed from the black list and placed on the on the Grey List.

Conversely, the British Virgin Islands and Costa Rica have been moved from the blacklist to the grey list, reflecting their commitments to implement the EU’s tax good governance principles.

“It is the government’s intention—our intention—to get us totally off the grey list and back on the regular list, the white list. And that’s important, Mr. Speaker,” Walker affirmed.

He further stressed the importance of using parliamentary sessions timely to ensure the country not only exits the grey list but also avoids future negative classifications.

“We do support the amendments, and we hope that, again going forward in a timely manner, the government would receive these recommended amendments because these things are continuous and ongoing,” concluded Walker.

With the next update of the EU list of non-cooperative tax jurisdictions expected in February 2024, today’s legislative efforts are a step towards reshaping Antigua and Barbuda’s standing on the global financial stage.

Jurisdictions may be placed on the blacklist where they do not meet the EU’s criteria for tax good governance principles and, as a result, may face more stringent reporting rules and ineligibility for certain EU funding, among other measures.

The EU also made other amendments to its grey list that identifies jurisdictions that do not currently meet the criteria, but have committed to implement tax good governance principles. Specifically, in addition to the inclusion of British Virgin Islands and Costa Rica (moved from the blacklist), the EU removed Jordan, Montserrat, Qatar and Thailand from the grey list for fulfilling their previous commitments. In addition, Belize and Seychelles are no longer on the grey list now that they have been moved to the blacklist.

The next update of the EU list of non-cooperative tax jurisdictions is expected in February 2024.

Background

The EU instituted a blacklist as part of its efforts to curtail tax avoidance and harmful tax practices. When determining whether a particular jurisdiction is listed, the EU assesses jurisdictions against three main criteria— tax transparency, fair taxation and implementation of OECD measures to prevent tax base erosion and profit shifting. The EU has also indicated that it is considering adding other criteria to further strengthen the listing process.

The EU has revised its list several times since it was first published in 2017.

The EU also identifies grey list jurisdictions that do not yet comply with all of the EU’s criteria, but which have made sufficient commitments to implement tax good governance principles. These jurisdictions are required to follow-through on these commitments to avoid being moved to the blacklist.

Most EU countries have implemented administrative measures as well as one or more defensive tax measures targeted at non-cooperative jurisdictions on the EU blacklist, such as:

- Non-deductibility of costs

- Withholding tax measures

- Controlled foreign company rules

- Limitation of participation exemption on profit distribution.

The EU Mandatory Disclosure requirements also include a specific reporting rule for cross-border payments between associated enterprises where the recipient is resident in an EU-blacklisted jurisdiction. Additional disclosures will also be required for countries on the EU blacklist, or on the EU grey list for two consecutive years, under the EU public country-by-country reporting rules that generally apply for financial years starting on or after June 22, 2024.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

All these things about grey list and opposition backing government shows that they all working for the rich, these crooked white thieves hide drug money in their banking offshore system they set up here with our government complicity in bending our laws to hide their loots is the main problem, don’t make our government or opposition whip up patriotic frenzy on you the common citizens, it’s all done for white benefits, the thing is in those white people country the law is applied, but when they come here they are deities.

Comments are closed.