Residents in Antigua and Barbuda could soon be required to pay the Antigua and Barbuda Sales Tax (ABST) when they make purchases online.

The 15% value-added tax is currently applied to most items purchased at local businesses.

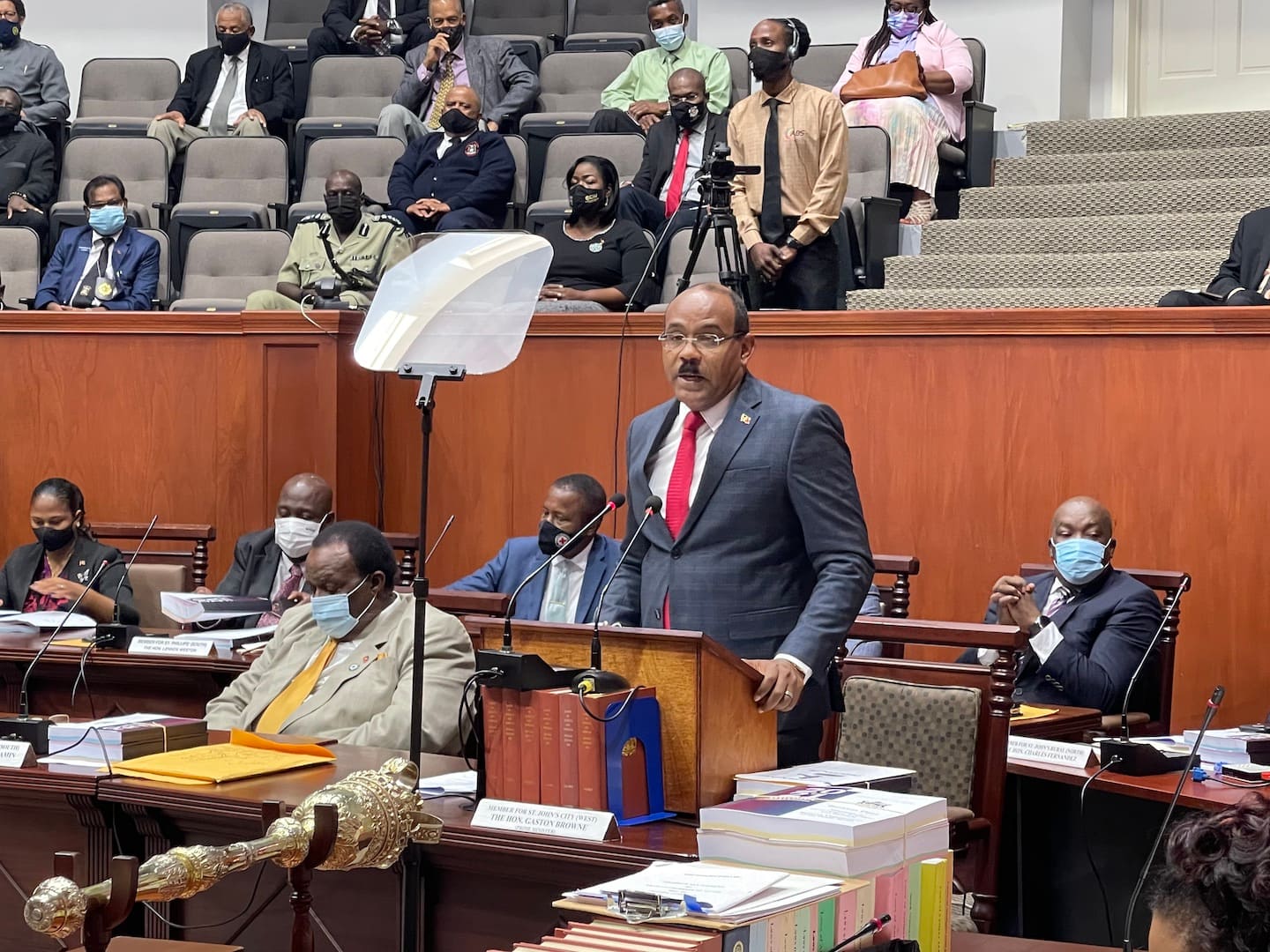

“The government is considering amending the ABST legislation to allow for the application of the ABST to online purchases to include Amazon, yes, Amazon”, Prime Minister Gaston Browne announced on Thursday as he delivered the budget speech in parliament.

Browne, who is also the country’s Minister for Finance said that “a lot of purchases are now taking place online”, he said, “wereas before that our local businessmen and women were paying the taxes at the port, and they had to pay the full amount of duties and taxes, we now recognize that these online imports have been utilized to manipulate government revenues.”

The Prime Minister added, “we have the unfortunate situation in which some of the individuals who provide these logistic services, they are stealing government’s revenue so we are going to source, to make sure that when you make a purchase online, let’s say Amazon, for example, that the tax is collected at source.”

“The details of this initiative will be declared when the methodology for applying the ABST is finalized. By the way, thi is not a new initiative, in terms of a new tax, we’re just seeking to protect government’s revenues”, the Prime Minister said.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Wow the poor always suffer. The stores in town get there product so cheap and charge us so high. There are the one is killing us. That is why we resort to online. We still have the pay for the port charges plus whatever the overseas box charge. And now we are getting tax more. Is like we don’t get break. Well for me I will not be passing any stores in town anytime soon since covid we don’t really need much. We need as Antiguan’s not to go buying expensive over price in St. john’s.

Everytime they come with their plans we are not in the aquasion.

Do you have any idea why amazon prices are cheaper?

Fasten your seatbelts people we will soon have to pay for the air we breathe and the sunlight above.

The government is already charging 50% duty.

Shipping prices to Antigua are outrageous.

And then you have to waste your time going to the airport or post office to pick up your package.

This is not the way to get Antigua into the modern era and will severely compromise the digital nomad program.

Is everyone in Antigua government a moron or just the ones making these foolhardy decisions?

PM Browne and his administration must be reminded, of the World Court Ruling in favor of A,B&Redonda against the USA, as it pertains to Online Gaming.

If the POS – point of sale, nor business is registered as an entity, in the Nation how can the PM and his Government determine what taxes to apply to such, outside of the Nations jurisdictions?

Again the World Court ruling is clear on this.

Pure nonsense on this one PM. Please find more creative ways to enhance the economy!

Not surprised this comes from a man who does not live here. Since at least 2007 (about when abst was introduced) we have paid abst on items purchased online. The difference now is where you will pay (at the point of sale vs at the port). Barbados since 2019 has had Amazon collect the ABST. Anyway man you are forgiven for not knowing

@Tenman…whatever tax/duties paid at the port(s) in Antigua has nothing to do with the taxes paid, at a POS – Point of Sale in the USA.

A…Not all States in the USA charge taxes on all items purchased(Delaware is one such State).

B…The taxes collected at POS varies per State.

C…A times varying times of the year, States will offer “Tax Free” purchases for a particular period.

Again whatever taxes/fees that the A,B & Redonda have being collecting as ABST are not based upon the regulations, of any State in the USA but based upon the policies of A, B & Redonda.

As for this “not living in Antigua” it’s only used as a ploy to divert from the real issues at hand. The ironic thing is you don’t live in America but you know of all the policies from the local City Councils to the Federal government’s. This says and have always spoken to your #SenseOfReasoning.

Guy its a state tax hence different jurisdictions. Are you so desirous of arguing that you refuse to see this? Different states are considered different jurisdictions. Its one of the issue we faced with online gaming. Even if you got the FEDS to accept it, you still needed the states (examine the cannabis issue) You are wrongly arguing Amazon cannot collect a tax for a jurisdiction its not in. Again it is collecting state taxes, not a federal tax, for jurisdictions its not in. Again its collecting VAT for Barbados since 2019. You don’t believe me?

“As a result of new legislation, Amazon Web Services, Inc. (“AWS”) is required to charge VAT on services purchased online for consumption and utilization by Barbadian customers and, accordingly, VAT at 17.5% will be added to AWS charges for taxable services.”

@Tenman…you are all over the place on this. So, I’ll direct you to From The Sidelines comment on this issue!

Ras. you can’t hide under his frock, he is man and wears no such thing. There is nothing to support your argument re world court. By the way I agree with him in terms of we need to also fix the problem at yard. Get them compliant and if you wre viewing my FB posts you would see me making similar arguments as FTS

@Tenman or is it Cornell da Chameleon, of many #Hues?

No need to reiterate the fact, that I can tell the difference between #Chameleons and #Drags in lycra and stilettos. On many occasions you’ve pointed out the fact, that #Ten wears the dress and controls the #Man in you, therefore the indoctrinated need to pay your dues by any means necessary, as in keep the #LynchingNoose around poor people’s necks while popping in and out of costumes(monikers) to be first at the #CheckeredFlag in the #DragRace sponsored by the ABLP!

Go ahead start your engine! But remember to put your brains in gear, before your throttle(throat) start sucking, on the air(LIVE BROADCAST IS IN SESSION)to relieve your #Choke hold on poor people.

Exactly! I can’t wait for the next election

People who are sleeping time to arise out of your sleep they are no different from the murders and rapist in this economic challenging time pressure he want to pressure the people at this time. They pretend to care about our health taking about social distancing, sanitizing, mask wearing but are not concerned about our finances. Wickedness in high places. Arise people the population in this country is greater that those nefarious leaders. Time to remove Adolf he have done enough damage to the country selling out to Yida, only care about his pocket. More taxes, dishonesty, control, cover up. The businessman that is encouraging him why he dont tell them to drop their prices

First, sales tax is applied at POS. You buy from Amazon.com, you pay your sales tax in the US state it is supplied from (there is currently no Amazon.ag !!)

Second, whenever you do buy from Amazon.com in Antigua you MUST ship it in personally (or more commonly use a freight forwarder from Miami such as ezone.) In which case you must go through customs…and pay CUSTOMS DUTIES, RRC, ABST… The government ALREADY collects ABST (on top of any US sales tax) on Amazon purchases!! Explain to me how it is currently possible to order from Amazon.com and NOT pay ABST in Antigua!

You don’t pay US sales tax on where it is supplied from, unless you pick the item up there in person, at an amazon store/locker. You pay sales tax at the local rate for the state AND county it is delivered to. If you use something like aeropost, they have a zero sales tax zip code in Miami.

I think places like Ezone, Aeropost, and Kes imports do it all correctly, and pass the money on to the government. There are many smaller agents acting from their homes though, who just consolidate all their customers things into one large box, and most likely don’t declare it all honestly, thus evading tax, and getting much more profit.

PM is dream you dreaming!

That’s impossible. Amazon’s point of sale system is located inside the US, and if the purchased item is shipping from certain States, you are charged local State tax based on the laws of the State. From the point of view of the State, any attempt to substitute a foreign ABST tax on a US based company that has no business affiliation or registration with Antigua would be an attempt to rob them of State income. Allowing this would set a precedent that neither Amazon nor the States hosting Amazon fulfillment centers will ever allow. Other countries around the world would subsequently make a run on Amazon to force a similar arrangement. That will never be allowed to happen. Amazon would stop shipping to Antigua instead.

The government already collects tax on Amazon purchases. In fact, I have been paying local taxes on the cost of the items, the US sales taxes I paid AND the cost to ship it to Antigua. But you complain about Amazon purchases… even as you, the government of Antigua, have been allowing dollar barrel? Every thing I buy on Amazon can be sent down free of additional costs in the suitcase of relatives and friends, so be careful what you wish for.

This is f ing ridiculous after you got to pay so much to clear your shit. This is being discussed at a time when curfew has manipulated jobs for alot of pple. I must be going insane this isn’t real ha

Gaston Browne,if you know for a fact .That persons are stealing from the Government.Turn the matters over to the Police.Because anyone who steals from the Government.Steals from all of us.It is not your personal monies.The same holds true to those.Whom you allege forged your signature.Then them thief $3 million from the Customs.The people’s money again,not yours.What is really going on in Antigua.Can we see a Comrade being paraded into the Courts for thiefing are we money.

First

Agreed

From what I understand, is not that we going to be newly charged this ABST, HE He specifically States that the logistic providers are the problem. So it’s not that he going charger you ABST additionally. you already pay abst on anything you bring in. I think he’s saying that these logistic providers are charging the ppl of Antigua the tax but the government isn’t getting that revenue. you supposed to get charged that at the port but the logistic providers but paying the government the taxes owed. so the government going have to charge it directly

Read my comments above.If he knows persons are stealing.We have a police Investigative Unit.I think it is known as the CID. Damn well turned what you have over to them.

The audit department need to audit these businesses once found guilty the government need to deal with them and leave the people alone. We pay for our logistics service with these shipping companies.

15% ABST.That is really high.Then he intends to add more taxes onto the people.My fellow Antiguans and Barbudans.The weight of the Nation would be on our backs.We would be like Atlas. Carrying the weight of the Nation on our bending backs. Heaven Help Us All.Would those $40 millions per annum from PIT help us now.The last time I checked.A bird in your hand is worth more that a million birds in the bushes.You were getting $40 million into your hands yearly and you threw it all away.Oh what a political gimmick.It is now coming back to bite all of us.Red Kool Aid Drinkers,Blue Kool Aid Drinkers,all in our backsides.

Guy do you live on the moon? ABST has been applied on online purchases since ABST began in about 2006

No,I have been living inside a cave.What the hell are you defending,Tenman.

Mr. PM Browne in order the solve the problem you have indicated you are not going about it the right way. First of all the freight forwarders need to be regulated now that this has become big business. Anyone bringing goods must have original invoices to show or the freight forwarders will not be able to clear these goods on behalf of their clients. The clients will then have to present themselves in person to the Custom Department with proof of payment for the goods. Custom has the option to accept or deny the valuation presented. The freight forwarders must supply each customer with a detail receipt of the duties and taxes paid on their behalf. And post audit will then conclude if the freight forwarder is benefitting from the taxes paid. They should clearly show on a line item the charges they have for their service to include the freight.

Trying to get taxes at the source is only possible for items that are directly shipped to Antigua from the Supplier. And Antigua calculates ABST on the CIF value and not on the FOB value of the goods. Therefore, AMAZON cannot charge the right ABST. And who knows how fast AMAZON will forward this collected sales tax to the government. We had this problem with the airlines.

In my opinion we need to address the issue here at home with the freight forwarders. And they should not be able to clear goods on people’s behalf as a total batch. It needs to be done individually.

When I bring in a barrel with a freight forwarder I must go and clear the barrel myself or hire a broker to clear it for me. In which case my name is on the warrant and I can see what duty and taxes are charged.

It will delay things but at least no one would be able to circumvent the system.

Rethink of this again. In my opinion it is not well thought of.

What IRD needs to do is go after services that are offered online. Such as advertising on websites targeting customers in Antigua and Barbuda. There are many advertisers on this website and IRD should make sure they are paying the sales tax. Even the ads placed by google.

@From The Sidelines…of course the Government is “not going about it the right way.”

Saying all that you have said, where does the World Court Ruling against the USA, in favor of A,B & Redonda regarding online gambling and the collection of fees/taxes from jurisdictions outside of a Nation, come into play regarding this #KneeJerk decision by the PM and his financial advisors?

Mr Prime Minister. Why don’t you apply to amazon for an Amazon.ag like Australia and the UK. Then the charges will be applied at the point of sale. But if you do that then you will have to pay amazon millions. And Ofcourse you can’t!

But u want to tax the poor people with your little under handed methods. Do it the right way but you won’t because then you can’t grease your pocket and the pocket of your rude obnoxious, spoil brat of a son.

What a misleading headline. Residents have been paying ABST on goods bought online since ABST was introduced by the UPP. ABST is part of the taxes imposed on imports. The only difference now is government will charge it at point of sale instead of at the port. The feeling is doing it this way will help prevent fraud. Some persons have been providing fake invoices to customers in order to cheat and evade some or all of the tax. Find it telling that some argue against adding new taxes, that government should focus on collecting existing taxes. Yet strangely when they look at measures to do just this, there are loud noises from some circles. Have to wonder if those complaining arn’t the ones who are sending in the fake invoices

@Tenman…one simple question! How can the Government of A,B&Redonda regulate or charge any tax, at a POS outside of its jurisdiction?

More jobs lost and More taxes now?

Selling and giving away the people land is one of the biggest downfall colonizing the country and have the moustache to talk about withholding taxes.

For the love of money the leaders will pressure the poor to fill their pockets more while the rich get all the incentives at the poor expenses

Comments are closed.