The Eastern Caribbean Central Bank (ECCB) says the Eastern Caribbean (EC) dollar remains a strong currency as it launched the new family of EC polymer notes throughout the sub-region.

The ECCB serves as the central bank for Antigua and Barbuda, Dominica, Grenada, St. Lucia, St. Vincent and the Grenadines, St. Kitts-Nevis, Montserrat and Anguilla.

“I hereby confirm that our EC dollar is strong. As of Friday, 24 May 2019, the backing ratio was 98.4 per cent. More importantly, our foreign reserves continue to grow and now total US$1.75 billion,” ECCB Governor, Timothy Antoine, said.

“As we celebrate the strength of our currency, let me be very clear. The ultimate defense for our strong EC dollar is our production. It is through the production of goods and especially services, increasingly higher up the value chain, that we will earn our way in the world; enhance our capacity to finance and determine our development scope and trajectory; reduce public debt and deliver shared prosperity for the citizens of the Eastern Caribbean Currency Union (ECCU),” Antoine said at the launch of the new notes that will be phased in across the sub-regional states.

“As unfit paper notes are returned to the Central Bank and our current inventory of paper notes is depleted, they will be replaced by polymer notes. Therefore, as a practical matter, the public ought to expect that both paper and polymer notes will be in circulation at the same time.

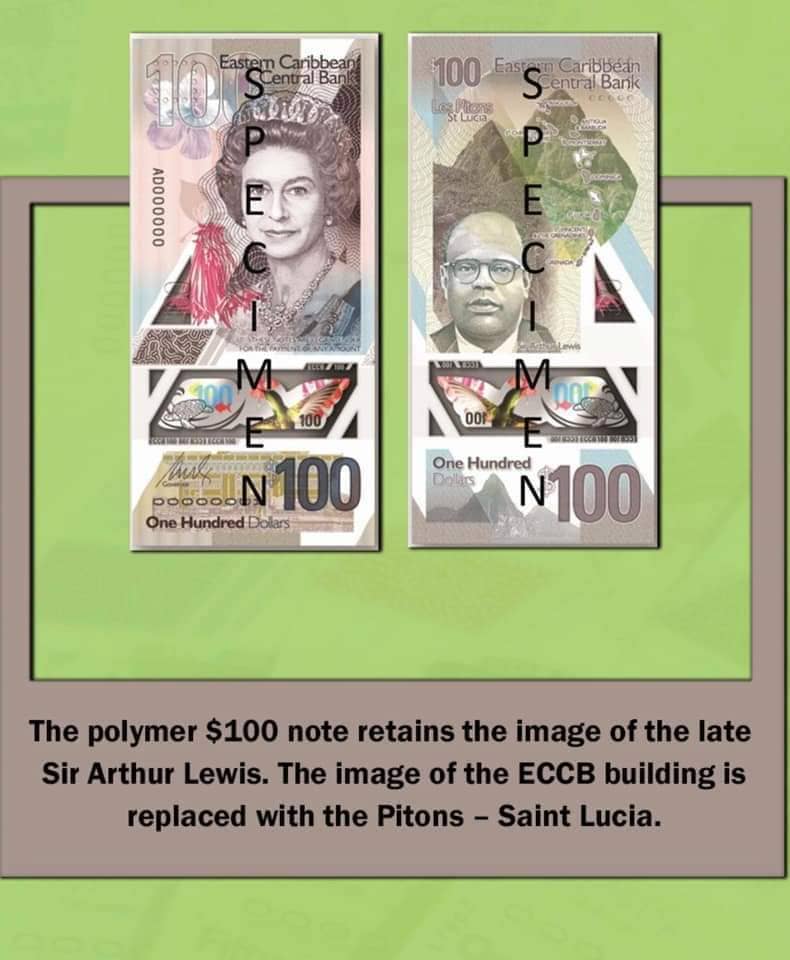

“They are both legal tender. In respect of the rollout, our current projection is: the EC$100, EC$20 and EC$10 notes will be issued around September of this year and the five dollar note around September of next year,” Antoine said.

He said the launch of the notes marks another milestone in the ECCB’s Strategic Plan 2017-2021 that has been “styled Transforming the ECCU Together”.

Antoine said the decision to move to polymer is to enhance the security and usability of the EC notes.

“It is amazing to observe how commerce, banking and money have evolved over the past 3,000 years. From barter to bitcoin; private money to central bank money and, now, crypto assets. Notwithstanding this long history, the fundamentals of money have not changed.

“Stripped to its core, money is based on trust and has three basic characteristics: unit of account, store of value and medium of exchange. To maintain trust and to stay ahead of counterfeiters, our Central Bank has a duty of care, indeed an obligation, to continually upgrade our notes.

“But our motivation is also personal. On several occasions, I have had fishermen and vendors lament to me, their inability to get value for their notes after they were soiled or torn. These stories have affected me. I have asked myself how can our Central Bank help ensure that these hardworking folks get full value for their hard-earned money? I believe polymer will greatly ease this hardship,” he said.

The ECCB governor said that from an economic standpoint, polymer notes are more cost-effective than paper.

“Although polymer notes are more expensive to produce upfront, their extended lifespan means that the notes are replaced less often. Consequently, there will be a reduction in transportation and handling costs thus reducing the overall cost of cash for the ECCB, commercial banks and credit unions.

“As part of our due diligence, the ECCB consulted with colleagues from the Bank of England, the Bank of Scotland and the Bank of Canada on their experiences with changing from paper to polymer.”

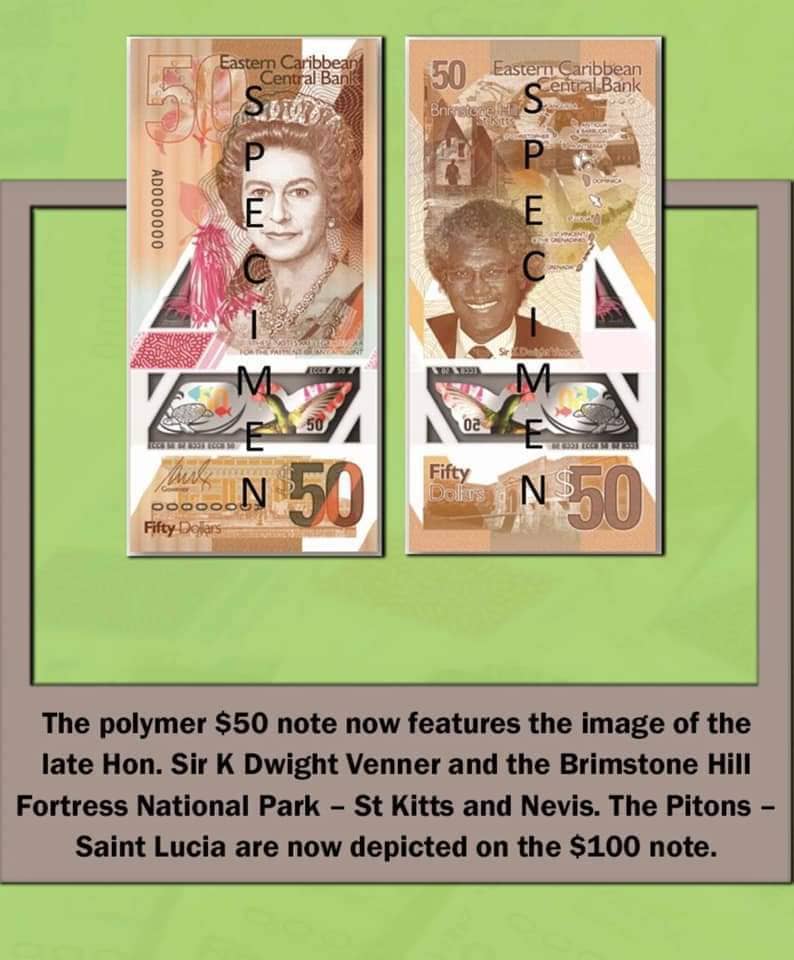

The first note in the EC family of notes, the EC$50, bears the image of the late ECCB governor, Sir K Dwight Venner..

Grenada’s Prime Minister, Dr. Keith Mitchell, who is also the chairman of the ECCB’s Monetary Council, described the launch of the notes as historic, adding “the ECCB is the first Central Bank in the Caribbean to issue an entire family of notes on polymer.

“This is therefore a significant achievement for the bank and by extension, for all members of the Eastern Caribbean Currency Union,” he said, adding that the launch “provides a clear demonstration of the bank’s leadership, innovation and its commitment to protecting our currency”.

Mitchell said that in addition to being more durable, the new polymer notes are also more secure.

“From a security standpoint, the new polymer notes would allow for the introduction of more advanced features to better protect our EC currency, making it even stronger. In a world of increasingly sophisticated criminal activities, security is a foremost consideration.”

He too paid tribute to Sir Dwight, adding he “must be recognised for the tremendous contribution he made, giving yeoman service to the ECCB and to the region as a whole”.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

This is a move in the right direction, but why in the world don’t they update the picture of Elizabeth II? The woman looks like she’s around 40 years old. She’s in her late 80s. Come on. Canada updated her photo on their money, and she looks like the grandma she is. Why didn’t somebody do some updating on our end??? This is silly.

Does it matter? I mean when she dies what is the update gonna be? Are they gonna take a picture of her and update it? Some people have real silly way of looking at things.

lol lol u hab chang fu Elizabeth? A who send u?

When will Antigua pass a comprehensive cryptocurrency law? I want to use cryptocurrency, not the ECD or anything else for that matter. Also, wasn’t the CBI/CIP supposed to allow using cryptocurrency already? Their website is totally silent on the issue.

I thought we were an Independant state?

Why is the Queen of England’s photo still plastered so big and bold on our currencies?

Why Antigua and Barbuda has to be on the smallest currency value note?

Just thinking out LOUD!!

Comments are closed.