Source- Real News Antigua: With the budget lacking meaningful relief for the citizens of Antigua and Barbuda – when compared to the St. Kitts and Nevis budget –

what has been presented, instead, is a budget that seeks to pauperize the people through a set of fiscal measures, critics are saying.

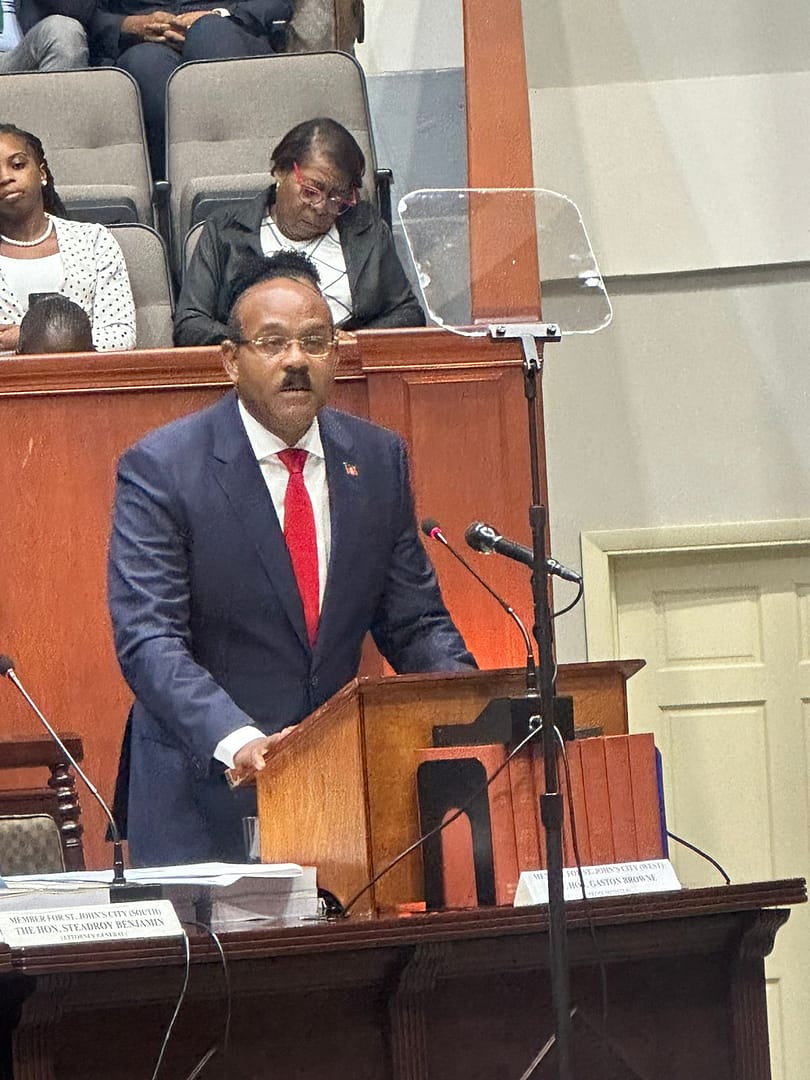

Finance Minister Prime Minister Gaston Browne says the measures being introduced in 2024 are to strengthen the Government’s revenue collection; reduce distortions in the tax system; and improve taxpayer compliance.

Some of the measures outlined include a reduction in tax concessions, especially discretionary exemptions – a promise made in previous budgets, but apparently not followed through.

Browne says his administration recognizes that concessions and tax incentives are required to encourage investments in new projects and major commercial expansions.

Accordingly, he says the Government will continue to provide them as required and in accordance with the Antigua and Barbuda Investment Authority (ABIA) Act and the Small Business Development Act.

But, he says, “for ongoing routine business operations – to include consumables – these concessions will be discontinued.”

Another noose around the necks of the people, critics say, is an increased tax rate on properties valued at $3 million or more.

There will also be a 10 percent excise tax (sin tax) on alcohol, tobacco, and cannabis products, while the Money Transfer Levy will increase from 2 to 5 percent, as well.

The Browne Administration will also be broadening the base of the Antigua and Barbuda Sales Tax (ABST) by enhancing the list of services that would attract the tax – including online streaming services.

According to the finance minister, the Government will also end the concessionary ABST rate applicable to several transactions, most notably within the tourism sector.

“Increasing the ABST rate from 15 percent to 17 percent and applying this rate to the tourism sector, which currently attracts a

rate of 14 percent,” is another tax measure, Browne says.

The cost of living and inflation are already high; however, although there may be a nominal impact on prices because of the rate adjustment in the ABST, Browne says the change will not affect a wide selection of food and other essential items.

“Already, many of the basic food items we presently consume are zero-rated, so consumers do not pay ABST on them,” he says.

He listed some of the zero-rated items, including most fruits and vegetables, including – but not limited to – bananas, oranges, grapes, potatoes, broccoli, cauliflower and lettuce; baby products; dry goods and oils to include pasta, sugar, corn meal, flour, rice, and cooking oils; chicken, fish, locally produced meats, and eggs; canned sardines

and tuna; bread; cereals, cheese and milk; water; medicine, pharmaceutical supplies, and adult diapers.

According to the prime minister, exempt supplies for use in the agriculture and fisheries sectors will not be affected by the change in the ABST rate, either.

He says that the Government, through the Ministry of Finance; the Prices and Consumer Affairs Division; the Customs and Excise Department; and other critical stakeholders, will monitor prices as the revenue reforms are implemented.

Additionally, Browne claims that the basket of essential goods and the list of price-controlled items are being reviewed, and recommendations will be made to the Cabinet for appropriate adjustments.

“The intention is to minimize the price effect on basic and essential

goods and ensure timely interventions are made to cushion any impact on vulnerable groups in society,” he says.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

St Kitts Sales Tax is 17.5% value added while Antigua and Barbuda is now at 15% to be increased to 17%.

St. Kitts has a small zero rated basket of goods while Antigua and Barbuda may have the largest in the Caribbean.

St. Kitts public services is about 3 thousand (3000) worker while Antigua and Barbuda has in excess of 14 thousand (14000)

It is evident that the St. Kitts Government places emphasis on the growth of their Private Sector,while ALP employs a Job-for-vote Program and that scheme is now causing them headaches.

St. Kitts/Nevis uses it’s CIP to give back to the people! They do not borrow indiscriminately without a clue as to how to pay back! Just saying! The name of the game there is wise financial decisions which will benefit the citizens and not fly by night investors with empty briefcases!

Less Job!

More Taxes!

More lies!

I can recall some laborhypocrites will condemn the other party for taxes, but know they will justify these changes although they are suffering, just because of party they support.

Lord why are there so many dumb people on the UPP side. They want to make an educated case on the budget but contradicting themselves in everything they say. How can you pauperize people that have the ability to build a house of $3million with a little increase on their property tax. How can you pauperize people who smoke and drink alcohol by implementing a sin tax of 10%. Afterall we would like to deter them from doing such harm to their health, which when they get ill we then have to provide them with expensive healthcare.

I can go on and on but it just not worth my time. You guys wheel and come again. Go and do your homework.

Comments are closed.