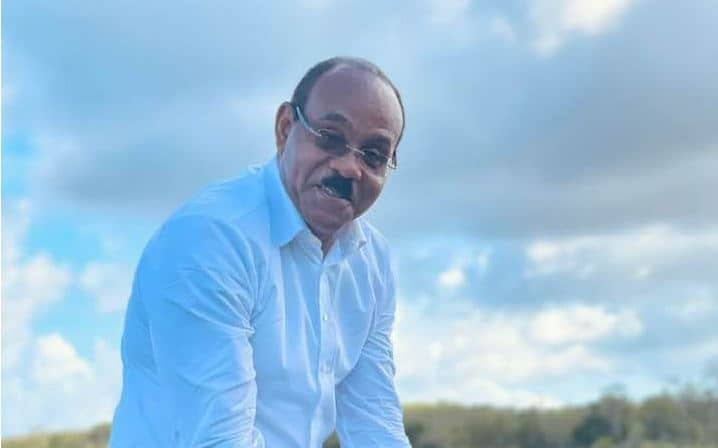

The Antigua and Barbuda government says it may suggest to some of its creditors that they consider taking a haircut even as it remains confident that it would be able to meet its obligations to pay the debts owed as well as meet the increased wage and outstanding arrears to public servants by the end of this year.

Prime Minister Gaston Browne, in a two-hour television interview on the state-owned ABS Radio and TV on Sunday night, said that his administration is banking on receiving at least US$25 million from the Barbados-based Caribbean Development Bank (CDB) as well as other sources of funding including floating a US$200 million bond.

Browne said he hopes the CDB funding will become available within the next “30 to 60 days” noting that a planned board of directors meeting of the region’s premier financial institution a month ago had not taken place.

“So, we expect that sometime this month or next month that they will have this board meeting,” he said and the US$25 million made available to St. John’s.

“We have earmarked those funds for certain funding including giving public servants an increase,” he said, adding that he would not want to pre-empt the negotiations with the trade unions.

“A negotiating committee was established in 2018 and you would recall we gave a five percent and we are now negotiating the final amount. I believe initially there was a proposal for seven percent which was rejected by the various bargaining agents and we have asked our negotiating teams to increase the amount.

“So I am hoping that within the upcoming weeks they will come to some agreement and we will have a formal proposal before the Cabinet which we stand ready to accept,” he said, adding “it will be retroactive and we certainly put the arrangements in place to also pay the back pay…. before December 31, 2022”.

Browne said in pursuing other initiatives to fund socio-economic projects, his government has floated a US$200 million bond acknowledging that the island had not fully recovered from the impact of the coronavirus (COVID-19) pandemic.

Browne suggested that some creditors “suggest that they take a haircut and then pay off the balance,” adding “we want to make a significant dent in the outstanding payables so that we can have more monies in the economy and even to fuel more robust growth…”.

He said while the economy is predicted to grow by 7.5 percent next year, “when you look at the plethora of projects coming on stream and the fact that the public sector itself will be poised for spending more money within the domestic economy then it means we should be in a position to even exceed those seven and a half percent”.

CMC/

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

I hope and pray that all his cabinet ‘self-enrichment’ members are first in the queue to purchase this type of multi-million dollar bond.

Because Gaston Browne had an opportunity to help the citizens of Antigua to grow economically and fiscally whilst in office beforehand, however he decided to put his associates first – and now he wants to help us with an unbelievable HIGH YIELD BOND of around 7.5% per annum. Really boss?

COME ON GASSY, PULL THE OTHER ONE!

I have a good mixed amount of stocks and shares in my portfolio, and not one of them guarantees or promises a 7.5% per annum return.

For those of you thinking about investing (ensure that it is part of an eclectic mix of other stocks, shares and bonds), please remember these two Latin words: caveat emptor.

LET THE BUYER BEWARE!

DAMN, I’M GOOD …

If I’ve misunderstood his true intentions for this high yield bond and growth for Antigua then hopefully we’ll all benefit in the not too distant and foreseeable future …

How many Bonds is he going to float? CDB,please get ready to write off all of those Loans borrowed by this Administration. Dem no lob foo pay back nutten dem barra. What asset is he using to secure those loans from CDB? Those other Member Nations of the Caribbean Development Bank had better begin to tell the Bank to pump the brakes on those loans.

MUUUUURDA! GASSY WHAT HAPPEN TO THE 2 BILLION THAT YOU GET FROM THE CIP!

WAY DE MONEY GORN!

All Antiguans,Barbudans and Residences. Gaston “Einstein” Browne did say,he was going to borrow Antigua and Barbuda out of debt .Could someone like Dave Ray with a Tertiary Education explain to me,a former Wharf Rat. How does one arrived at that Mathematical formula? Borrowing out of Debt.

IMF Loans have conditions as to who to fire and what to cut down. Other loans you set your conditions

@ Little Johnny

Was anybody fired by the UPP when they received the loan from IMF?

YOU USEFUL IDIOT?

Like agreeing to giving away 50% of our taxes for 15 years on all your businesses and receiving a penalty of 50% of the loan if contract breached. No IMF loans because no accountability and IMF loans have to be accounted for and can’t go in foreign personal accounts.

Comments are closed.