CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Antigua and Barbuda Parliament Approves Regional Deposit Insurance Bill to Safeguard Bank Depositors

Antigua and Barbuda’s Parliament has approved the Eastern Caribbean Deposit Insurance Corporation Agreement Bill 2025, part of a suite of harmonised legislation across the Eastern Caribbean Currency Union (ECCU) designed to bolster financial stability and protect depositors in the event of a bank failure.

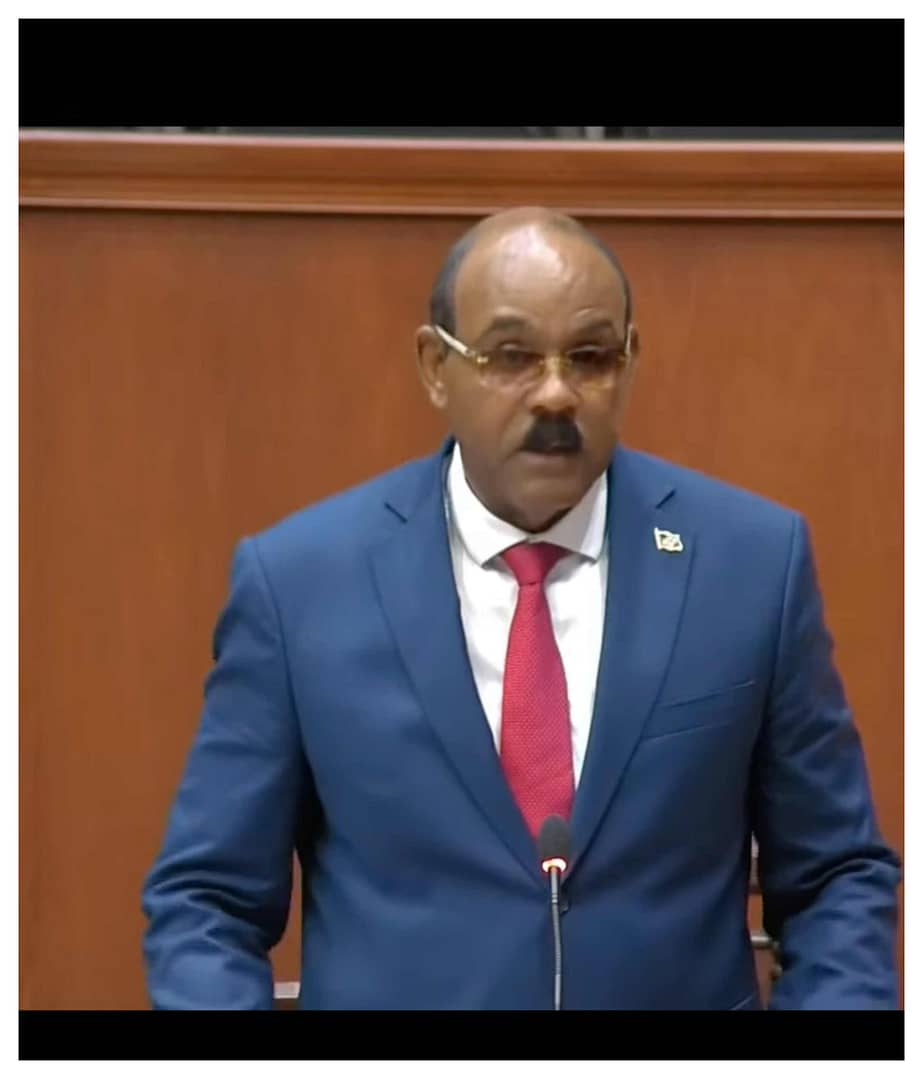

The bill was presented by Prime Minister Gaston Browne, who described it as a “landmark step” towards regional financial security.

It paves the way for the establishment of the Eastern Caribbean Deposit Insurance Corporation, a regional body that will insure deposits of up to EC $50,000 for individuals and businesses holding accounts at participating financial institutions.

“This will literally protect depositors in the event of a failed bank,” Prime Minister Browne told lawmakers. “All eight member states of the ECCU have agreed to this initiative.

It is a critical layer of protection and a means of avoiding taxpayer-funded bailouts.”

According to Browne, the initiative will be funded primarily by premiums paid by financial institutions.

While the precise methodology has yet to be finalised, he said banks may allocate a portion of the interest income from depositors to contribute to the insurance fund.

An initial capital injection of EC $1.5 million will be provided by the Eastern Caribbean Central Bank (ECCB), with the fund expected to grow significantly over time.

Browne pointed to the region’s banking history as justification for the move, referencing past failures in Antigua and Barbuda, including ABI Bank, Bank of Antigua, and Caribbean Union Bank (CUB).

The Prime Minister said the government spent EC $300 million to protect depositors during the collapse of ABI Bank, a burden he argued should not fall on taxpayers again.

“This country suffered fiscal failure, economic failure, and bank failure all at once.

No other country in the Caribbean has faced that trifecta. We must put systems in place to avoid repeating that history,” he said.

The bill also outlines a strong governance and compliance structure, with a five-member board to oversee the corporation’s operations. Non-compliant banks could face fines of up to EC $500,000, with additional daily penalties for continued violations.

The ECCB will serve as custodian of the fund, managing deposits and investment returns under the guidance of the new corporation’s board.

Browne encouraged depositors with savings above the EC $50,000 threshold to diversify their holdings across multiple banks to ensure full coverage.

“There is a practical way to protect your full savings—split your funds between institutions,” he advised.

He also noted that the coverage limit may be increased in the future if the fund grows significantly, possibly reaching EC $100,000 or more.

The Prime Minister used the opportunity to clarify provisions in the bill regarding legal immunity for officers and directors of the corporation.

He drew a parallel to recent controversy surrounding the government’s payment of legal fees in the Alfa Nero matter, stating that indemnity clauses for public officials acting in good faith are standard in both national and international law.

“If we acted corruptly, there would be no immunity. But we acted in good faith and within our legal duties,” he said.

“These provisions exist to protect those serving the public—not to shield wrongdoing.”

While Grenada is currently lobbying to host the headquarters of the new corporation, Browne said Antigua and Barbuda supports a collaborative approach, having previously hosted the Eastern Caribbean Asset Management Corporation (ECAMC).

The bill now awaits finalisation of similar legislation across the ECCU before the deposit insurance scheme can become operational.

“This is not just a financial instrument,” Browne concluded.

“It is an expression of regional solidarity and a long-term investment in economic resilience.”

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

You know I’ve been watching our parliamentary debates and what I notice is that whenever their is a non-contentious bill or a bill that won’t attract political expedience in any way, the opposition members have nothing to contribute. Except for Richard Lewis and Sherfield Bowen. It shows the intellectual capacity of the members, or the lack thereof. The people who voted in the other member such as Shuggy and Serpent should be ashamed of themselves. These are really as the PM called them LAGGARDS. They do not make any contribution to bills in parliament. Theyn are just lazy bitches. And all they care about is self. Getting Duty Free on Vehicles, getting land for cheap and all the other benefits that the position award them. They say you get the government you deserve. But really St. Georges, St. Marys’ South. Is that what you deserve. Don’t you really think you deserve a much better representation. I really hope you reflect on the choice you made last election and correct this coming election. These guys have no place in our Parliament. They are not cut out for that work. They don’t study bills, they do not contribute to any of them. Only when it is a controversial bill. So they can grandstand. Please voters do not bring down the country this way. Chose persons that are worthy to represent you.

Long overdue if you ask me. People need to feel safe when dem put dem money inna de bank.

Protecting depositors? Yes please! But who protecting de small man from high bank fees still?

Is about time we get regional systems in place. Caribbean integration should benefit ordinary people too.

Regional cooperation pon finance? Finally we behaving like one Caribbean.

Wha bout dem who nuh trust bank inna de first place? Dey still go hide cash under mattress.

Why this legislation at this time? Are you afraid somebody will disclose the deposits from the Alfa Nero sale?

Comments are closed.