UK PRIVY COUNCIL RULES IN FAVOUR OF THE BARTHLEY FAMILY IN A SHARES DISTRIBUTION DISPUTE WITH PIC INSURANCE COMPANY

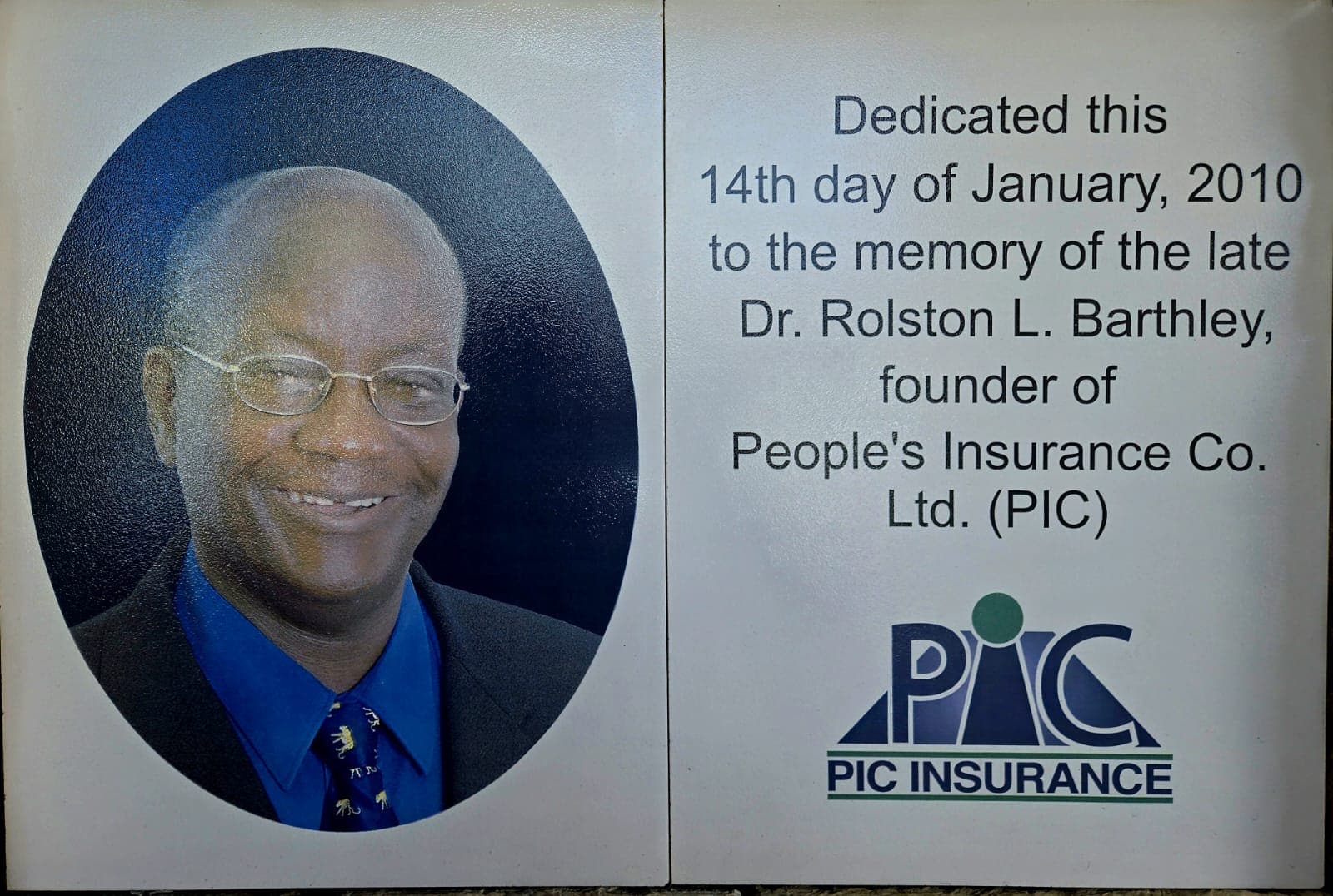

The Privy Council, the highest appelate court for Antigua and Barbuda upheld a lower court ruling on Thursday, affirming that PIC Insurance Co. Ltd. (PIC) wrongly refused to transfer majority control of the company to the estate of its founder, Dr. Rolston Barthley.

The Privy Council rejected PIC’s appeal, finding that the Eastern Caribbean Court of Appeal and a lower court had correctly determined how the shares of the company should be distributed following Barthley’s death in 2005.

The ruling was based on evidence showing that PIC’s investors had been aware that Barthley intended to retain 51% of the company’s shares as a tribute for his dedicated, unpaid service to the business.

Justice Nicholas Hamblen, delivering the Privy Council’s judgment, confirmed that all shareholders had agreed to this arrangement from the start. The Privy Council also upheld earlier conclusions that Barthley’s son, Zorol Barthley, was entitled to 5% of the shares.

Barthley, who founded PIC, a general insurance provider, in 2002, passed away in late 2005. His estate, along with his son Zorol, claimed that all shareholders had agreed that they would receive shares in the company. However, some shareholders of PIC disputed this and refused to allot the shares.

In December 2019, Judge Rita Joseph-Olivetti ruled in favor of the Barthleys, stating that PIC’s failure to distribute the shares was “unfairly prejudicial” to their interests. Judge Joseph-Olivetti found that Barthley had clearly communicated to prospective investors his intention to retain a 51% shareholding, an arrangement that was part of his commitment to the company and its growth. In a direct reference to the three witnesses presented by PIC, the Judge opined that it took painstaking precision to extract the truth, even when faced with obvious facts.

In January 2021, the Eastern Caribbean Court of Appeal also dismissed PIC’s appeal, agreeing with the findings of the lower court. The court highlighted Barthley’s significant, unpaid contributions to the company, including his four and a half years of dedication to building the business.

On appeal, PIC argued that the issue was not solely a “question of fact” but involved legal matters related to the interpretation of board meeting minutes and other documents. However, the Privy Council ruled that the lower courts had properly considered all evidence and that the case was fundamentally a factual determination.

The Privy Council’s decision marks the final resolution of this long-standing dispute, ensuring that the Barthley estate and Zorol Barthley are entitled to the shares they claim in PIC Insurance Co. Ltd.

PIC Insurance was represented by Dr. David Dorset of Watt, Dorsette, Hewlett Law.

The Barthleys were represented by Kendrickson Kentish of Lake and Kentish, instructed by Lake, Kentish and Bennett.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

CONGRATULATIONS!!! Lemme check Supa Dymand qucik day

PIC is a WICKED COMPANY!!!!

They very well knew that the deceased retained 51% ownership stake.

MONEY HUNGRY WICKED NEARGAH DEM BE.

The worse thing here is the facts were ways in favor of the BARTHLEY family but the dishonest PIC lawyers knowing that the facts were on the Barthley’s side; presented the most ridiculous arguments that is not about facts but “involved legal matters related to the interpretation of board meeting minutes and other documents”

To bad attorneys can’t be sanctioned for this type of conduct.

Full time David Dorset retire. Always taking cases that he knows from the onset is doom and gloomed. What will your legacy be David? Wait you’ve never stopped to asked yourself that bro? WHAT WILL YOUR LEGACY ENTAILS!

Win, lose or draw lawyers who some call liars will always get paid! The interpretation, of the legalese language comes at at high price.

It would be nice if lawyers can be sued for malpractice like [they] themselves do, to other professions.

Do lawyers and law firm have to carry liability insurance?

See a plaintiff who looses a case on a “technicality” should be made to pay all costs incurred by the plaintiff(s), who is their client(s).

Those who cut deals behind your back, give wrong advice should pay up too!

Yes, there is #disbarment, but by then it’s like a criminal already did the crime(s) and a plea deal is made with that criminal to get to another criminal.

Crime really does pay.

Comments are closed.