CLICK HERE TO JOIN OUR WHAT’S APP GROUP

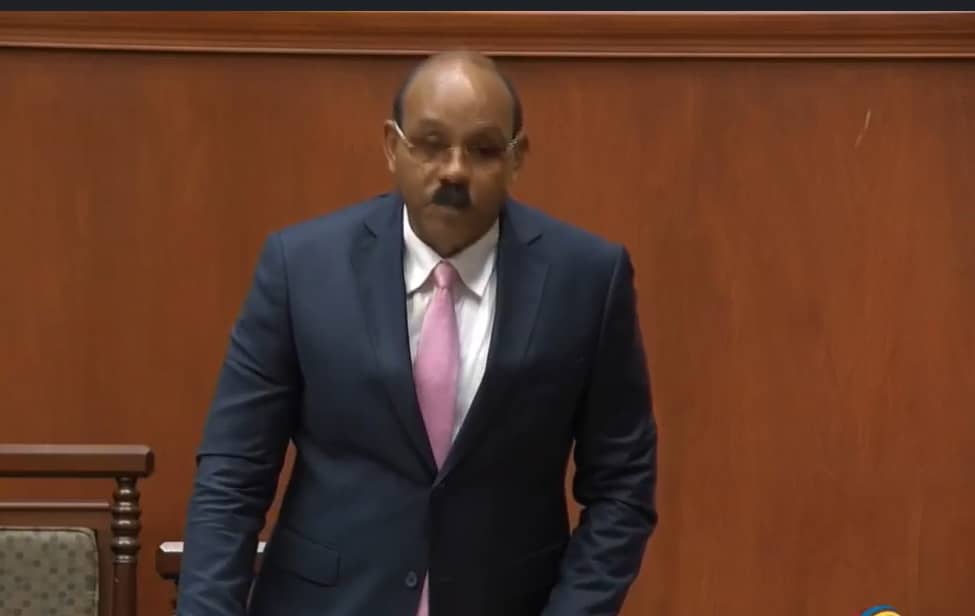

Prime Minister Gaston Browne has urged Antiguans and Barbudans to take a proactive approach to financial planning, warning that pensions alone may not be sufficient to maintain a comfortable standard of living in retirement.

Speaking on The Browne and Browne Show on Pointe FM, the Prime Minister stressed the importance of long-term investments, particularly in real estate, as a means of securing financial stability in later years.

“Pensions were not designed to take care of all of the expenses of a pensioner,” Mr Browne said. “It has to be supplemented, so our people must have the discipline to save and invest to boost their income during the retirement years.”

The Prime Minister Gaston Browne encouraged citizens to explore investment opportunities in property, pointing to the government’s ongoing initiative to make beachfront and waterfront properties available for local ownership.

“If our people do not seize these opportunities, you may find that the wealthier ones are the ones who end up buying them, investing, and making the money,” he warned.

He said that middle-class citizens in particular should consider real estate investment as a retirement strategy, noting that many have significant savings but do not always leverage them effectively.

“There are plenty of middle-class people who have $400,000, $500,000, maybe up to a million dollars saved,” he said. “But if you have a few hundred thousand dollars in the bank right now and you get one bout of sickness, that can wipe it out.”

He suggested that purchasing property and participating in the growing Airbnb market could generate stable, long-term income, particularly for those preparing for retirement.

While acknowledging that real estate investment may not be accessible to everyone, Mr Browne said there are ways for lower-income individuals to participate, including through joint investments.

“You can have individuals coming together and jointly investing—two or three people pooling their resources,” he said. “If it’s two people and you want to come up with $200,000 in equity, you put in $100,000 each, go to the bank, get a piece of land, build a property, and share the revenue.”

He also highlighted the potential of mutual funds and real estate investment trusts (REITs) as options for smaller investors to gain exposure to the property market.

“One of the areas in which we can probably assist those making less money is by getting our mutual fund and investment trust legislation going, so that they can invest in these funds,” he said. “That way, even someone with $20,000 or $30,000 saved can still invest and earn dividends.”

The Prime Minister emphasised that financial preparedness for retirement should be a national priority, as many citizens find themselves struggling in old age due to a lack of proper planning.

“We need to have some discourse about this so that people understand the importance of investing and building some level of wealth to take care of their old age,” he said.

He noted that while some may expect financial support from their children, changing economic conditions mean that younger generations often have their own financial burdens.

“You have to understand that the world is becoming more and more competitive, and even children have their own challenges,” he said. “By the time they finish taking care of their own obligations—mortgage, car payments, children’s education—it’s difficult for them to take care of a parent.”

Mr Browne said the government would continue to facilitate opportunities for investment and financial growth, but ultimately, individuals must take responsibility for their own financial futures.

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

PM Browne is right on the money with this one. People need to start thinking about their future now because pensions alone might not cut it.

I’m glad the PM is raising awareness about this. It’s easy to put off thinking about retirement, but it’s so important to invest now for peace of mind later.

I’m glad the PM is talking about this. Too many people wait too late to start planning for retirement. It’s something we all need to pay attention to now.

I agree with the PM. A pension isn’t always guaranteed to cover everything when you retire. We need to start thinking long term and invest wisely.

A lot of people don’t realize how fast time flies. PM Browne’s urging everyone to plan ahead for retirement is solid advice. Start early, and you’ll be better off in the long run.

I dont agree with Browne on alot on things but sometimes what he says makes some kind off sense.

After they done raise contributions cost, up the retirement age, and can’t pay in a timely manner smfh

Well Prime Minister Browne, maybe if you stop putting up our vehicle licensing fees by 40% and curtailed the rising costs of living prices, then Antiguans might have a chance to NIDIFICATE or invest in their retirement.

Sometimes I wonder if this man engages he brain 🧠 before he open he mout’ …

He’s so correct. Pension is probably not going to be enough for most of the populace but more than adequate for him and his team, after they gave themselves that substantial pay raise which will eventually be their Pension.

At the current cost of living and the forever increasing prices, citizens and pensioners alike faces a daunting task trying to make ends meet. For pensioners, it is a no win situation even after devoting most of their life to work. This is the reason why I forever sing this chorus. Government must do more in order to cut waste and reduce the cost of living especially for pensioners and other vulnerable citizens. Many are living hand to mouth daily and are barely able to survive. Politicians are quite fortunate. They serve 2 terms in the Upper or Lower House and they receive a pension equivalent to their last salary. Every increase, whether it is vehicle license fees, eggs, water, electricity or other consumer items, pensioners are impacted far more.

@Audley Phillip March 9, 2025 At 2:26 pm

\Why do you keep on making stupid remarks. Whether or not the government spend money or not has nothing to do with your pension. Antigua and Barbuda has for decades now a system of pension at social security that is and was never setup to give you such a pension that will allow you to keep living the kind of standard of living that you had when you were earning a salary. Your contributions that you paid in at social security gives you the maximum return that you have put in. The sealing used to be $4500 and the most you would get if you made all your contributions is $2500. And now the sealing is $6500 and the most you will get is $3500.00. That is a drop in income of 46%.

I have in many occasions try to bring this to people’s attention. You will fall in poverty if you depend solely on your social security pension. And many people start contributing very late in life. So they never reach the maximum. It is therefore wise to have another private pension that you contribute to or an endowment fund. You need to check with your insurance provider what is the best option for you. However I also have called on the government to look into re-organizing the social security pension to make a portion of contributions above the ceiling not mandotory, but in which people can get a much greater return or were people can chose to increase their contributions up to an amount that they want to have that income that they belive will make them live comfortable. We have many pension calculators that can let us know how much you need to contribute monthly. The employees contribution presently is only 7%. And that after 500 monthly contributions will give you $3500 p/m untill you die. So in total you would have contributed $227,500 and to withdraw every month $3500 means you will have done so in 65 months or 5 years and three months. If you retire at 67 and life for another 5 years and 3 months means that by age 73 you have used up your money. And I did this very simplistic to show you that people live longer these days and therefore the average person get more than what they paid into the fund. As I said this is very simplistic. No interest is taken in consideration and no adjustment for inflation. The Prime Minister has unilatery decided to increase the minimum payment from Social Security pension to $500.00 This was done to assist the most vulnerable ones. yes we have people that are getting this low of a pension, because they just did not pay in enough over the years. Especially vendors and construction workers fall in to that category. Public Servants on the otherhand have two pensions. One state pension and one from Social Secuity. Therefore they are much better off.

many of our pensioners are living in poverty because of this. They did not plan for their retirement age. And then they became a burden for the state. Some have to go to the Board of Guardian to get some handouts. I wonder if this is fair. Should my tax dollars paying for those thatb were not responsible enough to plan for their retirment?

Or should the government insist that we take up the social secuirity contributions to that level that will guarantee a more livable pension. That I would agree with. No one should drop at retirement more that 25% in income. A person making $3,000.00 should be retire with a pension of $2,250. And we need to calculate how much his contribution should be

Well highlighted @ Audley Phillips, once again you’ve correctly accentuated how out of touch this government is with hardworking Antiguans and pensioners.

It astonishes me that ABLP supporters are equally out of kilter as well, and their stupefied support for this wannabe autocrat Gaston Browne.

Audley, wouldn’t it be great if the Prime Minister treated the Antiguan voting public as equally as those lobbyists that have the spondulicks in their deep, deep pockets to sway Browne in their gravalicious direction.

Again, well said sir … 👏🏾👏🏾👏🏾

@Brixtonian March 10, 2025 At 9:02 am

@Audley Phillip March 9, 2025 At 2:26 pm

Dumb Dumb and Dumb Dumb brother are giving each other praises. What else can you expect from them. Stupidity to the core.

bold words coming from a politician, politicians are entitled to 100% of their salary as a pension after serving 2 terms. lol I would love to see who “middle class” can afford to save $500,000.

Education, education, this is man’s salvation.

If our future is in the hands of our children we need to make sure that they are given the tools within which they are empowered to make better choices.

Learning how to master a budget early on in life will teach them about the habit of early saving, growth in savings, transitioning from saving to investing, avenues of investment etc.

For those still in the income earning bracket, those same lessons need to be taught.

Where does the janitor, the domestic worker, the garbage collector get this same knowledge that can be applied to their situation?

People also need to be open minded to expanding their knowledge.

If one is in a low income bracket then look at creating a side hustle to begin your savings. It could be as simple as making juices or snacks that can be sold to generate a small profit. Take some time to learn new things. Everybody has a phone, that is an access to learning. The more you learn the easier your access to earning. You have to give to get. Give up some time to increase your worth.

We definitely cannot depend on either Social Security (a mis-nomer these days), and/or our children to carry us into old age.

The Prime Minister is right. We need a mindset change to change the current status quo.

Anything outside of food and necessary clothing that one spends money on should be bringing in a return.

The prime minister is correct, I can remember my friend Mr Cornwall who had the supermarkets advising me to build apartment or house to rent and don’t depend on government pension.

A what is dis, finally Gaston has said something that I absolutely agree with, keep it up Bro., you might get more kudos from me

We need to learn from the so-called developed countries, Europe, Canada, USA and perhaps their are others, where the people retire and live comfortably with the pension they receive. People are like children. You have to protect them against themselves and against the state. Because in the end they will become a burdon to the state and will end up in vbarious social programs or the Poor House. Feinnes Institute. The old way where children take care of their parents when they get old is almost out the window. Some just drop them in front of Fiennes and they are on the next flight to North America. Never to look back at their parents. Children these days cannot take the stress. They have their own problems to deal with. Many old people therefore have a veru sober look on life. Their future is grey. They are not happy. I do not have a mother and father anymore, but I took care of them untill they passed away. However I am financially well of and I do not expect nor am I counting or hoping for my children to take care of me.

Indeed it is not a fair society that we are living in. Poltician get their state pension after two terms that is as high as their last earned salary. No wonder why some people trying their best to get elected for the wrong reason. It is a form of self enrichment. And the political parties are playing the game by appointing those that did not win their seat to the Senate. That way they can still get their pension.

We need to ne willing to make the sacrafice of putting aside a larger portion of our salary towards a pension scheme. But we need more securities and guarantees that our monies will not be missapropriate and no government can borrow these funds and not repay them. This is not rocket science to do. People need to be able to start looking forward to their retiement years and not enter into these years uncertain and in fear of having to live in abject proverty

Comments are closed.