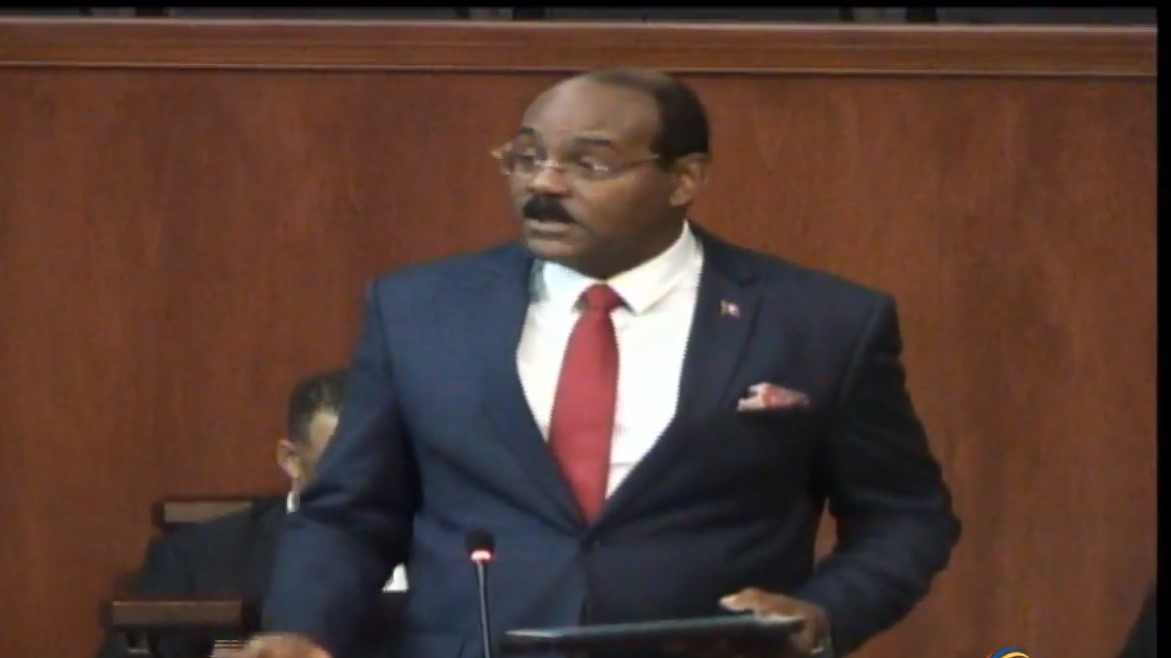

Prime Minister Gaston Browne is seeking to amend the Banking Act of 2016 on the heels of the proposed Scotiabank acquisition by the Trinidad-based Republic Financial Holdings Limited (RFHL).

The PM seeks to strengthen its authority over final approval of sale or transfer of bank assets.

“We are looking down the road, recognizing that there is still some vulnerability,” said PM Browne

“If Scotiabank here in Antigua has $1.5 million in assets in Antigua and they are generating $37 million a year in profits, why should we sit back and allow those lucrative assets that are owned by Antiguans and Barbudans to be… repatriated to wealthy countries.”

Local bank representatives recently met with the Prime Minister to express interest in acquiring the local Royal Bank branches. The Eastern Caribbean Central Bank (ECCB), the Antigua Commercial Bank (ACB), and the Caribbean Union Bank (CUB) have expressed a desire to form a consortium to facilitate the acquisition.

The purchase price is estimated to be estimated at approximately $60 million according to a government official.

Browne further explains that one of the aims of this local acquisition is to prevent another collapse like that of the recently defunct ABI Bank.

“We had to spend over $300 million to salvage the depositors at the now defunct ABI Bank,” Browne reminded.

“So, it is in the interest of the government and the people of the Antigua and Barbuda to have a stronger indigenous banking sector because if there are any future failures, again the government will be obliged to protect depositors.”

Section 174 (3) of the Banking Act currently reads: “On completion of the investigation, the Commission may, if it thinks fit, make a recommendation to the Minister to make a Banking Business Vesting Order transferring to and vesting in the transferee financial institution the undertaking, as from the date specified therein, and on the making of such an order, all such existing property, rights, liabilities and obligations as are intended by the agreement to be transferred and vested shall, by virtue of this Act, and without further assurance be transferred to, and shall vest in, the transferee financial institution to the intent that the licensed financial institution shall succeed to the whole or such part of the undertaking of the transferor financial institution as is contemplated by the agreement.”

The amendment will change the wording in the section from ‘may’ to ‘shall’ thus strengthening the government’s vested position allowing for greater final say with regards to sale of banking assets within its jurisdiction.

Governor of the Eastern Caribbean Central Bank Timothy Antoine has indicated that the sale of Scotiabank branches within the nine territories will take another two weeks, at least, to allow for due diligence to be done on the transaction.

With the passage of the bank amendment, the Antigua and Barbuda government will now have an increased position over the final sale of the entities holdings on the island.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Just like a few Antiguan & Barbudans got together & aquired OMG which you never gave yr blessing. Consortium my ass. He’s suppose to own everything & no one else….

I guess this editor has no standard to maintain. Everything goes. Even foul language.

Who feels like vomiting Everytime this man opens his mouth and it is not a case that they are preggers?

Comments are closed.