CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Tax Revenues Up, but Inland Revenue Targets Hotel Levy Underreporting

While Antigua and Barbuda is seeing a rise in tax revenues for the first quarter of 2025, government officials are now turning their attention to suspected underreporting by some hotels—particularly in the collection and payment of the guest levy.

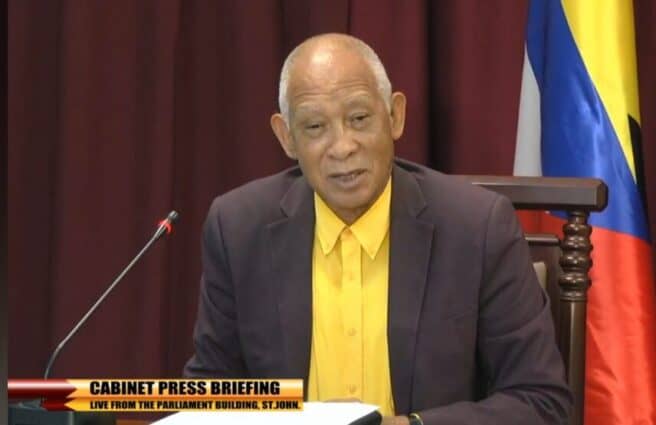

During Thursday’s post-Cabinet media briefing, Chief of Staff Ambassador Lionel Hurst confirmed that Customs duties and the Antigua and Barbuda Sales Tax (ABST) have shown measurable increases, suggesting positive economic activity. However, he noted that guest levy receipts from the hotel sector do not reflect the booming tourism figures being reported.

“The hotels are full to the brim, yet many are still paying the same amount in guest levy as they did last year,” Hurst said. “That doesn’t add up, and the Inland Revenue Department has taken notice.”

He explained that the IRD will use data collected through the country’s electronic embarkation/disembarkation (ED) cards—where visitors indicate their length of stay and accommodation provider—to calculate estimated tax liabilities for each hotel. If a property’s reported payments fall below these estimates, they will be issued a demand notice.

According to Hurst, if hotels fail to meet the estimated tax thresholds, “they will be challenged, and the Inland Revenue Department is prepared to defend its position.”

He suggested that some establishments may be engaging not only in underreporting but potentially in tax evasion. “It’s one thing to be avoiding taxes; it’s another to be evading them altogether,” he said.

The guest levy, which is meant to contribute directly to national revenue from tourism-related income, is calculated based on guest nights and rates. Officials stress that the levy is a critical source of funding for infrastructure, marketing, and public services.

“Hotels can’t boast about record numbers and then report minimal levy payments,” Hurst said. “That’s not going to be tolerated going forward.”

The announcement follows broader efforts by the Ministry of Finance to boost tax compliance and ensure that all sectors contribute fairly to the country’s economic recovery and growth.

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

That’s skullduggery from the management of these hotels but lots of people say there is skullduggery in Government too, seems to me everybody got to clean up their act. Remember if the top slack the every will fall apart

If hotels are truly underreporting, that is thief for public purse

Not Surprised

Why do we even have a levy if it’s not being properly collected?

How can hotels not be paying tax and i have to pay?

And most a dem nah pay the staff proper service charge

They steal service charge, tips, and under pay. What a world we live in smh

What is happening? Are you guys going after robin hotels because he sick and not in the government as he usually do to cover his tracks?

Comments are closed.