The Antigua and Barbuda government is blaming a shortfall in revenue for the delay in the payment of salaries to public servants last month.

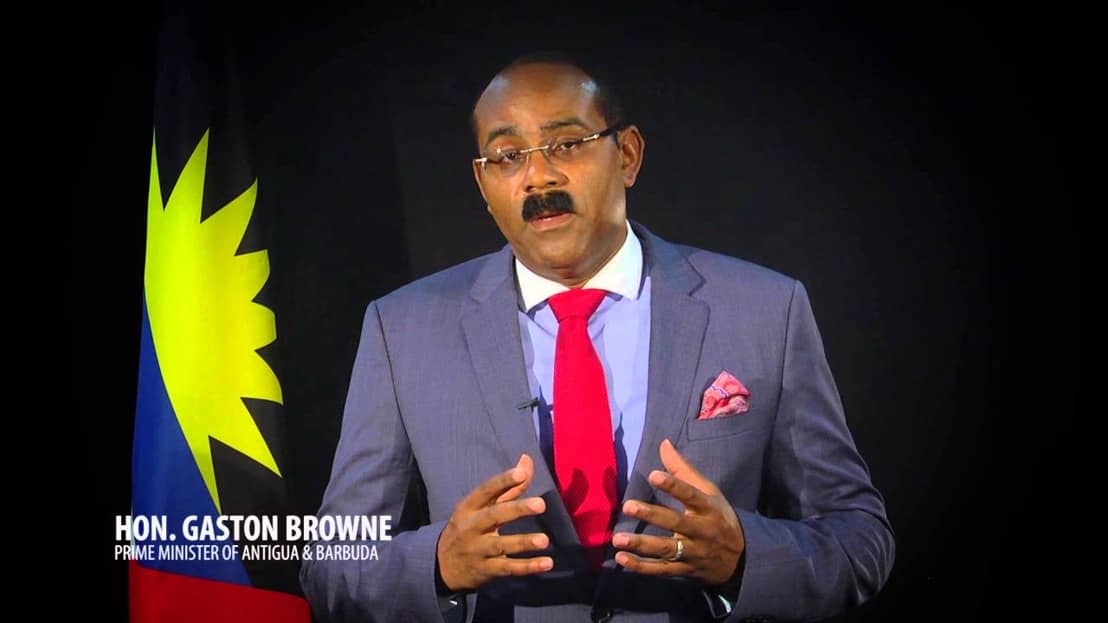

Prime Minister and Minister of Finance, Gaston Browne, told legislators that traditionally September and October “are very difficult revenue months” for the government.

“I am told that for September, all but six million dollars (One EC dollar=US$0.37 cents) of revenue would have been covered, or at least monies to pay wages and salaries had been covered,” he said, adding that his administration had just given instructions “to transfer another six million dollars from a CIP Fund…in order to ensure that the remaining public servants are paid.

“But the reality is there has been a shortfall in the revenue versus expenditure and we have this structural problem Mr. Speaker in that two items of expenditure, salaries and wages and debt repayment, account for 110 per cent of all revenues”.

Browne told legislators that the situation is not unique to his administration, but a recurring problem for successive governments for years.

He said the government has turned to the CIP (Citizenship for Investment Programme) to relief the shortfall in salary payments.

Under the CIP, foreign investors are granted citizenship of the island.in return for making a significant contribution to the socio-economic development of the country.

“So it is really the CIP that is keeping us afloat and again today we just had to transfer a couple million US dollars from CIP account….in order to cover salaries and wages,” Browne said.

“But the reason why the salaries and wages may have been paid a day or two late for some individuals is because there was a shortfall in revenue and we may have a similar situation in October. But, whenever that arises we may have other funds to cover payments,” Browne added.

Prime Minister Browne also dismissed a statement by an opposition legislator that the government’s decision to abolish the income tax could have contributed to the situation.

“In fact what the evidence would have shown is that whenever we had personal income tax the rate of growth would have slowed. So if you took out for example the revenue or the years leading up to Cricket World Cup where you had exceptional growth, you would recognise that generally speaking the (Antigua and Barbuda) Labour Party years without income take, the economy grew at a faster rate.

“So what you felt that we may have lost in terms of collecting direct taxes, we would have collected indirect taxes and that is helping to fuel stronger growth because disposal incomes are stronger, people could spend more so that consumption itself would have increased,” Browne said, adding “that’s why people could buy more cars”.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

You are the Minister of Finance?? You should have your hands on the pulse of the financial ups and downs of the Nation.The months of September and October have been known for decades as slow months in Antigua and Barbuda.When did you Gaston Browne as Prime Minister/Finance Minister know this? Were you hiding in a cave for the past 20 plus years of your political existence.Thanks to the so called CIP.That your political party,ABLP was so strongly against.This is now the savior of the country’s financial woes.What has happen to all of the incomes the country took in from January to August?Were those monies misspent.So now you are so broke.You had to withdraw some millions of CIP funds from an account at Global Bank.By the way.How much money was/is in that account at Global Bank.Why is the CIP money in an account at Global Bank? Who are the shareholders of that Bank? Change the name from CIP to SOP (Sales Of Passports).

Agreed

This is what happens when you hang your hat too high. Parents always advise to live within your means. The PM should have listened to those who told him to ease the spending and leave what can be left for later. It should be now clear that they are not enemies of the state but those who urged you along might be.

Broke is just broke and not a shortfall

The shortfall is in competent fiscal management not in revenues. This is not a unique and one off phenomenon, it is cyclic. If September and October are low revenue months then you make provisions for that shortfall and not spend money wild like a drunken sailor then say ooops!!!!

Time to seek assistance from the IMF, we are broke.

“Shortfall my big toe”

The problem isn’t “revenue”; it’s the bloated civil service that we can’t afford.

FACTS!

V.S Naipaul

Thank You for saying/recognizing it! “If September and October are low revenue months then you make provisions for that shortfall and not spend money wild like a drunken sailor then say ooops!!!!”

UWI ?

I heard monies went missing at one of the financial institutions Rappaport had?. Can someone enlighten me on this?.

“more disposable income…”???? QUESTION: for who? If I recall income tax was paid by those ONLY earning over $3000 per month….

“Indirect taxes cover what we lost collecting from a direct tax like income tax..”????

NOTE to the “master in economics”: while direct taxes (income tax) are designed to be FAIR since it’s a percentage of your salary, indirect taxes (those placed on the product) are UNFAIR since it’s no longer a percentage of your income hence those with higher salaries pay a LOWER percentage of their income to purchase the same product increasing constantly the gap between the wealthy and the poor. So yes, there is greater purchasing power, but ONLY for those earning more than 4000 or 5000 per month, anyone earning less than that is paying more in indirect taxes than what they were paying in income tax. Labour party doesn’t represent labourers!!!

Comments are closed.