So, you want to start investing. Maybe you’ve been squirrelling away funds in your younger years and have some to spare. Maybe you’re a little older, looking to make your money work for you. The reality is that today, anyone can trade, and many turn to investment over alternative methods of attempting to grow their wealth.

Pension accounts can be slow to mature while using a savings account means relying on fluctuating interest rates. In comparison, stock-trading means putting your money to work in a manner that offers more control, interactivity and strategic oversight than others can. Years ago, someone interested in kicking off their investment journey and opening a portfolio would have been limited to giving the broker a ring and filling out reams of paperwork. What’s more, the fees and limited touch-points meant the experience was expensive and fractured for the investor. Those days, thankfully, are behind us.

Nowadays, you can fairly easily trade, purchase or sell shares with a few clicks on your desktop or mobile, by opening an account, verifying yourself, depositing funds and getting started. It can be that easy. However, the only decision you might not be prepared to make is which broker platform you choose to invest with. Here are some things to consider when you make your choice.

Fee-ling it out

Fees used to be commonplace in stock-trading, and a huge limitation on who could invest. Nowadays, they’ve fallen to either minuscule size or none at all. One of the major benefits of some of the best-known platforms is the 0% commission and lack of management fees, markups or ticketing. If restricting your spending outside of actual investing is important to you, look for these low-cost sites, specifically. It’s important to remember, however, that you won’t have access to certain benefits like 24-hour customer service, but these are expected with low-cost or free services.

Trading places

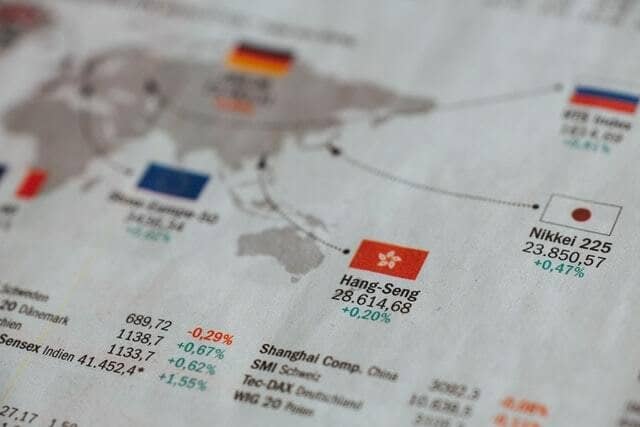

Some platforms will allow you to trade certain types of stocks, but not others. For example, platforms like Pepperstone specifically work with CFDs (Contract for difference), rather than the typical dividend-yielding shares and stocks. Equally, you might want to trade in very specific markets, like forex, for example. In those cases, having access to good resources is key, due to the fast-moving nature and idiosyncrasies of each market. Forex signals are subscription-based resources, offering insights into when or what forex trades to make. It’s worth checking out a guide to forex signals to understand your options. Equally, some platforms like Capital.com will offer excellent resources on-site. Knowing precisely what you’re trading in and the market’s characteristics are great strengths to have.

Trading can be a brilliant adventure, and something to not only make your money work for you but a chance to be more engaged and involved in your financial future. That said, your choices matter, and understanding that you need a strategy and the platform you use will matter – these sorts of decisions are hugely important, and shouldn’t be underestimated.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]