Eastern Caribbean Central Bank

P. O. Box 89, Basseterre, St Kitts, West Indies

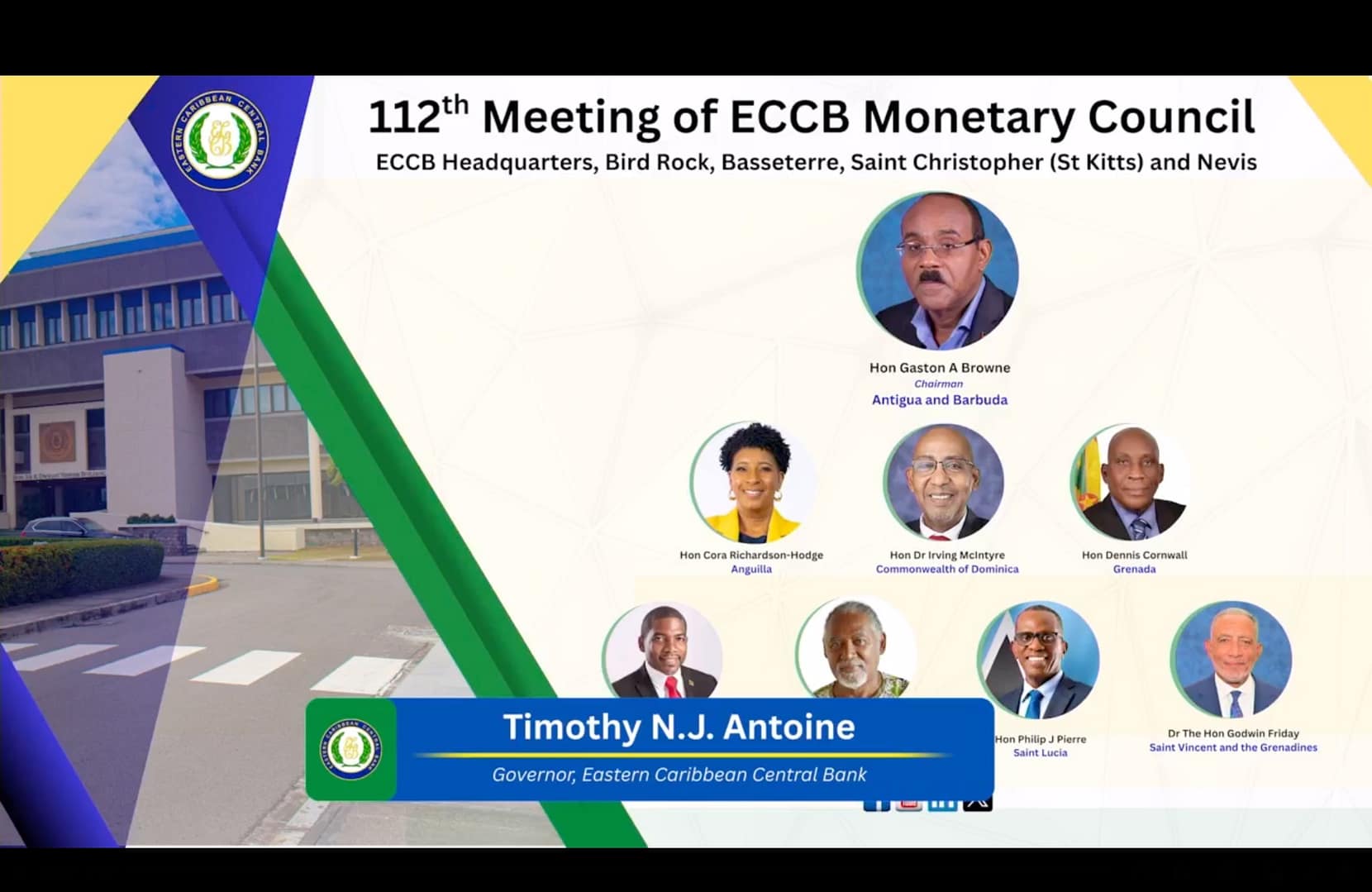

Communiqué of the 112th Meeting of the Monetary Council of the Eastern Caribbean Central Bank

Issued: 13 February 2026

OPENING

The Monetary Council of the Eastern Caribbean Central Bank (ECCB) convened its One Hundred and Twelfth (112th) Meeting on 13 February 2026 at the ECCB Campus in Saint Christopher (St Kitts) and Nevis, under the chairmanship of the Honourable Gaston A. Browne, Prime Minister and Minister for Finance of Antigua and Barbuda.

The Council met against a backdrop of evolving global dynamics, shifting geopolitical conditions, and persistent structural challenges within the Eastern Caribbean Currency Union (ECCU). The deliberations focused on safeguarding monetary and financial stability while accelerating structural transformation under the region’s Big Push for Shared Prosperity and Resilience.

1.0 LEADERSHIP CONTINUITY AND INSTITUTIONAL STABILITY

The Monetary Council confirmed the re-appointment of Mr Timothy N.J. Antoine as Governor of the ECCB for a term of five (5) years, effective 1 February 2026.

The Council underscored the importance of leadership continuity at a time when the region must pursue bold and coordinated policy action to maintain stability and secure durable growth, diversification and resilience.

2.0 MONETARY AND EXTERNAL STABILITY: A STRONG ANCHOR

The Council reviewed the Governor’s Report on monetary, credit and financial conditions in the Eastern Caribbean Currency Union titled:

“ECCU 2026 and Beyond: Bold Policies for Bigger and More Resilient Economies.”

The Council reaffirmed that monetary and financial stability remain the bedrock of the ECCU’s development strategy.

The EC dollar remains strong and credible.

The Backing Ratio stands at 99.5 per cent—well above the statutory minimum of 60.0 per cent.

Foreign reserves total EC$5.83 billion.

July 2026 will mark the 50th anniversary of the EC dollar peg at EC$2.70 to US$1.00.

In light of stable domestic conditions and moderating global inflation, the Council agreed to:

• Maintain the Minimum Savings Rate at 2.0 per cent; and

• Maintain the Discount Rate at 3.0 per cent (short-term) and 4.5 per cent (long-term).

The Council reaffirmed that the stability of the currency union remains non-negotiable and central to investor confidence and regional prosperity.

3.0 GLOBAL CONTEXT: VIGILANCE IN A TIME OF HEIGHTENED UNCERTAINTY

The Council noted that global growth is projected at 3.3 per cent in 2026 and 3.2 per cent in 2027, supported by technological investment and easing inflationary pressures.

However, risks remain elevated due to:

• Geopolitical tensions;

• Shifting international trade and policy regimes;

• Commodity price volatility; and

• Uncertainty surrounding global mobility and financial flows.

The Council emphasised the need for policy agility and strategic partnerships to mitigate external vulnerabilities.

4.0 FINANCIAL STABILITY

The ECCU banking sector remains stable and highly liquid, supported by strong capital buffers, a rising capital adequacy ratio, and a declining non-performing loans (NPL) ratio. Excess liquidity was estimated at EC$1.41 billion as at the end of January 2026.

The ECCU Credit Bureau continues to expand its reach. Five member countries—Antigua and Barbuda, Grenada, Saint Christopher (St Kitts) and Nevis, Saint Lucia, and Saint Vincent and the Grenadines—are now live on the credit bureau system.

The Council endorsed continued efforts to channel liquidity toward productive investment, particularly SMEs and priority sectors under the Big Push framework.

5.0 THE BIG PUSH: FROM RESILIENCE TO ACCELERATION

While ECCU growth is projected to improve modestly to 3.3 per cent in 2026, the Council acknowledged that this remains significantly below the approximately 7.0 per cent annual growth required to double regional output over the next decade.

The Council therefore affirmed its commitment to advancing the Big Push—a coordinated regional strategy to:

• Raise productivity;

• Diversify economic activity;

• Strengthen food and energy security;

• Deepen financial markets;

• Enhance competitiveness; and

• Build climate resilience.

The Council stressed that the region’s challenges are structural rather than cyclical. Sustained acceleration will require deliberate reform, targeted investment, and stronger regional coordination.

The Council agreed on four strategic Theatres of Transformation as central to the Big Push agenda:

I. Food Security

II. Energy Security

Reducing import dependence, scaling renewable energy, and strengthening climate-smart agriculture to improve resilience and ease cost-of-living pressures.

III. Logistics and Connectivity

Modernising ports, shipping, and inter-island transport to reduce transaction costs and improve regional integration.

IV. Financial Deepening and Inclusion

Expanding access to credit, capital markets, and digital payments to support entrepreneurship and private sector growth.

V. Human Capital and Productivity

Addressing youth unemployment, skills mismatches, and outward migration through targeted education, training, and innovation strategies.

The Council underscored that implementation discipline and measurable targets will be critical to success.

6.0 CITIZENSHIP BY INVESTMENT REFORM AND GOVERNANCE

The Council welcomed the enactment of the ECCIRA Agreement into national law by the participating ECCU member countries, paving the way for the operationalisation of the Eastern Caribbean Citizenship by Investment Regulatory Authority (ECCIRA) in 2026.

Together with the launch of a Regional Biometrics Programme, these reforms are expected to:

• Strengthen governance and due diligence;

• Enhance transparency and credibility; and

• Support sustained investor confidence.

The Council reaffirmed its commitment to high standards of integrity and regulatory oversight in this strategically important sector.

7.0 FINANCIAL INCLUSION

The Council approved the suspension of DCash 2.0 development to prioritise:

• Development of the Fast Payment System; and

• Participation in the CARICOM Payments and Settlement System (CAPSS) pilot.

The successful pilot of the ECCU Retail Bond Programme in 2025 was noted as a milestone in broadening household participation in capital markets and deepening regional financial integration.

The Council expressed concerns about the ease and experience of customers doing business with financial institutions in the ECCU and welcomed the ECCB’s plans to commence operations of the Office of Financial Conduct in 2026 to enhance consumer protection and strengthen confidence in the financial system.

8.0 FISCAL AND DEBT SUSTAINABILITY

The Council noted that some member countries were not on track to secure the Debt-GDP ratio of 60 per cent by 2035. It acknowledged ongoing efforts by member governments to strengthen fiscal and debt sustainability and the necessity for fiscal resilience frameworks in a climate of constant shocks.

Sustainable fiscal policy remains essential to preserving macroeconomic stability and supporting long-term growth.

9.0 GROWTH AND COMPETITIVENESS

Tourism continued to underpin growth in 2025, with total visitor arrivals reaching approximately 3.3 million and expenditure estimated at EC$6.4 billion by the third quarter.

However, the Council emphasised that sustainable growth requires moving beyond recovery toward structural competitiveness, productivity enhancement, and diversification.

The upcoming 10th Annual Growth and Resilience Dialogue (22–24 April 2026), under the theme “Big Push: Resilient Leadership in a Dynamic World,” will further advance this strategic agenda.

10.0 DATE AND VENUE OF 113TH MEETING OF THE MONETARY COUNCIL

Council agreed that the Ceremony to mark the change in Chairmanship of the Monetary Council will be held on Thursday, 09 July 2026 in the Commonwealth of Dominica. The 113th Meeting of the Monetary Council will be convened on Friday, 10th July 2026.

The Honourable Dr Irving McIntyre, Minister for Finance, Commonwealth of Dominica, is due to assume Chairmanship of the Council.

11.0 PARTICIPATION

Council Members attending the meeting were:

- Honourable Gaston Browne, Prime Minister and Minister for Finance, Antigua and Barbuda (Chairman)

- Honourable Cora Richardson-Hodge, Premier and Minister for Finance, Anguilla

- Honourable Dr Irving McIntyre, Minister for Finance, Commonwealth of Dominica

- Honourable Dennis Cornwall, Minister for Finance, Grenada

- Honourable Reuben Meade, Premier and Minister for Finance, Montserrat

- Honourable Dr Terrance Drew, Prime Minister and Minister for Finance, Saint Christopher (St Kitts) and Nevis

- Honourable Wayne Girard, Monetary Council Alternate and Minister for Economic Development and Youth Economy, Saint Lucia

- Honourable Dwight Fitz-Gerald Bramble, Monetary Council Alternate and Minister for Foreign Affairs, Foreign Trade, Foreign Investment and Diaspora Affairs, Saint Vincent and the Grenadines

The Eastern Caribbean Central Bank (ECCB) was established in October 1983. The ECCB is the Monetary Authority for: Anguilla, Antigua and Barbuda, Commonwealth of Dominica, Grenada, Montserrat, Saint Christopher (St Kitts) and Nevis, Saint Lucia and Saint Vincent and the Grenadines.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]