Communiqué of the 110th Meeting of the Monetary Council of the Eastern Caribbean Central Bank

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

The One Hundred and Tenth (110th) Meeting of the Monetary Council of the Eastern Caribbean Central Bank (ECCB) was held at the Eastern Caribbean Central Bank in Saint Christopher (St Kitts) and Nevis on 14 February 2025.

The Monetary Council welcomed back its newest member, Premier Reuben Meade of Montserrat.

- Monetary Stability

The Monetary Council received the Governor’s Report on Monetary, Credit and Financial Conditions in the Eastern Caribbean Currency Union (ECCU).

The Report, titled Seizing the Opportunities to Reposition the ECCU for Transformation,provided global and ECCU updates on monetary, credit and financial conditions and assessed their potential impact in the near to medium term.

The Governor’s Report indicated that:

- The global economic environment is pregnant with uncertainty.

- Amid easing inflation, global growth is projected to remain resilient with the USA projected to grow around 2.7 percent and China projected to grow around 4.6 percent (according to the IMF’s World Economic Outlook, January 2025).

- Key downside risks for the global economy include renewed inflationary pressures influenced by factors such as protectionist measures, geopolitical issues and climatic shocks.

- Key downside risks for the Currency Union include policy shifts among major trading partners, volatility in Citizenship by Investment Programme (CBI/CIP) revenues; and climatic shocks.

- Key upside risks (opportunities) for the ECCU conducive credit conditions, timely implementation of major infrastructural projects in member countries and financial sector reforms such as the ease of opening of bank accounts and rollout of the credit bureau.

- The ECCU’s growth outlook for 2025 remains positive in the range of 3.5 percent – 4.5 percent, with Tourism, post-hurricane Beryl reconstruction and investments in physical infrastructure expected to drive growth. Cognizant that bold reforms — and timely passage of legislation — are required for sustainable growth outcomes, the ECCB continues to support a stable and resilient financial sector and encourages the member Governments to expedite the enactment of the relevant legislation.

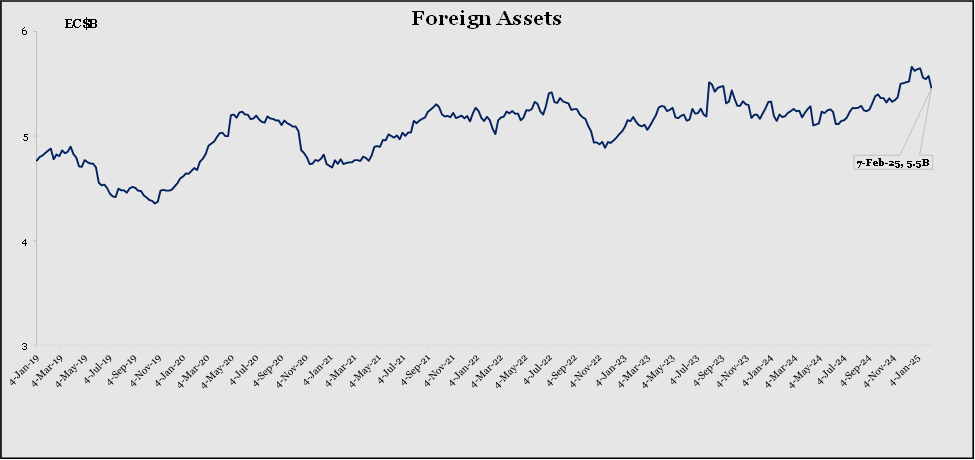

The EC currency remains strong: the backing ratio (also known as the ratio of foreign assets to demand liabilities) continues its upward trajectory, and stood at 98.2 per cent as at 7 February 2025. Reserves are EC$5.5 billion as at the week ending 7 February 2025 — up from EC$5.4 billion as at 11 October 2024.

Source: Eastern Caribbean Central Bank.

- Having considered the state of monetary, credit and financial conditions in the ECCU, the Monetary Council, on the recommendation of the Governor, agreed to:

- Maintain the Minimum Savings Rate at 2.0 per cent; and

- Maintain the discount rate at 3.0 per cent for short-term credit and 4.5 per cent for long-term credit.

The Minimum Savings Rate is the lowest rate that commercial banks can offer on savings deposits. The Central Bank’s discount rate is the rate at which the ECCB lends to governments and commercial banks.

- Financial Stability

The Monetary Council was advised of the following developments in the ECCU financial sector:

- Banks are generally well-capitalised. Deposits continue to grow, including from businesses

- The ECCU banking system remains stable with a high degree of liquidity (estimated at EC$1.5 billion at the end of December 2024).

- Credit conditions have eased and competition is intense thereby creating a favourable environment for borrowing, particularly for mortgages.

- EveryData ECCU Ltd (the credit bureau operator) has signed agreements with 27 of the 32 (84%) licensed financial institutions (LFIs) under the Banking Act in the ECCU. Eleven (11) have already gone live. Others are expected to follow in the upcoming months. Nineteen of forty-seven (40%) of credit unions signed agreements. Public education is ongoing throughout the region.

- The Monetary Council noted the contents of the Financial Stability Report 2023 (Part 2) and approved its publication. The Report indicated that key risks to financial stability include cyber and climate.

In support of financial stability, efforts at addressing risks include:

- Lowering credit risk by enhancing credit underwriting with the commencement of the credit bureau.

- Lowering the risk profile of CBI/CIP programmes. The Interim Regulatory Commission (IRC) has selected Lydia Elliott, Legal Drafting Consultant, to draft uniform legislation that would enable the establishment of a Regional Regulator for CIP/CBI in the ECCU. Stakeholders from Government, the CIP/CBI industry and social partners will be invited to share their views on the establishment of the Regional CBI/CIP Regulator in a series of in-country consultations commencing in March 2025.

- Fiscal and Debt Sustainability

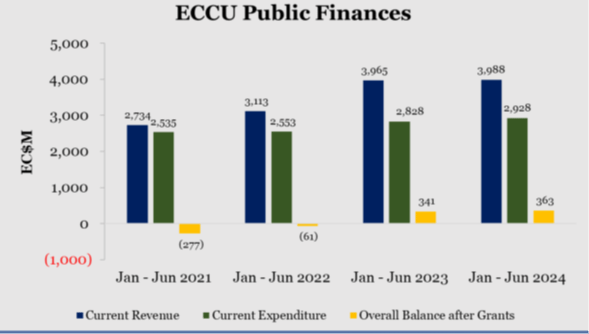

The ECCU fiscal situation showed signs of improvement in 2024 to increased economic activity and stronger fiscal management.

Source: Monthly fiscal data reported by countries consolidated by ECCB.

The Regional Government Securities Market (RGSM) continues to be a vital source of funding for member governments. An estimated EC$1.2 billion was raised in 2024 — a 9.0 per cent increase over 2023.

- Growth and Competitiveness

Growth in the ECCU continued to be propelled by Tourism and domestic-related construction activity in 2024. This trend is expected to continue in 2025. Despite some improvements, there is still need for more regional action to address the high cost and inconvenience of intra-regional air connectivity. The current situation is a major constraint to trade and faster growth and is inimical to the Big Push.

The Monetary Council, on the recommendation of the ECCB, approved an allocation of $25 million for a food and nutrition security programme in the ECCU from ECCB’s Fiscal Tranche II account. This funding will support the efforts of ECCU member countries as they strive to reduce the food import bill by 25 per cent.

5.0 Financial Inclusion

The ECCB issued a circular in November 2024, encouraging all LFIs governed under the Banking Act of 2015 to make basic bank accounts available to their customers, effective the first day of December 2024.

To date, all LFIs have implemented some aspect of Simplified Due Diligence (SDD) in their policies and procedures, to facilitate the ease and reduce the complexity of opening a bank account for customers.

The ECCU banking industry is targeting a unified rollout of SDD and/or the basic bank account by April 2025.

The Monetary Council strongly endorsed these actions and further committed to swift enactment of the amendments to the Banking Act, which include provision for the establishment of a basic bank account.

Consultations with a broad range of stakeholders, on the establishment of the Office of Financial Conduct and Inclusion (OFCI) and the Eastern Caribbean Financial Standards Board (ECFSB) have begun.

These discussions, which are being held across the ECCU, commenced on 6 February, 2025, in Saint Christopher (St Kitts) and Nevis and will run through to June 2025.

The Monetary Council noted the update on the preparatory work towards procurement and deployment of a commercial-grade retail central bank digital currency solution (DCash 2.0).

The DCash website (www.dcashec.com) was revamped, updated and relaunched in November. The website will continue to play a key role in public outreach and education on digital finance and DCash.

In respect of the Eastern Caribbean Partial Credit Guarantee Corporation, the Monetary Council noted that there were 147 guarantees approved across the ECCU (as at January 2025), in support of small business access to credit.

The value of loans guaranteed to date is EC$18.1m and the value of the actual guarantees approved is EC$13.8m.

6.0 Date and Venue of the 111th Meeting of the Monetary Council

Council agreed to hosting the Handing Over Ceremony to mark the change in Chairmanship of the Monetary Council on Thursday, 17 July 2025 in Antigua.

The 111th Meeting of the Monetary Council will be convened the next day, Friday, 18 July 2025, on the sister island of Barbuda.

The Honourable Gaston Browne, Prime Minister and Minister for Finance of Antigua and Barbuda, is due to assume Chairmanship of the Council.

7.0 Participation

Council Members attending the meeting were:

- The Honourable Dr Ellis L Webster, Premier and Minister for Finance, Anguilla (Chairman)

- The Honourable Gaston Browne, Prime Minister and Minister for Finance, Antigua and Barbuda

- The Honourable Dr Irving McIntyre, Minister for Finance, Commonwealth of Dominica

- The Honourable Dennis Cornwall, Minister for Finance, Grenada

- The Honourable Reuben Meade, Premier and Minister for Finance, Montserrat

- The Honourable Dr Terrance Drew, Prime Minister and Minister for Finance, Saint Christopher (St Kitts) and Nevis

- The Honourable Philip J Pierre, Prime Minister and Minister for Finance, Saint Lucia

- The Honourable Camillo Gonsalves, Minister for Finance, Saint Vincent and The Grenadines

14 February 2025

About the Eastern Caribbean Central Bank

The Eastern Caribbean Central Bank (ECCB) was established in October 1983.

The ECCB is the Monetary Authority for: Anguilla, Antigua and Barbuda, Commonwealth of Dominica, Grenada, Montserrat, Saint Christopher (St Kitts) and Nevis, Saint Lucia and Saint Vincent and the Grenadines.

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]