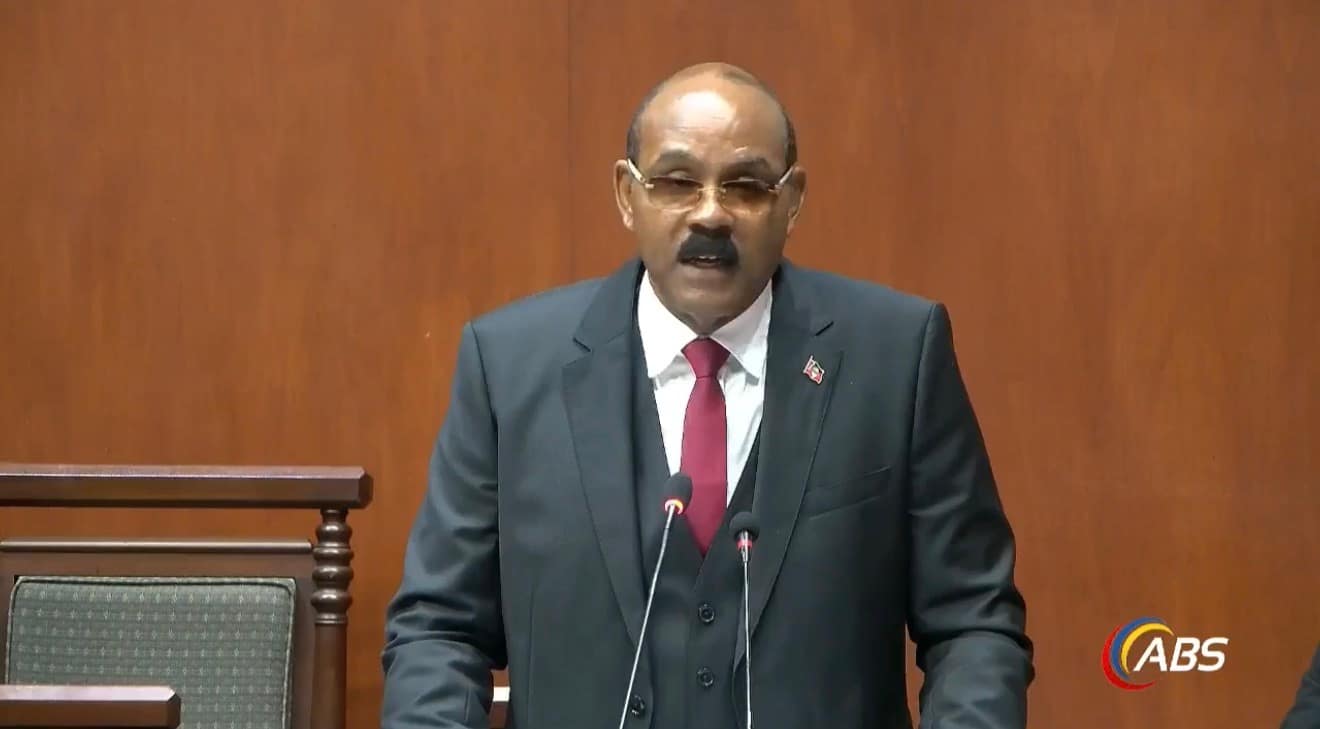

The government’s EC $2.078 billion budget for 2026 is a masterful display of political and economic maneuvering. While Prime Minister Gaston Browne delivers a potent narrative of historic surpluses (EC $116.3M overall) and a rapidly shrinking Debt-to-GDP ratio (61.4%), this budget fails the critical test of feasibility and realism for the majority of citizens. It is a politically front-loaded document that risks being people-centred as a burden, asking the general populace to fund macro-economic success through unequal taxation and deferred social relief.

1. 💰 The Surplus Illusion and Public Contribution Paradox

The claim of an EC $116.3 million surplus must be rigorously questioned.

- The Surplus Reality Check: The public is asked to believe that this substantial surplus will be realized in just one year. This raises serious questions about whether there were similar, unacknowledged surpluses in prior years. If so, why have citizens simultaneously faced the heavy tax burden (ABST, RRC) and seen the government securing funds (borrowing) for major infrastructure projects, including road works? The surplus figures appear decoupled from the reality of the nation’s ongoing financing needs.

- The Burden of Duty on Gas: The duty on gas at the pump represents a hidden, highly effective tax on every citizen and business, demonstrating how we have been already contributing heavily to the government’s coffers. This continuous, major contribution from consumers directly funds the surplus narrative, yet the public sees no commensurate relief or infrastructure quality.

- Infrastructure Funding Paradox: Road works were publicly justified and funded by an increase in licensing fees. Despite this dedicated user contribution, our roads remain deplorable—a quick-fix reality that is destroyed during heavy downpours. The failure to use dedicated road funds effectively, combined with the continued practice of borrowing to fix our roads, suggests profound mismanagement within the Ministry of Works.

2. ⚖️ Structural Inequity and the Two-Tiered State

The most glaring hypocrisy within the “people-centred” budget is the massive and codified disparity in treatment between the political class and the core public service.

- The Elite’s Privilege: A select group of politicians and top Permanent Secretaries command five-figure salaries alongside an array of generous, taxpayer-funded benefits. A politician needs only a few terms in office to secure a full, robust pension.

- The Cogs’ Reality: The majority of the public service—the essential “cogs” that keep government moving—are trapped near the EC $1,560 minimum wage. These workers are paid late “ever so often,” forcing them to navigate daily life with financial uncertainty.

3. 📚 The Education Illusion: Building the Roof Before the Foundation

The substantial EC $40.1 million increase in the Education budget, dedicated to securing free tuition at UWI Five Islands, is a visionary commitment. But vision requires practical sequencing.

- The Foundational Gap: The ultimate success of free tertiary education depends entirely on the quality of the primary and secondary education students receive. If the foundation—the pre- and primary levels—is failing, the investment in the roof (UWI) becomes inherently inefficient.

- The Resource Misalignment: The emphasis on the tertiary expansion suggests a political preference for a high-visibility, easily quantifiable deliverable over the hard, localized work of upgrading primary school facilities. If the bottom is not fixed (the primary and secondary levels), there will not be enough qualified persons for the top, no matter how free the education is.

4. 🚨 Neglect in Health and Security: The Crisis of Core Institutions

The budget’s allocations for key social and security institutions continue to expose a cycle of promises, neglect, and under-compensation for essential staff.

- Health Sector Failures: The promised transformation to a full National Health Insurance (NHI) plan in 2026 is undermined by continued institutional crises. The dire conditions at Fiennes Institute and Clarevue Psychiatric Hospital persist, with the promise of relocation becoming an annual, recycled goal. Critically, nurses and healthcare staff remain underpaid, and many are still not receiving the promised COVID allowances.

- National Security: The Prison Crisis: Despite year-on-year talk about building a new prison, the budget lacks a definitive, funded capital line item for a new facility. This perpetuates poor conditions, including poor food quality, and reflects a systemic failure to fund essential welfare: wages and allowances remain poor, and there is a critical lack of government-funded programs and training for staff.

5. 🗺️ Comparative Ministerial Analysis: The Gap Between Policy and People

Ministerial allocations must be scrutinized for their realistic capacity to meet the stated goals.

- The Barbuda Crisis: Contributing vs. Receiving: Barbuda has always contributed significantly to the GDP through land sales, hospitality, and tourism, yet even to meet their allowance constitutionally due the Council has to fight to receive. The capital allocation for Barbuda’s tourism-driven infrastructure must be scrutinized to ensure equitable development and preservation of communal land rights, rather than further centralizing control over revenue generated by Barbudans.

- Sports & Creative Industries (The “One Nation” Question): The persistent issue of persons a year later still asking for their just payment for events like Carnival suggests poor financial management. This raises serious questions about whether the money is going to one nation concert and high-profile events while failing to pay local artists their arrears and fund foundational infrastructure.

- Agriculture and Food Security: A true Food Security priority would show a significant, multi-million dollar increase in recurrent and capital spending dedicated to local infrastructure. The current reality is that the entire nation remains burdened by high, volatile food import prices.

- Trade and Transport: The government’s policy focus on lobbying the IMO for a carve-out against rising global shipping costs and the lack of specific funding for LIAT 2020 or a dedicated regional transport vessel shows reliance on diplomatic efforts rather than budgeted solutions to reduce regional shipping costs.

6. 💸 The Political Calculus and The Accountability Deficit

- The Wage Gimmick: The high-impact December “double salary” is a settlement of retroactive arrears, not an increase in the current wage rate. The promise of a future raise is conditional on the July 2026 reclassification—a strategic delay that protects the current EC $116.3 million surplus.

- The Accountability Void (PAC): The budget’s figures lack integrity due to the continued absence of a functioning Public Accounts Committee (PAC). The PAC is the body responsible for ensuring public funds have been administered, managed properly, and spent in previous years. Without this core parliamentary oversight, the EC $2.078 billion budget remains a document of unverified claims.

A Call to Action for Structural Dignity

The EC $2.078 billion budget must be recognized not as a statement of achieved prosperity, but as a demand for accountability. The time for political rhetoric and recycled promises—on the Prison, Clarevue, and staff wages—is over. The citizens deserve a budget that shifts its focus from accumulating macro-surpluses funded by regressive taxation to one that guarantees structural dignity for every resident: transparent spending, fair wages for essential workers, and funded solutions for crisis-level institutions. We demand action, not just allocation. – The People’s Auditor

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Well sah! This gives us a lot to think about. Thank you, People’s Auditor

I hope Prof. C. Justin Robinson of UWI Five Islands is reading this; rather than the nonsense he recently wrote about the budget speech.

As a students looking to continue my education at UWI Five Islands I am hoping it offers quality of education that is not tainted by politics.

To the west of The West Country Pond, in the area where cars are washed,there is a pedestrian thru pass that is now closed by a business called Julies.

A pass thru from Tanner St where the gutter acts as lane division for East & West bound vehicles to Nevis st is now fenced off.

Was this authorized by your division?

I’ve used it for 66yrs,,was agahst when I had to walk up to Independence Dr,headed to the bus station.

I’ve Being saying that this budget speech and others in the past is one big fraud..in fact I have sumed it up to one big Ponzi scheme operation.

Thanks for the writer who have explained and broke in down nicely. I have stated in synapsis over the last 5 years how this government have ripped off the public purse and keep getting away with it.

It’s a bunch of gobbly gops, with no real realistic substance..but yet still the money is transfered from the Treasury with no real understanding of the public as to where it really goes. It’s like a offshore bank recycling it’s funds to obscure the whereabouts of its customers money.

It’s a classic banking move straight out of the corrupt play book. This guy GB has not fooled me, and it is time for Antigua’s to realize that they have been took.

It took y’all almost 15 years to realize that Allen Sanford was a two bit swindler, and the same thing is happening here. By that time he had stolen almost 10 million dollars.

But all will be revealed in time.

They have tried over the years to cover up the miss deads, but the flood gates will soon be broken.

We see it in the LIAT/Air Peace deal, the Alpha Nero, the Antigua Airways debacle, the car procurement mess..they even came for more with the suggestion of the jolly harbor foolish deal.. don’t forget also the ABST, the $100 mil borrowed for roads. All these money borrowed, but yet still we have a surplus of revenues.

Make it make sense..they can’t, because it’s a big fraud.

Politicians the world over always paint rosy pictures, but the truth, as the author writes is in the results. The roads, hospital, infrastructure to name a few are all failures. Don’t get me wrong, I think the ABLP is the party that does a better job running the country but there are short comings that should be focused on.

I personally believe that he and several of his cabinet colleagues used the opportunity while in office to enrich themselves at the expense of the country and by extension the people.

On the other hand whenever I listen to him, I am convinced that he is the most talented politician Antigua has produced. His delivery of the 2026 budget was outstanding. His command of language and finance was excellent.

I have made it clear before. That D. Gisele Isaac is the only person in Antigua and Barbuda political arena that can stand ground with him in a debate. Hence the budgetary debate is over.

I listen to Pringle yesterday morning on Good Morning Antigua and he was out of depth. All he could really say is that these are promises and that the intent is to win political support. I believe that a party in office should be re-elected on performance. That CXC initiative is a great move and will surely enhance the ABLP electability.

The low point in the presentation , was the Vechicle scandal. He said that the Cabinet had made a decision to restitute and not prosecute. That is not the role of the PM and his cabinet. This is the role of the judiciary arm of government.

I am looking forward to getting more detailed information , when the various ministers gives us more detailed explanation of their ministries allocations.

Professor Robinson of UWI Five Islands needs to learn something from article,

He seems to have only passed the course “ How to such up to a politician and discredit yourself “

This is the type of substantive retort UPP needs to present consistently, if they seriously think they can lead this Country.

Gaston provides them with the opportunity to do so and they fail in doing so.

The late Asot Micheal had his cost of living charts showing the cost of basic good spiraling high.

He did not wait for Gaston’s budget speech. He developed his on credible numbers and presented them in simple form. That’s why he was viewed as a danger,

THE PEOPLES AUDITOR has made a straight forward analysis/commentary highlighting the weaknesses and deliberate misinformation in the The Prime Ministers Budget Speech.

While the Budget Speech was primed by The Governor General in his Throne Speech and The Vice Chancellor of UWI Five Islands in his article in ANR the day prior to the Budget Speech

There are number of unfortunates illustrated here.

Both the Governor General and the Vice Chancellor Robinson clearly were in possession of the Budget Speech document and set out to tube up the public in whst is a false and misleading narrative. And that they did with plump.

THE PEOPLES AUDITOR the author was not able to identify himself or herself given the blowback that would have been directed at him or her personally.

On the other hand The Governor General Sir Rodney Williams and The Vice Chancellor of UWI Five Islands Robinson could have identified themselves notwithstanding the misleading and politically motivated presentation they both made

The Governor General has proven over the years he is a political tool of Gaston Browne.

Professor Robinson who always list his academic credentials and accomplishments; he too has made himself a political figure having written a number of articles on politically sensitive subjects in which he has reduced himself to being a political shrill for the Prime Minister.

By doing so Professor Robinson had positioned himself as a political advance man for The Prime Minister Gaston Browne. He has belittled himself as an academician and that’s unfortunate.

My vote goes to THE PEOPLE’S AUDITOR as “THE PERSON OF THE YEAR” who is well aware of the reputational harm should he or her identify his or herself.

This piece has all the signs of LOW, in the sense that it seems like sour grapes from someone who bears the full name, LOW. LOW was once in the very company that LOW now curses, simply because the South of Phillip rejected LOW.

What is ironic is that LOW was once a person who championed the very policies now being despised, simply because the South of Phillip rejected LOW.

Now, the grapes are sour for no other reason than the South of Phillip rejected LOW and pushed the fruit table further away.

Make no mistake, more of this will come because LOW has an agenda to destroy, simply because the South of Phillip said we will not go LOW.

Alas, LOW! You are no “People’s Auditor;” you are simply who you are and will always be – Lennox O’Reilly Weston!

Why not write this yourself instead of using AI?

Comments are closed.