2021 BUDGET STATEMENT

By the Honourable Gaston Browne

Prime Minister and Minister for Finance, Corporate Governance and Public Private Partnerships

To the House of Representatives of Antigua and Barbuda

On Thursday 28th January 2021

“Maintaining a Healthy Nation and Restoring a Vibrant Economy”

Mr. Speaker

As I rise to present to this Honourable House my Government’s Budget for 2021, I know that the overriding issue on everyone’s mind is COVID-19 – and its devastating effects.

People are worried about being infected and the impact on their lives and livelihoods.

They worry about the health of their elderly family; about their young children; and other relatives and friends.

I know that many people are also worried that their jobs have been lost; that their savings are depleting; and that they are living in suspense and uncertainty.

Everyone wants an end to the Pandemic and a swift return to life as it was before, including employment, festive gatherings, congregating to pray in Church, attending sports events, and just simply being able to commune with friends and family.

That is why we present this Budget Statement under the theme: “Maintaining a Healthy Nation and Restoring a Vibrant Economy”.

Mr. Speaker, everyone knows that on the health aspect, our Government has done better than most to keep the people of our country safe.

Today, we are amongst the few countries in the world with a low rate of death, a low rate of infections, a high rate of recovery, and no known community spread.

That is an achievement of which we should all be proud.

It could not have happened without the cooperation and responsibility of the great majority of our people.

For that great sense of civic duty and discipline, the people of our nation, especially those on the frontlines, deserve the deepest appreciation and warmest applause.

On the economic side, our Government has done all in its power, despite significant odds, to maintain public sector employment; to pay our pensioners; and to provide safety nets for the most vulnerable.

Our country remains stable.

Our people remain undaunted.

Our Government will continue to do everything possible to guide our nation successfully through this era; which, too, shall pass.

ECONOMIC DISRUPTION WILL NOT LAST FOREVER

Mr. Speaker, there is disruption to our economy.

But it will not last forever.

People around the world will travel again.

Jobs will be restored.

Our economy will recover.

However, this will not happen overnight.

Recovery is not in our hands alone.

The world is involved.

And every nation must play its part.

The one thing of which we can all be certain is that people everywhere will do their best to end this pandemic.

They, like us, have been hurt by it.

They, like us, want its effects diminished.

They, like us, want to take back control of their lives.

Let us be clear – we still have a tough period ahead of us, particularly the first two quarters of this year.

It is that period we must navigate with resolve and determination.

We must remain vigilant and stay the course, by continuing to exercise personal responsibility, as we prepare for our economic recovery.

It is the strategy for riding out the present circumstances and readying the path for the future, that I will set out in the Budget Statement today.

Mr. Speaker, we remain grateful for the diplomatic and cooperative relationship enjoyed with many bilateral and multilateral partners who provided development assistance, technical support, and donations of equipment and supplies, to aid our fight against the coronavirus. We highlight the contributions of the Peoples Republic of China, the Republic of Cuba, the United Kingdom, the Bolivarian Republic of Venezuela, and the Government of India.

OUR POSITION – ONE YEAR AGO

Mr. Speaker, one year ago, I stood before this Honourable House as our nation – and everyone within it – looked forward to a year that assured massive development and social progress.

We had reduced unemployment to a single digit for the first time in over a decade.

It was an estimated 8 per cent.

We were welcoming the prospect of 6.5 per cent growth, after a reported growth rate of 7 per cent in 2018 and 3.4 per cent in 2019.

And, public and private sector investment was set to reach $2 billion, generating an economic boom, creating more jobs, and increasing income for all.

All these rewarding conditions, Mr. Speaker, were created by the constructive and productive policies that our Government vigorously pursued, with the strong support of the people of Antigua and Barbuda.

We were on the cusp of a great take-off.

We were not to know, that one tiny microbe – external to our country and invisible to the naked eye – would bring all nations, rich and poor, to their knees: infecting over 100 million persons globally and killing more than 2.2 million.

No one could foresee the wreckage of economies across the world, sparing none.

TODAY’S GLOBAL CONDITIONS

Mr. Speaker, the economy of the United States contracted by about 3.5 per cent in 2020; the Eurozone countries suffered a decline of 7.4 per cent; and Japan’s economy shrank by 5.3 per cent.

Of all the major economies, only China is reported to have experienced growth of 2.3 per cent in 2020.

And in our hemisphere, only Guyana – with its newly found oil and gas – was able to register 30 per cent growth down from the 86 per cent growth projected a year ago.

Just this week, the International Labour Organization estimated global job losses in 2020 of 114 million, compared to 2019. Also, total labour income lost was a staggering US$3.7 trillion.

The COVID-19 pandemic, in whose grip we are still clutched, exacted a heavy toll on our shared planet and our common humanity.

Mr. Speaker, nations around the world continue to be paralyzed by the pandemic.

Lockdowns have derailed economic activity, affecting not only national economies, but the global economy; which is a network of countries, interconnected in trade in goods and services, in a shared financial system, and in myriad forms of social contact, including tourism.

CAUTIOUS GLOBAL PROJECTIONS FOR 2021

Mr. Speaker, the International Financial Institutions are cautious in their forecasts for 2021.

Economic performance and recovery depend on many factors; the most important of which is how quickly and fully all countries bring the coronavirus under firm control.

Just three weeks ago, on January 5th, the World Bank published a careful statement, suggesting that the global economy could expand by 4 per cent this year.

But the Bank warned that this would depend on the widespread roll out of the COVID-19 vaccine to tame the pandemic.

If nations fail to control the rise in infections by timely vaccine rollout, global expansion could be limited this year to just 1.6 per cent.

The Word Bank Group’s Chief Economist, Carmen Reinhart, also emphasised that the economic impact of the pandemic was more acute for most emerging markets and developing economies, such as ours.

As an example of this, I draw attention to the performance of the Eastern Caribbean Currency Union (ECCU), of which Antigua and Barbuda is an integral part.

IMPACT OF THE PANDEMIC ON THE EASTERN CARIBBEAN

Mr. Speaker, against the backdrop of global lockdowns and travel restrictions, Gross Domestic Product (GDP) in the ECCU plummeted by 16.2 per cent for the year 2020.

This contraction was mainly driven by the severe decline of the tourism sector.

Total visitor arrivals over the period January to September 2020, contracted by 52.5 per cent compared with the same period in 2019.

The entire sub-region was dramatically and grievously impacted.

ECCB data further reveals that the overall central Government fiscal balance for the ECCU region deteriorated from a surplus of $4 million for the first six months of 2019 to a deficit of $297 million for the same period in 2020.That the $4 million surplus plunged to a deficit of $297 million for the first half of 2020 was no fault of any member state of the ECCU.

This calamity was driven by the loss of revenues created by the global effect of the COVID-19 pandemic.

THE SITUATION CONFRONTING THE NATION IN 2021

Mr. Speaker, that is the background against which I present our nation’s Budget for 2021.

Faced with severe shocks from the pandemic, economic activity in Antigua and Barbuda is projected to have declined by 17 per cent in 2020.

We should recall that this decline came after an annual average 5 per cent growth over the preceding five years. Further, this Administration increased GDP from $3.2 billion in 2013 to $4.5 billion in 2019. This is a $1.3 billion increase in the value of economic output.

Were it not for that five-year period of robust growth, engendered by our Government’s policies and private and public sector investments, our nation could not have withstood the steep decline experienced in 2020.

Our country was sustained by the previous five years’ successful performance that helped to cushion the impact of the pandemic.

We saw similar resilience when our country recovered from the devastating impact of Hurricane Irma in 2017, to become the world’s tenth fastest growing economy in 2018.

So, we have a track record of recovering from crises.

We have done it before.

And, I assure this House and this Nation, that we shall do it again.

Antigua and Barbuda will rise and recover rapidly!

Let there be no shadow of doubt about it!

ECONOMIC PERFORMANCE IN 2020

Mr. Speaker, the tourism sector – our main revenue earner and significant employer – was heavily impacted in 2020.

The economies of all our major source markets were devastated by COVID-19, resulting in restrictive measures on travel.

Consequently, there were 395,647 total visitor arrivals for 2020 – a 62.5 per cent reduction from the 1.05 million visitors recorded in 2019.

Of this number, cruise visitors contracted by 64 per cent from 753,076 to 270,327 and stay-over visitors dropped by 58 per cent from 301,019 in 2019 to 125,320 in 2020.

This decline in visitor numbers, combined with shutdowns, implementation of curfews and social distancing measures, resulted in a 63.6 per cent contraction of the hotel and restaurant sector for 2020 as compared to growth of 7.7 per cent in 2019.

Additionally, the construction sector, which had real growth of 6.6 per cent in 2019, is projected to decline by 22 per cent in 2020.

The sector for Transport, Storage and Communication experienced a decline of 25.2 per cent for 2020 as compared to growth of 3.8 per cent in 2019.

The wholesale and retail sector also declined by 13.5 per cent.

EFFECT ON EMPLOYMENT

Mr. Speaker, these circumstances adversely affected employment.

Figures from the Social Security Scheme indicate a decline of nearly 40 per cent in the number of contributors.

This translates to about 11,000 fewer employed persons than when we started the year in 2020.

More than 70 per cent of these persons were employed in the hotel accommodation and hospitality sectors.

ACCOMPLISHMENTS IN 2020 DESPITE THE PANDEMIC

Mr. Speaker, in the face of this unprecedented and unexpected crisis, our Government did not wring its hands and lament its misfortune.

Urgent and careful action was necessary, and our Government moved swiftly to address both the public health emergency and the economic fall-out.

The priority was to stop infections by the coronavirus and to create conditions for saving the lives of our people.

Without doubt, our management of the virus was the singular most important accomplishment in 2020.

Through the policies implemented by the Government; the protocols established by the team of professionals at the Ministry of Health; and the commitment and hard work of all frontline workers, we managed to contain the transmission of the disease among the population and, to date, avoided community spread.

At the onset of the crisis, we immediately converted the Margetson Ward at Holberton, into an Infectious Disease Control Centre.

This ensured that we were able to isolate and treat patients suffering from COVID-19, in the event of an outbreak.

We also created quarantine facilities to ensure that, until persons were tested, or recovered, they would not mingle in the community, imperilling the health and lives of others.

We also rapidly bought and installed ventilators, personal protection equipment, rapid test kits, and medication to boost the resources of our medical facilities.

Those facilities were also expanded, putting us among the countries in the Caribbean region with the highest number of hospital beds in relation to the size of population.

Our Government also implemented protocols and rules that were not popular with everyone, but they saved countless lives.

While we still grieve for those who died, we should consider how much more mourning we would have, had the death rate increased.

Our mantra was the Latin phrase that has guided all success – Acta, non verba.

Action, not words!

Mr. Speaker, mindful of the devastating effect that sudden unemployment would bring to families, our Government decided that, despite a major reduction in revenue, no public sector worker would be laid off.

We continued to put money in the pockets of over 12,000 public sector employees, ensuring that they could care for their families, and continue to spend in the economy, thereby keeping businesses alive.

Apart from this, we executed an Emergency Food Assistance Programme, providing for the well-being of the elderly, disabled, single mothers, and other needy persons.

Several thousand persons benefitted from this programme.

We also initiated a Government Assistance Programme (GAP) under which beneficiaries received vouchers for redemption at supermarkets, to ensure these persons and their families do not go hungry.

In addition, we rolled out the Pandemic Relief Barrel Initiative in April 2020.

Households imported items such as food, toiletries, baby and disinfecting wipes, face masks, detergents, and vitamins for personal use.

In November, we augmented the Pandemic Relief Barrel with the Christmas Barrel initiative to include clothing and shoes among the items that could be imported.

To date, almost 13,500 barrels have been cleared under this initiative.

The Government exempted a significant amount of much needed revenue and strained to find funds to continue all the welfare programmes it undertook.

But this is a caring Government.

The peoples’ needs had to be met as a priority.

We wanted none to go hungry.

We wanted no ailment neglected.

That is the commitment of this Antigua and Barbuda Labour Party Administration – now and forever!

Mr. Speaker, I recall an observation that I made in my New Year’s greeting to the Nation.

I do so because it is important to record it in this Honourable House for posterity.

Not everything about 2020 was bad.

As a nation, we stared the world’s greatest adversity in the face.

Neither crouching down in fear, nor surrendering to its power; we acted in unity to resist it.

These trials have reminded us all, that we are tied together in this life as one nation, one people, with a common destiny; recognising that despair of any of us touches all of us.

But they have also reminded us that we are stronger than we imagined.

And that no trial can daunt the will of a nation whose people assume the mantle of their brother’s keeper, their sister’s protector, and their children’s guardian.

In essence, we successfully confronted an immense danger, while we endured its bruises and battering; and now we stand vigorous and vibrant, as a resilient people, filled with optimism about the prospects for a brighter future.

Hence, we know that whatever 2021 brings, we have the confidence to face it, the capacity to master it and the will to triumph over it.

Mr. Speaker, that is the spirit that permeates our society; it is the basis on which we will move forward, despite all the challenges.

LIAT – RISING LIKE A PHOENIX

This Honourable House is aware that, amid all the severe trials that our nation faced in 2020, we were confronted with a major threat to regional air travel and to regional integration itself.

A decision was taken by shareholders of LIAT 1974 Ltd. to wind-up the airline, leaving a great void in regional air transportation and hundreds of Caribbean people unemployed.

Our Government concluded that there were other options that could keep the airline flying, maintain a level of employment and continue to provide the arteries without which regional economic integration would wither.

Appropriate legal steps were taken to keep LIAT alive, and the Court appointed an Administrator, to maintain operations and examine options for reorganizing the airline, so that it could be a profitable operation going forward.

Mr. Speaker, my Government is aware that employees of the airline are in suspense over their severance and other entitlements.

As a Labour party Government, born of the struggles of the working people, we empathise and sympathise with the LIAT employees.

Our Government pledges to do all in its power, to address their legitimate concerns and has already agreed to making a compassionate payment to LIAT workers towards settlement of their outstanding benefits. We encourage other Governments to make similar compassionate payments to their citizens who worked for this regional institution.

We have already committed to provide over US$20 million to help reorganize and recapitalize LIAT. However, we are aware that LIAT’s future depends on the contribution of other Governments in the region, whose countries will benefit from its continued existence.

We expect LIAT to rise from these ashes and to fly high again like the proverbial phoenix.

That is a goal to which we are fervently working with the Administrator.

FISCAL PERFORMANCE IN 2020

Mr. Speaker, before the horror of COVID-19 spread across the globe, we had forecast a fiscal deficit of $96.1 million or 1.9 per cent of GDP in our 2020 Budget, and a primary surplus of $27.1 million or 0.5 per cent of GDP.

Significantly, before the virus fully made its presence felt, we had a 28 per cent improvement in tax revenue in the first quarter of 2020 compared to the same period in 2019.

The nation was on track to achieve the fiscal targets set out in the Budget.

However, preliminary data for 2020 now shows an overall fiscal deficit of 5.5 per cent of GDP, and a primary deficit of 2.9 per cent of GDP for fiscal year 2020.

Collected revenue was $100 million less in 2020 compared to 2019.

In the face of declining revenue, our Government took immediate steps to curtail expenditure.

There was an 8 per cent or $83 million decline in total expenditure.

Our Government focussed spending where it was most needed – in safeguarding the health of our people and protecting them from the coronavirus.

Savings were also realized from a moratorium on loan payments and extended credit facilities from merchants and vendors.

I take this opportunity to thank our creditors for their forbearance, and for their maturity in understanding that we are all in this dilemma together.

If they are to collect golden eggs in the future, there is every point in keeping the proverbial goose alive… and laying!

PUBLIC DEBT DEVELOPMENTS

Mr. Speaker, on the matter of public debt, I inform this Honourable House that it is estimated that the total public sector debt to GDP, at December 2020, amounted to 89 per cent.

It will be recalled, that it was our Government’s policy to lower the debt to GDP ratio, and at the end of 2019, we had done so successfully, reducing the ratio to 67 per cent.

At the end of 2020, the Government’s total public debt portfolio was $3.34 billion, of which central Government debt was $2.85 billion and $490 million was Government guaranteed debt.

Of that amount, external debt was $1.68 billion and domestic debt amounted to $1.7 billion.

I make two points here, Mr. Speaker.

Because of the skewed criterion of ‘high per capita income’, our country could not access concessional funding or grants from the international financial institutions as did a number of other countries in the region.

We were punished for our good economic performance, by being denied assistance, when consideration was most needed.

Therefore, we borrowed from willing lenders, among whom were the Eastern Caribbean Central Bank and the Regional Government Securities Market.

Others gave us cash flow relief for which we are grateful.

They include: the Caribbean Development Bank, the Abu Dhabi Fund, and domestic Banks.

The second point I make to this Honourable House is that, notwithstanding the cash flow challenges occasioned by the pandemic, our Government has not defaulted on any of its debt service obligations on the Regional Government Securities Market.

We continue to make every effort to meet our debt commitments as they become due and payable.

That took some doing, particularly as we have not laid off one public servant, and we have maintained spending on the health, education, and the well-being of the nation.

That, Mr. Speaker, is not only good governance; it is indicative of good performance!

MONETARY DEVELOPMENTS

Mr. Speaker, an analysis of the movement in the monetary aggregates since the onset of the crisis presents an interesting picture that is worthy of discussion. For the 10-month period ending October 2020, the Money Supply grew by 1.8 per cent to $3.5 billion. This was related to positive developments in Narrow Money, which includes private sector demand deposits and currency in circulation.

Mr. Speaker, Narrow Money grew by 9.9 per cent between January and October 2020. This was fueled by a 15.2 per cent increase in private sector demand deposits and a 3.4 per cent increase in currency in circulation.

Some of the increase in Narrow Money was partly offset by an 18.2 per cent decline in commercial bank deposits, as banks saw a decline in their liquidity position.

On the other hand, our people benefitted from the moratoria on rents, loans and APUA utilities. This allowed persons to use their limited household earnings to provide for their families and not reduce their aggregate savings in the banking system.

This is borne out by the growth of $97 million in household savings deposits between January and October 2020.

Further, in the midst of the pandemic, there was also an increase of $119 million in domestic credit. Of note is the 14 per cent or near $100 million increase in credit to businesses. If ever there was a demonstration of confidence in this Administration’s capacity to manage the economy through turbulent times, this is it.

Mr. Speaker, net liquid assets declined by $327 million to $1.4 billion in September 2020. This is associated with the loan moratoria extended to households and businesses.

Nevertheless, our banks remain significantly liquid and are the best capitalised in the ECCU region.

These outcomes indicate that quick and decisive action by our Government to contain the spread of the virus and to maintain employment levels; provided a level of confidence to households, businesses and investors that mitigated against a more sizable decline in output.

FINANCIAL SECTOR STABILITY

Mr. Speaker, having expended significant resources to ensure a strong and resilient banking sector in Antigua and Barbuda, the Government has seen returns in the form of dividends from its investment in the Eastern Caribbean Amalgamated Bank (ECAB).

ECAB has generated profits averaging $18 million annually for the last six years, and has paid dividends and corporate taxes totalling $30 million to the Government since 2016.

Because of Government’s intervention, ECAB is now poised to double in size, as it finalizes arrangements to acquire the Bank of Nova Scotia business in Antigua.

At the same time, the Government is working with the principals of ECAB, to increase the domestic shareholding in the bank for the benefit of Antiguans and Barbudans. This is to be achieved through the conversion of the Government’s preference shares in ECAB.

We have every reason to be proud of the achievements of ECAB and look forward to the continued profitability of this domestic institution.

Mr. Speaker, the Caribbean Union Bank (CUB) has also benefitted from Government’s capital injection of $30 million in 2016. Since the Government’s acquisition of 78 per cent of CUB’s shares, this institution has started to make profits for the first time since its formation in 2005.

STRATEGIC FOCUS OF BUDGET 2021

In 2021, even as we envision a year that will see the start of economic recovery, we will continue to put first the safety of our people.

Travel to our country is being sought by visitors, precisely because we have made Antigua and Barbuda a safe and desirable destination.

That is why until we have inoculated every person in our society, each of us continues to owe the responsibility to keep the other safe.

Strict adherence to the protocols including: physical distancing, wearing masks, hand washing and sanitizing continue to be vital until vaccines have been delivered to all.

So, as we continue to keep our borders open, providing visitors a safe haven, a secure refuge and important relief from the stresses and strains of COVID-19; we shall also maintain the protocols that have kept our people healthy and made our country safe and attractive.

These are our twin goals: maintaining a healthy nation and restoring a vibrant economy.

With the ongoing lockdown in the UK, and the requirement by the US for international travellers to quarantine for 10 days; we anticipate an adverse effect on travel in the first two quarters of 2021.

This will slow the pace of recovery in the tourism sector and the economy as a whole.

However, as will be outlined later in this presentation, execution of several critical public and private sector initiatives should secure economic growth, of at least 3 per cent in 2021.

That is the goal to which we must all work in our collective interest.

This is no time for naysayers and sophomaniacs.

The future of our country will not be served by obstructionists, iconoclasts and loafers.

It is a time to put our collective shoulders to the wheel, and every hand to the plough.

And, that is what every member of this Honourable House should pledge to do.

STRATEGY FOR FISCAL RESILIENCE

Mr. Speaker, the global health crisis laid bare the need for the Government to strengthen public finances over the medium term.

Therefore, we have developed a Medium-Term Fiscal Strategy (MTFS) for execution over the next three to five years.

The comprehensive fiscal strategy document is being finalized and will be published in the coming weeks.

However, let me say now that our fiscal strategy focuses on enhancing revenue performance, increasing efficiency in public spending, securing debt sustainability, and positioning the Government to meet its obligations in a more timely and predictable manner.

Key fiscal targets include:

- Primary surplus between 0.5% and 1% of GDP by 2023

- Overall deficit less than 1.5% of GDP by 2024

iii. Wages and salaries accounting for not more than 9% of GDP by 2025

- Tax to GDP to increase to at least 18% by 2023 and be maintained at a minimum of 20% over the medium-term

- Debt to GDP ratio to fall below 70% by 2030

Mr. Speaker, in last year’s Budget, I emphasised that although the Antigua and Barbuda economy is the second largest in the Eastern Caribbean Currency Union, and enjoyed far higher growth than most, our tax to GDP ratio was the lowest, at 16 per cent.

In other Eastern Caribbean countries, the ratio was as high as 27 per cent.

Clearly, this system of lop-sided advantage cannot continue. The practice of tax avoidance and tax evasion must and will be addressed.

It robs the majority of people of benefits they are entitled to enjoy, while a few gain greater individual prosperity.

It is not right; it is not just; and it cannot continue.

Therefore, Mr. Speaker I now describe the policy interventions, that will stem the haemorrhaging of revenues through under-payment of a range of taxes.

They include an end to tax exemptions and duty-free waivers for anything that is not firmly linked to provisions under the law.

Revenues from property taxes will be improved by increasing compliance from less than 50% to 70% in 2021 and up to 80% by 2025.

Tax audits and improved tax administration will cause a 15% increase in compliance for corporate income tax and unincorporated business tax by 2023.

Mr. Speaker, careful note should be taken that, in 2019, of every $1.00 that was collected by the Customs and Excise Division, an equivalent amount was waived.

This is not acceptable nor sustainable.

Therefore, the decision has been made to gradually reduce total exemptions, to no more than 25% of potential revenue.

The Revenue Recovery Charge Act (RRC) will be amended in the first quarter of 2021, to limit the waiver of the 10% charge.

The House will recall that this measure was planned for 2020.

It was delayed due to the pandemic.

With effect from March 2021, RRC exemptions will only apply in a few cases, including for current exemptions in the law for agriculture and fisheries inputs and equipment; medicines and pharmaceutical supplies; and entities with which the Government of Antigua and Barbuda has International Assistance Agreements.

Mr. Speaker, while the law will maintain some allowance for waivers in support of business activity and major investment, such waivers will not exceed 50% of the applicable charge.

Further, with effect from February 1, 2021, where the CIF value of imports is $10,000.00 or less, no exemption will be granted.

The Tourism Accommodation Levy (TAL) will also be implemented in 2021.

This measure was also planned for 2020 but had to be delayed.

It will now be instituted on May 1, 2021 and will fund the Climate Resilience and Development Fund.

This will be a special fund whose purpose is to finance projects and programmes that will build climate resilience, provide a fiscal buffer for public finances in times of natural disasters and economic shocks, and support development of our country.

The TAL along with a portion of the additional revenues yielded from the RRC, will be deposited to the Climate Resilience and Development Fund.

The TAL will be applied as follows:

- US$3 per night per guest for all room rates that are US$150 or less; and

- US$5 per night per guest for all rooms that are over US$150.

It is applicable to tourism accommodations including hotels, guest houses, apartments, AirBnB rentals, and villas.

Finally, the Government is considering amending the ABST legislation, to allow for the application of the ABST to online purchases, to include Amazon.

The details of this initiative will be declared when the methodology for applying ABST is finalised.

Mr. Speaker, by these interventions, the intention is to ensure that the tax yield does not fall below 20% of GDP – even then, it will be lower than in other Eastern Caribbean countries.

The fiscal strategy also includes policies that will help to improve Government’s delivery of value for money, and ensure that Government spending on general operations, does not exceed the revenue generated on an annual basis.

Some of the interventions include:

Bringing the recently gazetted Procurement Administration Act into force by June 1st, 2021 along with accompanying procurement regulations.

We will also maintain the wage freeze and continue to limit hiring except in cases where hiring is necessary; to achieve the objectives of the Government’s fiscal and growth strategy, or to deliver essential services.

We will also reduce the rates now being paid to rent office space and equipment, as is being done all over the world as revenues rapidly decline.

NON-TAX REVENUES – THE CITIZENSHIP BY INVESTMENT PROGRAMME

Mr. Speaker, the significant damage to our economy by the global effects of COVID-19 underscored the importance and benefits of the Citizenship by Investment Programme (CIP).

As tax revenues fell rapidly and swiftly, it was – and continues to be – that the CIP has helped to sustain our economy.

In 2020, a total of 366 applications were received, representing a 22 per cent decrease from the previous year.

Nonetheless, the CIP generated $115.7 million in 2020.

We have set a target to double the number of applicants in 2021, and every effort will be made to achieve it.

MANAGEMENT AND PAYMENT OF DEBT

Mr. Speaker, I want to make it clear that our Government has no intention of reneging on any of the national debt.

We do intend to satisfy our obligations to all our creditors.

That is why an important component of our Medium-Term Fiscal Strategy is the reduction of Government’s external arrears and domestic arrears to State-owned-enterprises, contractors and suppliers. This will be done in a fair and transparent manner and will include a combination of cash payments, bonds, and land swaps.

Regarding the Paris Club debt, the Government is pursuing a debt for climate swap initiative, whose implementation would allow arrears to these creditors to be cleared.

The Ministry of Finance has already begun to execute part of its domestic arrears clearance strategy, by facilitating setoffs of amounts owed against tax liabilities of contractors and suppliers.

This will continue in 2021, while other elements of the strategy are rolled out.

While the clearance of arrears is being executed, the Government will avoid any future accumulation of arrears.

Mr. Speaker, let the message ring out from this Honourable House, that our Government intends to honour debts fully, with the cooperation of all our creditors in structuring realistic repayment arrangements and schedules.

RESTORING ECONOMIC GROWTH

Mr. Speaker, I come now to our plans for restoring economic growth and rebuilding employment sustainably in the short and medium term.

The essence of our strategy is to build economic resilience through sustainable and inclusive growth.

This will be achieved with a strong and diversified tourism sector.

We will also strive to increase the contribution of the agriculture sector and further develop several new and emerging service sectors, including:

- health services, specifically renal and cardiac care

- health education

- tertiary education

- air transport,

- digital business assets

- ICT technologies

- logistics

- green technology investments

TOURISM WILL REMAIN AN IMPORTANT ENGINE OF GROWTH

Mr. Speaker, tourism and tourism-related construction will continue to provide the impetus to growth during the recovery.

Therefore, we have conservatively projected activity in the sector, to return to the 2019 level of output by 2024.

Over the medium term, we expect robust growth in the sector averaging 6.0 per cent, as new and refurbished properties enhance the quality and quantity of our hotel room stock, and tourist arrivals by air and cruise are buoyant once again.

As we await the return to full capacity of our tourism sector, the Government will enhance the system for air travel to Antigua and Barbuda.

A contract has been signed with an international company, to provide and install a state-of-the-art radar system at the airport. This $10.5 million project will be undertaken in the next three months and will greatly improve operations in our airspace.

Mr. Speaker, though our source markets have restricted travel in an effort to control the spread of COVID-19, we are not taking a wait and see attitude.

Through our “Your Place in the Sun” and “Business on the Beach” campaigns, as well as, the Nomad Digital Residency programme, we are offering enticing options to individuals who can travel safely, to reside and work in our country, while enjoying the recuperative sunshine and beauty of our twin islands.

CONSTRUCTION

Mr. Speaker, there continues to be strong interest by developers to proceed with projects, some of which were already in the pipeline.

Consequently, the construction sector is expected to grow by an annual average of 9.0 per cent over the next five years, moderating to annual average growth of 6.6 per cent over the long term.

The list of projects that are expected to fuel activity in the sector and generate a significant number of jobs in 2021 include:

- the US$2.5 billion PLH Ocean Club on Barbuda; which is expected to spend US$130 million in 2021 and provide over 400 jobs

- the US$45 million renovation and expansion project at the existing Rex Halcyon Hotel by Sunwing

- a US$25 million Airport Marriott, with US$10 million to be spent in 2021

- the US$100 million beach club at Fort James by Royal Caribbean Cruise Lines, with US$20 million to be spent in 2021

- the US$20 million Dulcina Project in Barbuda, US$3M to be spent this year

- the US$80 million Callaloo Cay Hotel Project at Morris Bay, with US$15 million to be spent in 2021

In addition to these projects, work will continue on other properties, including, private luxury dwellings across Antigua.

Among these are the Baron Lorne Thyssen mansion at Laurie Bay, with a construction value of US$70 million. Some US$15 million will be spent on this project in 2021.

Other luxury properties are being built at Pearns Point, Jumby Bay, Mill Reef Club, Galley Bay Heights, and Windward Beach.

Work on the YIDA project is set to advance with a projected spend of US$100 million this year.

Also, the US$30 million Bungalows project at Devils Bridge will start in 2021.

Mr. Speaker, the Government’s partnership with Global Ports Holding (GPH), produced investment in cruise infrastructure in 2020, despite the suspension of cruise business due to the pandemic.

It is expected that some cruise operations will resume in 2021 and that Antigua and Barbuda could potentially attain up to 40 per cent of the arrival numbers we enjoyed in 2019.

In preparation for the rebound of the cruise sector, GPH is poised to begin development of the US$25 million shopping centre on the St. John’s waterfront.

This public-private partnership in cruise tourism, has ensured that the people of Antigua and Barbuda retain ownership of the cruise port, while benefitting from the managerial and marketing expertise and upfront financial investment of GPH, as well as the receipt of annual rental income from the port facilities.

Although not included in our forecast, the Willoughby Bay project, which emanated from discussions by the Economic Recovery Committee (ERC), presents a novel opportunity to develop the southeast end of the island, while empowering Antiguans and Barbudans.

The proposed size and funding structure of the project allows for participation from locals and from foreign investors.

We continue to develop this project, with a view to begin the first phase in the second half of this year.

Mr. Speaker, there are several other private sector projects that will be implemented in 2021.

Work will start on a $25 million financial and commercial office and shopping complex on Friars Hill Road.

We expect 30 per cent of the project to be completed this year.

Construction will commence on a new $30 million Enterprise Zone, in the vicinity of Deepwater Harbour.

This development includes a shopping area and facilities to include: a marina, a boatyard, and amphitheatre.

Another multi-million-dollar project that will be implemented this year is the state-of-the-art Doctors Hospital and Medical Centre at Woods, which is being spearheaded by Antigua’s own, Dr. Joseph “Joey” John.

This new hospital and medical centre will further enhance health care services on the island and position Antigua and Barbuda to be a leader in medical tourism within the region.

Therefore, Mr. Speaker, while the continuing effects of the COVID-19 pandemic will plague our economic recovery in the first two-quarters of this year, there is light at the end of the tunnel.

We are working to make that light cast away the darkness that enshrouded the economy in 2020.

WIOC – NEW INVESTMENTS IN 2021

Mr. Speaker, the West Indies Oil Company (WIOC) will continue to make investments in 2021.

It will invest US$10 million in capital maintenance and upgrade activities, to ensure the company’s operations remain safe, efficient, and profitable.

This will increase WIOC’s business investments to almost $200 million since the Government secured majority ownership of this company.

Additionally, work will commence this year on the $40 million business park project on Friars Hill Road.

Mr. Speaker, our Government promised that it would divest a portion of WIOC’s shares to individual citizens, providing an opportunity for our people to own a piece of this extremely profitable company.

The company is working with the Eastern Caribbean Securities Exchange (ECSE), to structure and deliver this investment opportunity.

An initial 301,920 shares will be offered by June 2021. Based on the public response, an additional 142,080 shares will be offered.

Antiguans and Barbudans are strongly encouraged to participate – either individually or as part of an investment club.

Finally, Mr. Speaker, since this Administration’s creative financial engineering to acquire a majority stake in WIOC for Antiguans and Barbudans, we would have received dividend payments of $33.5 million up to 2020. In addition, WIOC has paid corporation taxes of $48 million between 2015 and 2020, resulting in an aggregate yield of $81.5 million, covering the full purchase price of US$30 million.

AGRICULTURE: A BRIGHT LIGHT IN THE DARKNESS OF 2020

Mr. Speaker, a bright light in the nation’s economic activity – and one that illumes possibilities for the future – is agriculture.

Although affected by the impact of COVID-19, the agriculture, livestock and forestry sector returned growth of 1.1 per cent in 2020, as compared to 0.5 per cent in 2019.

This improved performance is mainly due to the quick and effective implementation of Government’s policies which included:

- granting farmlands to 50 new farmers,

- distribution of seedlings throughout the sector,

- promotion of back yard farming,

- improvement in infrastructure, and

- increasing the availability and access to water on farms.

This strongly suggests, Mr. Speaker, that there is potential for increased agricultural production in the future that would create jobs and income, as well as foreign exchange savings and provide our nation with a measure of food security and food sovereignty.

We should not let the lessons we learned from this crisis go to waste.

With this in mind, we are finalising financing arrangements for the development of a US$20 million Agro-Industrial Park in Antigua and Barbuda. The Project will be comprised of several components including a broiler farm, slaughterhouse, feed production and feed mill, vegetable farm and training centre.

MANUFACTURING

In real terms, manufacturing contributes about 2.5 per cent, or $60 million to GDP annually.

While size and production costs prevent this sector from being a much more significant contributor to GDP, it is still an important component of the economy as it is a source of employment and income for our people.

That is why, through various laws, including the Small Business Development Act, special incentives are provided, to encourage local manufacturers and other entrepreneurs to start and expand businesses.

Mr. Speaker, we announced some exciting projects in Budget 2020 that were delayed due to the pandemic.

However, implementation will be advanced in 2021. These projects include:

- the US$20 million Carib Beer plant

- a US$5 million brewery project at Antigua Distillery

These will create construction and manufacturing jobs and increase the level of manufacturing exports.

SUPPORTING PRIVATE SECTOR EXPANSION

Mr. Speaker, the Entrepreneurial Development Program (EDP) continues to provide low-cost funding and technical assistance to locally owned businesses.

Since the start of the program in 2019, our Government has provided more than $2 million in loans to local entrepreneurs. These loans come with highly favourable financing terms and a maximum interest rate of 3%.

In addition to favourable financing terms, our Government continues to provide duty-free concessions for equipment and other supplies directly related to the start-up of these enterprises.

In response to the job losses caused by the pandemic, the EDP will ensure, that micro-business loans can be made available to individuals directly affected by the pandemic to start their own businesses. These loans have been extended without the requirement for collateral.

Mr. Speaker, the Government is working with the Caricom Development Fund (CDF) to restructure and revitalize the Antigua Barbuda Development Bank so it, too, can play a leading role in providing credit to small businesses in Antigua and Barbuda.

The revamped and revitalised ABDB will also be an important source of credit for young entrepreneurs, who may otherwise have difficulty accessing financing from other sources.

Ultimately, ABDB will be positioned to take advantage of the credit guarantee arrangement offered by the Eastern Caribbean Partial Credit Guarantee Corporation, thereby opening further financing options for local businesses.

A number of our domestic banks have already signed up with this Corporation through which guarantees are provided to banks offering credit for business ventures that are viable, but the borrower has difficulty meeting the collateral requirements of the lender.

Mr. Speaker, in addition, the Government has agreed to guarantee up to $50 million, to provide for business expansion and cash flow support for enterprises affected by the pandemic.

ENHANCING HEALTHCARE

Mr. Speaker, with the top three leading causes of death being cancer, heart disease, and diabetes; non-communicable diseases (NCDs) have become a major burden of morbidity and mortality for the healthcare sector in Antigua and Barbuda.

This has signalled the need to augment the capacity of Antigua and Barbuda’s health care infrastructure, expand existing systems, and provide lifesaving services for NCDs locally.

Therefore, the Government will construct and operationalize a renal centre, a cardiac centre, and a medical diagnostic centre in Antigua, to meet the growing needs of the population.

Investment in these centres will no doubt require adequate scale, commitment of human and financial resources, and ongoing training of our medical professionals to remain viable.

However, it also provides an opportunity for qualified Antiguans and Barbudans to access high paying jobs and for us to export health services.

For example, having a renal centre with excess capacity, could provide a niche in our tourism product to cater for tourists with kidney failure.

Mr. Speaker, also critical to the transformation of the healthcare sector, is the delivery of universal health coverage. This is to be achieved through the introduction of National Health Insurance. Work on this initiative started in 2019 but was delayed as fighting COVID-19 became the pressing priority in 2020.

The Government remains committed to creating the NHI and will provide our people with essential and world class health services through a system that emphasizes shared cost, quality services, and reliable standard of care.

EDUCATION AND TRAINING

Our Government continues to demonstrate a strong commitment to improving every level and modality of education in Antigua and Barbuda. We are acutely aware that high levels of economic growth cannot occur without a concomitant expansion in human capital.

One of the most effective means to achieve this, is by investment in education and training.

Mr. Speaker, the establishment of The University of the West Indies, Five Islands Campus is both an investment in the future of young people and an expansion of education as a vital export service.

This is yet another avenue, that we will pursue aggressively over the medium term to diversify the economy.

The University of the West Indies, Five Islands Campus, will play a vital role in the diversification process, as it is being positioned to offer programmes in non-traditional, high growth sectors of the global economy.

The Blue Economy is one such area being actively targeted by the Government.

Recently, we signed a tripartite Memorandum of Understanding to establish a Centre of Excellence for Oceanography and the Blue Economy.

This, Mr. Speaker, is a critical development since, as indicated by the Caribbean Development Bank, the ocean’s value added will rise by US$3 trillion by 2030.

With Antigua and Barbuda’s exclusive economic zone being far larger than its land mass, our island nation must be prepared to benefit from this high growth sector.

Many of the industries comprising the Blue Economy are not new industries to Antigua and Barbuda. The task at hand is to use research and development to move up the value chain in existing areas such as coastal tourism, marine transport, and shipping, while scoping the potential of emerging areas, such as marine aquaculture, offshore energy, seabed mining, and biotechnology.

The Centre of Excellence for Oceanography and the Blue Economy will help us to do just that.

Another intervention in education in 2021 will be modernising the Antigua and Barbuda Institute of Continuing Education (ABICE), to enhance the skills training options offered by that institution.

Special focus will be placed on the development of the creative industries in our schools and at the national level, with the establishment of a performing arts centre, as we seek to develop this sector into a significant export industry.

Further, we will continue to maintain and expand the school plant in Antigua and Barbuda by investing $8 million, to build a new science block and additional classrooms at the Sir Novelle Richards Academy.

We will also finalise a project with the Caribbean Development Bank that will provide US$15 million in funding, to expand and rehabilitate other schools, to include the Ottos Comprehensive School and the Antigua Girls High School. The project also comprises a component for training over 950 teachers.

ENSURING PUBLIC SAFETY

Mr. Speaker, unfortunately, there is an element within our society that is intent on preying on the vulnerable and perpetrating acts of violence on law-abiding citizens and residents.

As I have stated in the past, we have zero-tolerance for crime and those who continue to engage in criminal behaviour.

In 2020, the Royal Police Force of Antigua and Barbuda, was able to reduce crime by about 16%.

Though some sought to take advantage of the requirements for wearing masks, as a means to commit crime, the Police, working along with other law enforcement agencies, has enhanced patrols to help prevent the commission of crime and to apprehend perpetrators.

I congratulate the members of the Royal Police Force, Defence Force, and ONDCP, for their hard work in keeping our nation safe. We recognise that commitment to duty, of all our national security personnel, is not only essential for the safety of our people, but for maintaining an environment where economic activity can thrive.

Mr. Speaker, we are aware that some law enforcement officers have had to execute their duties under difficult conditions. To address this, we have begun work on a number of police stations, including Police Headquarters and the Parham Police Station. In 2021, we will complete work on these and begin work on All Saints and Bolans police stations.

We have also acquired new crime fighting equipment, to ensure the safety of officers in the execution of their duties and continue to collaborate with regional and international agencies in the crime fighting effort.

MAJOR PUBLIC SECTOR INVESTMENTS

Mr. Speaker, our Government will also make considerable investments in 2021, despite our constrained circumstances.

Here are the projects which will be advanced, and which are of importance to our people.

ROADS:

Having substantially completed works on the Friars Hill Road and Sir George Walter Highway, work began on the second phase of the road rehabilitation project in 2020.

This EC$65.6 million project involves the reconstruction of Anchorage Road, Old Parham Road, Sir Sydney Walling Highway, and Valley Road North.

The contractor has started work on the Sir Sydney Walling Highway and should begin work on the other roadways later this year.

The third phase of the road rehabilitation project will be undertaken as part of a US$28.7 million Rehabilitation and Reconstruction Loan (RRL) project.

This project focuses on rehabilitating and reconstructing critical infrastructure.

It includes an allocation of US$10 million to help finance the reconstruction of Darkwood Bridge, Herbert’s Main Road, Burma Road, and Royal Gardens Road.

The funding for these projects comes from loans obtained from the Caribbean Development Bank.

The Government will also continue its road repair and maintenance programme and installation of concrete roads in several communities across the country.

To facilitate and accelerate this process, a concrete plant is being acquired.

ELECTRICITY AND WATER:

Mr. Speaker, in turning to electricity and water, I remind that in the midst of the adverse effects of the COVID-19 pandemic, our Government caused APUA to reduce the fuel variation charge on electricity and offer discounts for residential and commercial users.

The value of this relief was $21.8 million.

Further, farmers received a 25 per cent reduction in their water bills to encourage increased food production.

Our Government insisted on providing this relief to the people of this nation, at a time of great adversity.

Despite this significant loss of revenue, APUA intends to increase electricity generation capacity by 25-30 Megawatts very shortly.

We are determined to make electricity outages a thing of the past.

It will take funding, including the timely payment of bills by households and by businesses.

APUA can raise the money from the banking sector and development institutions, but only if its profit and loss statement and balance sheet demonstrate its capacity to repay the borrowings.

Mr. Speaker, consistent production and reliable supply of water remain a priority.

Our traditionally arid country relies on reverse osmosis to produce most of our water.

It is not a cheap undertaking.

Nonetheless, last October, APUA began work on installing an additional reverse osmosis plant at Ffreys Beach.

This plant, valued at US$2 million, was provided by the Government of Japan and is expected to increase daily production by 400,000 gallons.

The installation of reverse osmosis plants at Fort James and Bethesda will be a priority in 2021, increasing water production by 3.5 million gallons daily.

Further, to ensure reliability of supply, APUA is implementing a $30 million re-piping project to help reduce water loss.

Our financial circumstances are acute, but we are striving to install the infrastructure that will serve us well, as our economy revives and re-energizes.

TELECOMMUNICATIONS:

Mr. Speaker, we can all agree that affordable and efficient telecommunications infrastructure is vital to the economic and social life of our country.

It is unimaginable how commerce, international relations, financial services, education, and entertainment, would have been possible in the epoch of COVID-19 without reliable telecommunications.

The Ministry of telecommunications was exceedingly effective in ensuring that the Government and its agencies remained operational during the extended lockdown, due to COVID19. The Ministry continues to progressively automate and digitise various Government departments, thereby facilitating the digital transformation of our state.

The important lesson we have all learned, is that we must maintain and improve telecommunications.

In this regard, APUA has secured US$30 million, to install its own sub-sea cable, providing more reliable, cost effective, high-speed internet service.

The world is the customer, and that customer can be serviced from within our shores.

Our Government is providing the means.

Our enterprising people must seize the enormous opportunities, to stake a claim in the global digital business sector.

A HOUSING REVOLUTION

Mr. Speaker, the National Housing and Urban Renewal Company, is the primary vehicle through which this Administration is delivering on its promise to transform the housing stock in Antigua and Barbuda.

While the protocols to control the spread of COVID-19 slowed the company’s activities in 2020, it was still able to complete and deliver 80 homes to homeowners.

In 2021, the company expects to deliver the keys to another 160 proud homeowners.

The Booby Alley housing project will be greatly advanced in 2021.

With residents moving into temporary housing, construction will start on new, climate resilient homes for Booby Alley residents. This is part of a larger $100 million affordable homes project, that is being funded with a grant from China. In all, 250 homes will be constructed at several locations on Antigua and Barbuda.

Mr. Speaker, I announced in Budget 2020 our plan to accelerate the construction of houses, by selling lands at concessional rates to local contractors and developers, who would build affordable homes for sale to citizens and residents. This initiative is being managed by the Central Housing and Planning Authority (CHAPA).

The response from contractors and developers has been positive. CHAPA has allocated 917 parcels of land in North Sound, Lightfoot, Jennings, Seatons, Cades Bay, Judges Hill, Bolans, Dunbars, Lindsey’s, and Willikies.

Over the next 18 months several contractors, will construct 629 houses in these areas at an estimated cost of $200 million. These houses will be sold to Antiguans and Barbudans at prices ranging from $180,000.00 to $330,000.00.

Additionally, the Construct Antigua Barbuda Initiative (CABI), continues to support our people in constructing their homes. In 2020, 114 projects valued at $36.3 million were approved for CAB-I concessions.

Mr. Speaker, though the land distribution process was delayed in 2020, we were able to allocate 64 parcels of crown lands.

Distribution of lands will be boosted this year, with parcels of land to be made available in Cedar Valley, Piggots, Old Road, Freetown, Glanvilles, Donovans, Monks Hill, Montrula, and Piccadilly.

Included in this land distribution drive, are special provisions for sale of 900 parcels of land to young Antiguans and Barbudans through the Land for Youth initiative.

Finally, the Government will join the United Nations Office for Project Services (UNOPS), and Sustainable Housing Solutions (SHS), in an exciting and innovative project designed to deliver 10,000 affordable homes across the Caribbean. At least 3,000 of these houses will be allocated to Antiguans and Barbudans.

This project, which is part of UNOPS’s Sustainable Infrastructure Impact Investment initiative, will be implemented over a period of 10 years and will generate an initial US$30 million in private investment. The houses constructed under this project will boast energy efficient solar panels, waste to energy technology, and mosquito repellent coating.

The initiative also involves establishing a factory in Antigua and creating sea transport services, for the movement of building materials to the islands, that will benefit from the delivery of these resilient houses.

Mr. Speaker, the gross development value of the homes is an estimated US$500 million, and we stand to benefit, not just in terms of the delivery of houses, but in terms of jobs and increased incomes for our people.

DEVELOPMENT OF BARBUDA

Mr. Speaker, I turn now to Barbuda – always a subject dear to my heart.

The improvement of life on Barbuda and the economic empowerment of every Barbudan, as equal citizens of our single state, are articles of faith of our Government.

There is no question that public and private sector projects have boosted economic activity on Barbuda and provided hundreds of jobs for its residents.

Our Government will continue to collaborate with the Barbuda Council, to deliver more than $100 million of planned investment for the benefit of all Barbudans.

Work has started on a number of these projects including the Sir McChesney George Secondary School on which $6.5 million has already been spent.

Other public sector projects to be executed on Barbuda include:

- Construction of a new Disaster Office

- Construction of a Multi-purpose Centre/Disaster Shelter

- Construction of a Reverse Osmosis Plant and Storage Tank

- Development of Agricultural Infrastructure

- Completion of the Barbuda Energy Resilience Project, which is being funded with a UK-CIF grant of about $10 million

Additionally, completion of the new Barbuda airport at a cost of US$8 million, is a priority in 2021.

A Barbuda Masterplan, currently being finalized, envisages the establishment of a new capital city at Louis Hill. This masterplan is based on the joint vision of the Barbudan people, the Barbuda Council, and the Government.

The development of the Louis Hill area includes:

- the Wa’omoni Cottages housing project funded by the Prince’s Foundation and the Calvin Ayre Foundation, in which 20 disaster-resistant homes will be constructed for Barbudans, whose houses were destroyed during Hurricane Irma.

The Government and the Halo Foundation will also contribute to this initiative, that is intended to help make Barbuda more climate resilient.

- the UNDP Project to construct 150 homes started in 2020 and will continue this year.

This project is being funded with a grant from the European Union and has already repaired and rebuilt 20 homes.

- the construction of the New Holy Trinity Primary School, which will be primarily funded by the Government of the Dominican Republic.

Also, Barbuda will benefit from the $100 million housing development grant, that has been provided by the Peoples Republic of China to our country.

Barbuda, and all those who inhabit it, can look forward to advancement and progress that our Government is determined to deliver.

SOCIAL SECURITY

Mr. Speaker, the significant reduction in the number of contributors to the Social Security Scheme has affected its cash flow unfavourably.

Therefore, the Scheme has been unable to meet pension obligations in a timely manner.

Our Government is conscious of the grave difficulties this situation poses to pensioners and the alarm and fear that they experienced.

That is why our Government has intervened to help, even in the most challenging financial circumstances.

In 34 years, between 1979 and 2013, successive Governments paid a total of $88.2 million into Social Security.

In just 6 years, between 2014 and 2020, my administration paid twice the amount paid by previous Governments in 24 years.

We paid over $170 million into the Scheme.

That is the concrete, indisputable evidence, of how much this Administration cares for the people of this country, including our pensioners, who deserve to be free of anxiety in the twilight of their years.

Given this reality, Mr. Speaker, it is farcical that the very persons who did not pay contributions to the Scheme when they were in power, encourage innocent pensioners to picket the Government.

Politics does not get any lower than that.

Mr. Speaker, our Government will continue to pay more than its required contributions, to help bridge the gap created by those private sector contributors who are unemployed at this time.

As the world economy recovers, we in Antigua and Barbuda can expect a gradual return to pre-COVID levels of employment.

Cash flow for Social Security will improve and pensions and benefits will be made in a timelier manner.

Until then, Mr. Speaker, the nation can be assured that our Government and Social Security will pursue initiatives to manage the situation.

These include making payments to the most vulnerable pensioners first, ensuring compliance by private sector employers who are still operational, and by introducing a voluntary contributions programme.

The most vulnerable pensioners are the most elderly; pensioners with disabilities; and pensioners who have no other means of income, including occupational pension, or support.

I repeat what I have said before.

This Labour Party Administration cares.

And, we not only say what we mean, we mean what we say.

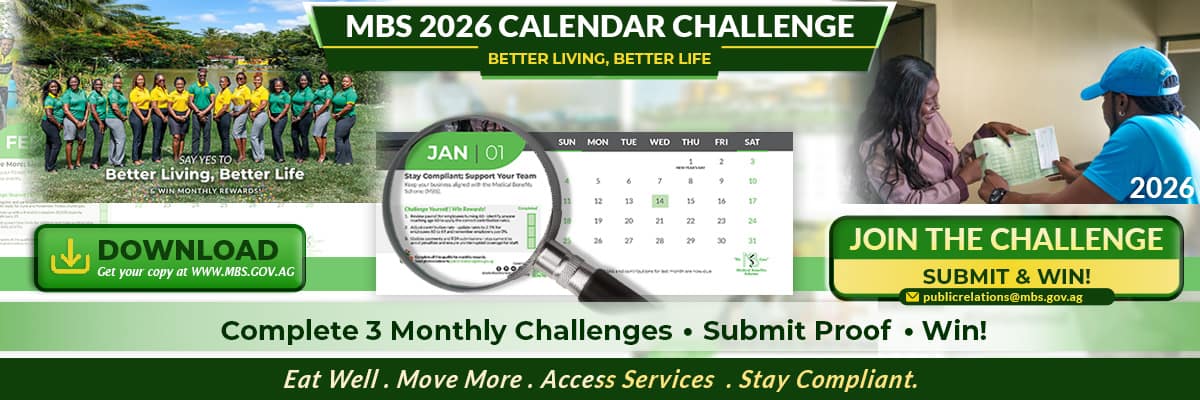

MEDICAL BENEFITS

Mr. Speaker, it is well known that our nation’s Medical Benefits Scheme (MBS), established in 1978, is a unique institution that does not exist anywhere else in the Caribbean.

Over the years, its crucial role has expanded, playing a large role in funding the healthcare system, including the Mount St John’s Medical Centre.

The economic fall-out from COVID-19 resulted in a nearly 18% reduction in MBS revenues, to which our Government responded swiftly.

We increased our transfers to the MSJMC and helped MBS to streamline and restructure its debt financing and expenditure arrangements.

MBS did not collapse, and it gave stalwart service to the people, at one of the most stressful periods in the history of our nation.

Approximately $115 million was spent on healthcare in 2020.

That too, Mr. Speaker, is not only good governance; it is unquestionably good performance.

CLIMATE CHANGE AND BUILDING RESILIENCE

Mr. Speaker, we note that our country suffered loss and damage amounting to approximately $767 million from two extreme climate events – Hurricane Irma in September 2017 and the November 2020 tropical disturbance, which dumped approximately 15 inches of rainfall over a 28-hour period.

Apart from damage to critical infrastructure and other public and private sector assets, these climate events cause disruptions to economic activity, which then translate into lost revenues and a corresponding spike in unbudgeted expenditures for the Government.

Ultimately, the total cost of these two climate events may well have been in the region of $1 billion.

We are deeply conscious that, long after the COVID-19 pandemic passes, we will still be vulnerable to the ravages of Climate Change.

Therefore, Mr. Speaker, Antigua and Barbuda will continue be front and centre in demanding climate action from the international community, while at the same time building our resilience through targeted actions, to adapt and mitigate against the effects of climate change.

Following our successful negotiations with the Green Climate Fund for new financing in 2020 for US$32 million, the Government will once again prepare additional projects for submission.

Notably, we are developing solutions to increase the climate resilience of our country, including in energy, the built environment, agriculture, and the financial sector.

Indeed, Mr. Speaker, building resilience will permeate all aspects of our economy, so that, in the event of future climate related events, we can bounce back quicker and stronger than before.

Finally, Antigua and Barbuda will lead the charge of the Association of Small Island Developing States (AOSIS) at the United Nations for the next four years. AOSIS has been essential in pressing the United Nations, to advance the Climate Change agenda since 1989.

BUDGET 2021 PROJECTIONS AND MINISTRY ALLOCATIONS

Mr. Speaker, I turn to the estimates of revenue and expenditure for 2021, which support a set of policies that are consistent with the imperatives for recovery, transformation, and resilience.

I am pleased, Mr. Speaker, that this Budget introduces no austerity measures, nor does it cut back on social sector spending on health, education and public services.

The Budget also introduces no new taxes on our people. It merely strengthens tax administration and improves tax compliance.

We are also tightening up on the collection of taxes and duties that have always been payable, except that payment has been evaded or exemptions sought.

This budget provides for an overall resource requirement of $1.4 billion. This represents a decrease of 18%, or approximately $300 million, when compared to total estimates for 2020. This reduction is not due to the Government’s reduction in service delivery, but an adoption of more efficient measures of service delivery.

The budgetary and fiscal position points to an overall deficit of 3.4 per cent of GDP or $133.7 million, and a primary deficit of 0.8 per cent of GDP or $30.5 million.

With the implementation of our fiscal strategy, there will be increases in revenue over the fiscal year 2020 in some of the major components of tax revenues.

We also project an increase in CIP receipts in 2021 and the budget includes disbursements from the CDB and committed grants that will finance a large part of the capital programme.

REVENUE

Mr. Speaker, total revenue is expected to improve gradually during this fiscal year.

Recurrent Revenue is estimated at $872.5 million for 2021, which is a 17% increase over the $745.8 million generated in 2020. The components of recurrent revenue are:

- Indirect Tax Revenue – $604.2 million

- Direct Tax Revenue – $98.5 million

- Non-Tax Revenue – $169.0 million

The Customs and Excise Division and the Inland Revenue Department are tasked with the all-important responsibility of delivering this revenue performance.

The amount budgeted for capital receipts is $7 million, while grant funding for Fiscal Year 2021 is budgeted at $82.1 million.

EXPENDITURE

Estimated Recurrent Expenditure, excluding principal payments, is $928.1 million. Therefore, a current account deficit of $55.6 million is projected for 2021.

The components of recurrent expenditure are:

- Wages and Salaries – $402.8 million

- Transfers and Grants – $154.4 million

- Pensions and Gratuities – $70.9 million

- Goods and Services – $157.9 million

- Interest Payments – $103.2 million

- Statutory Contributions – $39.0 million

Government’s Capital Budget for 2021 is $167.2 million, which is a 62% increase over the $103.3 million spent on capital projects in 2020. This increase in capital spending is part of Government’s strategy to promote economic activity while we await a rebound in the tourism sector.

Spending on road works will amount to $31.9 million in 2021 and $43 million has been allocated for major repairs and maintenance to Government buildings and to improve climate resilience of critical Government infrastructure.

SPECIFIC MINISTRY ALLOCATIONS

Mr. Speaker, Parliamentary Representatives with responsibility for Ministries will present details of the programmes to be executed in 2021, when they contribute to the debate on this Budget. However, I will now highlight the main allocations made in Budget 2021.

The Ministry of Education, Science and Technology has the highest budgetary allocation in the amount of $143.1 million.

Included in the allocation for this ministry is $18 million, to support the UWI Five Islands Campus.

The Ministry of Health, Wellness and the Environment receives the second largest allocation of $113.4 million.

The Office of the Attorney General, Ministry of Justice and Legal Affairs, Public Safety and Labour has the third highest allocation of $98.8 million.

The Ministry of Works is allocated $85.0 million in Budget 2021, to continue to manage and maintain public infrastructure.

The Ministry of Tourism and Economic Development is allocated $25.1 million in Budget 2021.

The Ministry of Information, Broadcasting, Telecommunications and Information Technology is allocated $14.8 million.

The amount allocated for the Ministry of Housing, Lands and Urban Renewal will is $4.7 million.

The Ministry of Foreign Affairs, International Trade, and Immigration is allocated $37.9 million.

The Ministry of Social Transformation, Human Resource Development, Youth and Gender Affairs is allocated $22.1 million.

The Ministry of Agriculture, Fisheries and Barbuda Affairs is allocated $16.4 million.

The Ministry of Civil Aviation, Energy and Transportation is to receive $8.7 million.

The Ministry of Sports, Culture, National Festivals, and the Arts is allocated $22.2 million.

The 2021 budget also includes allocations for:

- Office of the Governor General – $1.7 million

- The Legislature – $2.2 million

- The Cabinet – $3.8 million

- The Judiciary – $2.4 million

- The Service Commissions – $908,000

- Audit – $1.1 million

- Electoral Commission – $4.1 million

- Ombudsman – $634,000

- Public Debt Payments – $457.7 million

- Pensions and Gratuities – $69.1 million

I take the opportunity now to speak of the allocations and their purposes for the Office of the Prime Minister, which is allocated $34.4 million and the Ministry of Finance, Corporate Governance and Public Private Partnerships, which is allocated $111.9 million.

Included in the amount budgeted for these ministries is, $16 million for the Prime Minister’s Scholarship Programme.

The budget for the Ministry of Finance also includes an allocation of $6.5 million for the Barbuda Council.

Priorities in 2021 for these Ministries include:

- Ensuring Antigua and Barbuda’s compliance with international AML/CFT standards and successful completion of the FATF Mutual Evaluation re-rating. This effort will be spearheaded by the ONDCP.

- Identifying and accessing financing for the fiscal strategy and Government’s development initiatives.

- Undertaking preparatory work for the population census which has been postponed until 2022.

- Reforming the national procurement system for improved contract management.

- Preparing the 2022-2025 Medium Term Development Strategy.

- Executing the Authorized Economic Operator/Trusted Trader Programme.

- Ensuring timely submission of Government financials to the Director of Audit

Finally, continuing the work of the Government’s wage negotiation team will also be a priority in 2021. It is anticipated that the negotiations with bargaining agents for public sector employees will be concluded by the next financial year.

FINANCING BUDGET 2021

Mr. Speaker, Budget 2021 has a financing requirement of $480.6 million.

This will be financed by $228 million from Securities issued on the Regional Government Securities Market and loans and advances of $252.6 million.

SECURING VACCINES: PROTECTING OUR PEOPLE

Mr. Speaker, the inoculation of our people against the Coronavirus and its recent mutations is vital to the lives and livelihoods of our people.

That is why our Government is working diligently to secure safe and reliable vaccines from reputable sources.

We are already part of the World Health Organization’s COVAX programme under which we have bought 20,000 vaccines at an affordable price.

But we understand 20,000 vaccines are not enough.

Therefore, we are exploring other sources of supply.

In the coming days, we will make appeals to the Canadian, Indian, European and US Governments to sell a portion of their stocks to us.

The coronavirus skips over borders, it does not discriminate against race, age or religion.

Once it exists in any country, it is a threat to all countries.

Helping us, therefore, is also helping themselves.

In this context, we will press the case for the supply of vaccines, sufficient to achieve a high level of immunity amongst our population.

As it is in developed countries, such as the United States and European nations, inoculation is vital to subduing the virus, ensuring the health of our people, and rebuilding our economy.

CONCLUSION

Mr. Speaker, this is a Budget delivered in challenging times.

However, notwithstanding the devastation of the COVID-19 pandemic in 2020, and the effects that will reverberate for years to come, we remain optimistic that our economy will recover.

That is the goal to which we are working.

The present outlook suggests a minimum of 3 per cent expansion in economic activity in 2021, if the impact of the pandemic dissipates, and barring any other further disasters.

We will rise to this moment.

We will get through this together.

This Budget today lays the foundations for advancement tomorrow.

Mr Speaker, in 2020 circumstances changed dramatically.

But the people of this nation have not.

We are tough, we are resilient, and we are resourceful.

The road to recovery will be hard – but there is a plan, and, with it, a path to be pursued.

Our plans laid out in this Budget will keep our people safe and healthy; secure rapid economic recovery; restore and create new jobs; and return the vibrancy and dynamism that is distinctively Antiguan and uniquely Barbudan.

We will not be cowed, nor will we be paralysed by this pandemic.

Together we will build back Antigua and Barbuda – better, brighter and stronger than before.