CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Antigua and Barbuda’s Customs Division is on course to collect up to $560 million in revenue this year, fuelled by resilient trade activity and tighter enforcement across the border control system.

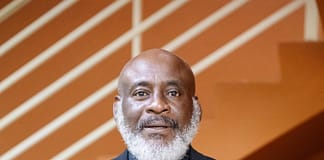

The forecast was made by Comptroller of Customs Raju Boddu during an interview with ABS, in which he revealed that collections for the first four months of 2025 have already reached $176 million—a 9.3% increase over the same period last year.

“This performance is significant considering there has been a slight decline in the total value of imports,” Mr Boddu said.

“It means we are collecting more efficiently, with better compliance and fewer leakages.”

The uptick in revenue is being attributed to a more disciplined approach to tax exemptions, stronger enforcement, and better tax yield.

The yield—which measures how much tax is collected per dollar of imports—rose from 19.5% to 21.1% year-on-year.

Construction and tourism imports drive growth

Despite a dip in the value of fuel imports, due largely to a fall in global oil prices, the construction and tourism sectors are continuing to power customs earnings.

Imports of building materials, furnishings, and fixtures remain high due to ongoing residential and hotel developments.

“There’s a lot of concrete, cement, fixtures, and fittings coming in.

That’s a positive indicator for the economy,” Mr Boddu told ABS.

Officials say recent changes to the tax exemption regime—particularly a move away from discretionary waivers towards more targeted relief for strategic sectors—have also improved revenue reliability.

Customs clampdown bolsters returns

Mr Boddu pointed to stronger frontline enforcement as a key contributor to the revenue surge, with tighter scrutiny at the ports and better compliance monitoring. However, he warned that certain vulnerabilities remain—especially at sea entry points where small vessels may slip through checks.

“We are performing well, but we must not be complacent. There are vulnerabilities, especially with small boats and vessels returning from nearby islands that are not always thoroughly checked,” he said.

He stressed the need to modernise outdated customs legislation and called for more robust maritime surveillance and the addition of a canine unit to counter smuggling.

Digital transformation on the horizon

Looking ahead, the Customs Division is preparing to launch a new single-window trade platform that will allow for streamlined interactions among all border agencies. Mr Boddu said discussions are under way with international donors to support the multi-year modernisation effort.

“This level of investment is critical to sustain revenue growth, streamline trade, and protect our borders,” he told ABS.

The Antigua and Barbuda Sales Tax (ABST) remains the single largest contributor to customs revenue, accounting for over 40% of collections.

Officials say this year’s performance positions Customs as a cornerstone of government revenue and a central player in economic management.

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

CLICK HERE TO JOIN OUR WHAT’S APP GROUP

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Fisherman never say dem fish stink. A word to the wise is….well you know

Trupz,

Where all that money garn?

Give me a break!

One big trupz.

If revenue going up, we need to see better roads, hospitals, and schools.

Dem tek $560M and na even build one proper public bathroom yet.

Time to STop TAXing the Freight… GET rid of CIF .. it created unfair imbalances for someone like a large supermarket vs a small store. They are able to get better freight rates due to thier size. CIF compounds the problem for small importers. Also if the cost of freight goes up the government makes more money. Why is that ! thats robbery.

This man is a professional, he is only been forced into a Gaston braggart posture by Gaston brown, this custom officer don’t look like the kind of a personality to say he is a tap dawg thing or loud mouth, he seems to have etiquette and their indian god holds them to some kind a ethical standards, a Gaston tell he for come out and pappy show he self to validate Gaston as some leader.

Comments are closed.